23 May 2013 IFA Roundtable

Q. 1 – Offshore Investment Funds

A taxpayer resident in Canada invests in an offshore mutual fund because it wishes to take advantage of the investment expertise of the fund managers. The fund is resident in a country that does not levy an income or profits tax on the income earned by the fund; nor is there a withholding tax on payments made by the fund to the Canadian resident. The mutual fund is widely held, and is not a foreign affiliate of the Canadian taxpayer. Will section 94.1 of the Income Tax Act (Canada) (the "Act") apply to the Canadian taxpayer with respect to the interest in the fund?

Notes from Presentation

CRA likely would consider that one of the main reasons for the investment was to avoid taxes as described in s. 94.1. The fact that a main reason of the taxpayer in making the investment was to access the managers’ investment expertise would not be inconsistent with one of the main reasons also being such tax avoidance.

Summary of Written Response

After stating that "it is our view that tax reduction or deferral does not have to be the only reason, or even the main reason for the investment; it merely has to be one of the main reasons," and noting (citing Walton v. The Queen, 98 DTC 1780) that regard should be had to "objective manifestations of purpose," CRA stated:

We generally would expect that a Canadian taxpayer investing in a mutual fund resident in a tax haven country would be subject to section 94.

Also summarized under s. 94.1.

Official Response

23 May 2013 IFA Round Table, Q. 1, 2013-0485311C6

Q. 2 - Shareholder Benefit Rules and Foreign Divisive Reorganization Transaction

Assume the following facts:

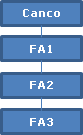

a) FA1, FA2 and FA3 are each foreign affiliates of Canco (within the meaning of subsection 95(1) of the Act) and are not resident in Canada.

b) Canco owns 100% of the shares of FA1 and FA1 owns 100% of the shares of FA2.

c) FA3 is either formed with nominal assets by FA1 or comes into existence as part of the legal division of FA2 into two legal entities pursuant to the corporate laws of the foreign country where FA2 and FA3 are resident (“Division”).

d) As a result of the Division, FA2 transfers some of its assets (for no consideration) to FA3 and under foreign country corporate law, FA3 must issue shares to the shareholders of FA2 pro rata based on the number of shares they hold in FA2. In this case, only FA1 holds shares in FA2 with the result that FA1 will become the sole shareholder of FA3.

e) Under the foreign country corporate law the legal paid up capital of the shares of FA2 will be reduced by an amount equal to the book value of the assets transferred by FA2 to FA3.

f) Similarly, under the foreign country corporate law the legal paid up capital of the shares of FA3 will be equal to the book value of the assets FA3 received from FA2.

Would the CRA agree that in the hypothetical example above, the Division results in a pro rata distribution by FA2 (equal to the fair market value of the assets it transferred to FA3) and therefore the payment of a deemed dividend pursuant to proposed s. 90(2), by FA2, such that there is no shareholder benefit pursuant to proposed s. 15(1.4)(e)?

Would the answer be different if the shares of FA2 were held directly by Canco and as a result of the Division, shares of FA3 were issued to Canco?

Notes from Presentation

CRA agrees that there would be a pro rata distribution for purposes of draft s. 90(2) in this situation so that the exception under s. 15(1)(b) for dividends would apply. In response to a supplementary question, CRA indicated that it would come to the same conclusion if a Canadian corporation was the holding company rather than a non-resident company (FA1), so that the divisive reorganization occurred with Canco or another Canadian corporation as a direct shareholder. CRA is proposing a favourable ruling in a case where a Canadian corporation is the shareholder of the foreign corporation.

Summary of Written Response

As the Division "results in a pro rata distribution on the shares of FA2 ... the amount of the distribution will be deemed to be a dividend pursuant to proposed subsection 90(2)," so that there is no shareholder benefit under proposed s. 15(1.4)(e) by virtue of the exception therein for dividends. The same applies if the shares of FA2 are held directly by Canco and as a result of the Division, shares of FA3 are issued to Canco.

Also summarized under ss. 90(2) and 15(1)(b).

Official Response

23 May 2013 IFA Round Table, Q. 2, 2013-0483741C6

Q. 3 – GAAR and Subsection 93(2)

• S. 93(2) generally applies to deny a loss on the disposition of a share of a foreign affiliate (“FA”) to the extent that exempt dividends had been received on that share, or on a share for which that share had been substituted, prior to the disposition.

• What is the CRA’s position on the application of the GAAR to a series of transactions undertaken for the purpose of avoiding the application of s. 93(2) so as to preserve the portion of the loss on the disposition of FA shares that is attributable to foreign exchange, such that it remains available to effectively offset a foreign exchange gain related to the investment in the FA shares?

Notes from Presentation

The GAAR would apply to transactions which are intended to circumvent s. 93(2), even where the loss is attributable only to FX rather than prior distributions of exempt earnings. The Directorate had recently considered a situation in which Canco, which borrowed in U.S. dollars to invest in the common shares of a U.S. subsidiary generating significant exempt earnings, then subscribed for preference shares of the FA and avoided the application of s. 93(2) by having dividends paid on the preferred shares – accordingly, a capital loss realized on a disposition of the common shares of FA could offset an s. 39(2) capital gain realized on the repayment of the U.S. dollar loan. Given that only a narrow exemption from the application of s. 93(2) was provided in s. 93(2.01)(b), the GAAR generally would be applicable to such a transaction. In CRA's view it would not matter if the preference shares had been put in place at the outset rather than just before the realization of the foreign exchange gain if there was not a valid commercial purpose for them.

Summary of Written Response

Given that proposed s. 93(2.01)(b)(ii) specifies "precisely which related foreign exchange gains realized by a taxpayer are intended to affect the computation of the amount of the loss to be denied on the disposition of an FA share," it follows that except in these narrow circumstances s. 93(2) and proposed s. 93(2.01) are intended to deny a loss on the disposition of an FA share to the extent that exempt dividends had been received on that share, or on a share for which that share had been substituted, prior to the disposition, "even in circumstances where the loss is arguably due to foreign exchange fluctuations rather than the extraction of earnings from the FA."

Consider a case where a corporation resident in Canada (“Canco”) uses borrows U.S. dollar proceeds of a related party borrowing to acquire common shares of an FA, which then generates a large exempt surplus balance from its active business, but with a large FX gain accruing on Canco’s borrowing. Canco acquires preferred shares of FA for nominal consideration, and receives thereon a distribution of FA's exempt earnings - in order that on the subsequent sale of the FA common shares, Canco can realize a loss which will offset a FX gain on repayment of Canco's debt. Given that a foreign exchange gain realized on the repayment of a non-arm’s-length debt is not a gain described in proposed s. 93(2.01)(b)(ii), it was not intended that it should affect the computation of the loss denied under s. 93(2). "Therefore the issuance of the FA preferred shares and the payment of the dividends thereon result in an abuse having regard to subsection 93(2) such that the GAAR would apply." CRA's opinion would be the same if, for the purpose of avoiding the application of s. 93(2), the preferred shares were issued on the initial incorporation of FA.

Also summarized under s. 93(2.01).

Official Response

23 May 2013 IFA Round Table, Q. 3, 2013-0486741C6

Q. 4 – PUC Planning (Prior to s. 212.3)

Can the CRA clarify its position on PUC planning prior to the coming into force of s. 212.3 in the context of the following hypothetical facts?

• NRCo owns Forco. Forco owns 100% of a Canadian operating subsidiary (CanOpco). The paid-up capital (PUC) of the shares of CanOpco is nominal.

• NRCo sets up a new Canadian company (CanHoldco), and CanHoldco acquires the shares of Forco for shares of CanHoldco. The PUC of the CanHoldco shares is equal to the FMV of the shares of Forco.

• Forco is wound up into CanHoldco, and the shares of CanOpco are transferred to CanHoldco. S. 212.1(1) does not apply on the transfer.

• CanOpco pays a taxable dividend to CanHoldco in an amount equal to its retained earnings. CanHoldco deducts the dividend from its taxable income under s. 112(1). CanHoldco pays the same amount to NRCo as a reduction of PUC.

In the context of the above facts, what is the CRA’s position on the application of the GAAR if the above planning is carried out:

A. Pre-acquisition – i.e. NRCo injects equity into CanHoldco, and CanHoldco acquires Forco from an arm’s length vendor (assume CanHoldco can’t acquire CanOpco directly because NRCO also wishes to acquire Forco’s other assets);

B. Post-acquisition – i.e. NRCo acquires Forco from an arm’s length vendor, then after a number of months transfers Forco to CanHoldco in exchange for shares of CanHoldco; and

C. Non-acquisition – i.e. the NRCo, Forco, CanOpco structure has been in place since the inception of CanOpco’s business activities, and NRCo transfers the shares of Forco to CanHoldco in exchange for shares of CanHoldco.

Notes from Presentation

The GAAR committee has considered the GAAR to be applicable in the post-acquisition and non-acquisition scenarios (B and C above), in light of the fact that without the interposition of CanHoldco, the distribution of the retained earnings of CanOpco would be subject to Part XIII tax. While the GAAR committee has not considered circumstances in which CanHoldco was interposed at or close to the time of the initial investment with a view to accomplishing this same result, GAAR may be applied because this planning would allow surplus that could not be taken out of Canada tax free prior to the transaction to be extracted through the higher PUC.

Turning to the current situation, proposed s. 212.3 would apply to the acquisition of the shares of Forco by CanHoldco.

Summary of Written Response

Given that in all three cases, a new Canadian corporation (CanHoldco) is "inserted" to establish cross-border PUC so as to enable surplus of CanOpco to be extracted from Canada, CRA would consider the application of GAAR in each case. CRA stated:

The GAAR Committee has determined that the GAAR applies to cases involving “Post-acquisition” and “Non-acquisition” planning as described above. The GAAR will apply to treat the return of PUC paid by CanHoldco to NRCo as a distribution of a taxable dividend subject to Part XIII withholding tax. The GAAR Committee has not recently addressed the “Pre-acquisition” tax planning case described above....If the acquisition of Forco by CanHoldco in all three scenarios occurred after March 28, 2012, section 212.3 would generally apply.

Also summarized under ss. 212.1(4), 245(3).

Official Response

23 May 2013 IFA Round Table, Q. 4, 2013-0483771C6

Q. 5 – Upstream Loan Rules

Q. 5(a) [s. 90(9) reserve]

Proposed s. 90(6) generally applies to include an amount in the income of a corporation resident in Canada (“Canco”) where a specified debtor receives a loan or becomes indebted to a foreign affiliate (“FA”) of Canco and none of the exceptions in proposed s. 90(8) apply. Proposed s. 90(9) entitles Canco to a reserve to the extent that an actual dividend from the lending FA would have given rise to a deduction under section 113 (based on the surplus balances of the lending FA at the time the loan was made or the indebtedness incurred) and s. 91(5) (in limited circumstances). Assume that Canco owns all the shares of FA. FA has $100 of taxable surplus (“TS”), no exempt surplus and no underlying foreign tax (UFT) balances. The TS is attributable to foreign accrual property income (“FAPI”) of FA and has been fully included in the income of Canco and the ACB of FA’s shares. Assume that FA makes a $100 loan to Canco and the “specified amount” in respect of the loan is included in Canco’s income pursuant to proposed s. 90(6). Will a reserve be available to Canco pursuant to the provisions of proposed s. 90(9)?

Notes from Presentation

Respecting the example, as a technical matter draft s. 90(9) does not provide a reserve for amounts of foreign accrual property income which would generate a deduction under s. 91(5) when distributed as dividends - nor does it provide a deduction for foreign taxes (s. 113(1)(c)). Furthermore, the proposed suppression election in draft Reg. 6901(2)(b) generally would permit a distribution to be elected to be paid out of pre-acquisition surplus. As the absence of a s. 90(9) reserve appears to be an unintended result, based on discussions with the Department of Finance and given that the provision itself uses the phrase "reasonably be considered to have been deductible," the CRA may be prepared to develop an administrative position that an election can be made to change the ordering so that the s. 90(6) amount is considered to be a distribution coming out of pre-acquisition surplus.

Summary of Written Response

In this scenario, no amount is included in the reserve under proposed s. 90(9)(a)(ii) in respect of previously taxed FAPI, because the specified debtor is Canco (which is not a person described in proposed s. 90(9)(a)(i)(D)(I) or (II)). Furthermore, no deduction could be made under s. 90(9)(a)(i)(C) because FA has no UFT, and no deduction could be made under s. 90(9)(a)(i)(D) because no portion of the notional dividend was out of FA’s pre-acquisition surplus. However, the ACB of Canco's shares of FA is increased as a result of the inclusion in respect of the FAPI of FA; and the suppression election in proposed Reg. 5901(2)(b) allows a taxpayer to have the whole dividend deemed to be paid out of pre-acquisition surplus. Since Canco would have been in a position to make the suppression election to deem the dividend to be paid out of pre-acquisition surplus, it is CRA's view that:

for the purposes of proposed subsection 90(9) an amount may “reasonably be considered to have been deductible” in respect of the dividend under paragraph 113(1)(d). Therefore an amount would be included in the subsection 90(9) reserve under proposed clause 90(9)(a)(i)(D).

Also summarized under s. 90(9).

Official Response

23 May 2013 IFA Round Table, Q. 5a, 2013-0483791C6

Q. 5(b) [FA sale]

• Proposed ss. 90(6) to 90(15) generally apply in respect of loans received and indebtedness incurred after August 19, 2011. However, they also apply in respect of a particular loan received or indebtedness incurred on or before August 19, 2011 that remains outstanding on August 19, 2014 as if it was received or incurred on August 20, 2014 [fn: in accordance with their coming into force provisions]. There is an exception for loans repaid within two years of inception.

• Consider a case where on September 1, 2011 a foreign affiliate (FA) of a corporation resident in Canada (Canco) made a loan to a “specified debtor” in respect of Canco. If Canco sells the shares of the FA such that FA ceases to be a foreign affiliate of Canco, before September 1, 2013, and the loan is outstanding on September 1, 2013, will Canco be deemed to have an income inclusion pursuant to proposed s. 90(6) on September 1, 2011?

• Consider another case where prior to August 19, 2011 a foreign affiliate (FA) of a corporation resident in Canada (Canco) made a loan to a “specified debtor” in respect of Canco. If Canco sells the shares of the FA before August 19, 2014, will Canco be deemed to have an income inclusion pursuant to proposed subsection 90(6) on August 20, 2014, if the loan remains outstanding on August 20, 2016?

• Alternatively, if Canco sells the shares of FA after August 20, 2014 but the loan remains outstanding on August 20, 2016, will s. 90(6) apply?

Notes from Presentation

CRA has regard to the wording of s. 90(6) and the transitional rules which focus on the state of affairs at the time the loan is made or deemed to be made, and do not reference any subsequent changes in the relationship. CRA also observed that a deduction would be available under s. 90(14) if the loan is repaid. CRA is consulting with Finance, and it may be appropriate to come to a conclusion that if the debtor ceases to be an FA within two years of the making of the loan by it, s. 90(6) should not apply.

Summary of Written Response

Respecting the first case, proposed s. 90(6) provides that the relationships between Canco, FA and the debtor are to be tested at the time the loan is received or the debt incurred (in this case, September 1, 2011) - so that, if the loan is not repaid by September 1, 2013 (even if FA is then no longer a FA of Canco), the exception in proposed s. 90(8)(a) will not be available so that Canco will have an income inclusion on September 1, 2011. In the other case, proposed ss. 90(6) to (15) are to be applied as if the loan was received or indebtedness was incurred on August 20, 2014. If FA is not a FA of Canco at that time (e.g., the FA shares were sold before then), proposed s. 90(6) will not apply to Canco. However, if the sale of the shares of FA takes place on or after August 20, 2014 and the loan remains outstanding on August 20, 2016, since proposed s. 90(6) provides that the relationships between Canco, FA and the debtor are to be tested at the time the loan is received or the debt incurred (in this case, August 20, 2014), it will apply, so that Canco will have an income inclusion on August 20, 2014, notwithstanding that those relationships are no longer in place on August 20, 2016. Note that Canco will get a deduction pursuant to proposed s. 90(14) when the indebtedness is repaid.

Also summarized under s. 90(6).

Official Response

23 May 2013 IFA Round Table, Q. 5b, 2013-0483791C6

Q. 5(c) [IT-119R4]

• Will the CRA use its various positions on s. 15(2) as a guide for administering proposed s. 90(6) to (15)?

• In particular, would the position in paragraph 38 of Interpretation Bulletin IT-119R4 which provides administrative relief from interest and penalties in respect of the requirement to remit withholding tax on dividends deemed paid to non-residents (by virtue of the application of s. 15(2) and s. 214(3)(a)) be applied in the context of a case where proposed s. 90(6) applies retroactively to include a specified amount in the income of a taxpayer resident in Canada (such that no interest and penalties will be applied when a previously filed return is reassessed)?

Notes from Presentation

CRA generally will look to the administrative policies for the application of s. 15(2) for guidance on the application of these draft rules. However, it will not so apply para. 38 of IT-119R4, i.e., it will enforce the Crown’s rights to interest and penalties.

Summary of Written Response

CRA generally looks to its practices on s. 15(2) to deal with practical issues involving the application of proposed ss. 90(6) to 90(15). However, as proposed s. 90(6) only applies to include a “specified amount” in the income of a taxpayer resident in Canada, consistently with its practice respecting the application of subsection 15(2) to Canadian resident debtors, CRA will not provide administrative relief from interest and penalties in the context of the application of proposed s. 90(6). Instead, it will exercise its right of enforcement.

Also summarized under s. 90(6).

Official Response

23 May 2013 IFA Round Table, Q. 5c, 2013-0483791C6

Q. 6 – Foreign Affiliate Dumping and PLOI Rules

Q. 6(a) [old s. 212.3(10)(f)]

• For transactions or events before August 14, 2012, a taxpayer can elect to apply a transitional version of the FA dumping rules. Does the CRA consider that the original version of s. 212.3(10)(f) that would apply during the transition period captures the indirect acquisition of foreign affiliates (i.e. the acquisition of Canadian companies owning foreign affiliates)?

Notes from Presentation

The original version will be considered to so apply only where substantially all (over 90%) of the Canadian target’s assets were foreign subsidiaries.

Summary of Written Response

Transitional s. 212.3(10)(f) provides that an investment in a subject corporation by a CRIC includes any transaction or event that is similar in effect to any of the transactions described in transitional ss. 212.3(10)(a) to (e). In general, CRA would view a CRIC’s acquisition of the shares of a Canadian company owning foreign affiliates to be similar in effect to the CRIC’s acquisition of shares of the capital stock of a subject corporation if the total fair market value of all the foreign affiliate shares that are held directly or indirectly by the Canadian company comprises all or substantially all of the total fair market value of all of the properties owned by the Canadian company.

Also summarized under s. 212.3(10)(f).

Official Response

23 May 2013 IFA Round Table, Q. 6a, 2013-0483751C6

Q. 6(b) [share redemptions]

• Does the PUC reinstatement rule in s. 212.3(9) apply where the PUC of the CRIC that was previously suppressed is reduced as part of the redemption of shares owned by the foreign Parent as well as on a return of paid-up capital on the shares?

Notes from Presentation

These words are broad enough to include a share redemption.

Summary of Written Response

In CRA's view:

the words “reduces…the paid-up capital in respect of the class…” as they appear in subsection 212.3(9) are broad enough to encompass a reduction in PUC of shares of a class that arises as a consequence of a redemption of shares of that class.

Also summarized under s. 212.3(9).

Official Response

23 May 2013 IFA Round Table, Q. 6b, 2013-0483751C6

Q. 6(c) [blanket PLOI election?]

• Can a PLOI election under either of s. 15(2.11) or 212.3(11) be considered to be made in respect of a particular debt if the election specifies that it is being made in respect of each indebtedness owing by the particular debtor to the particular CRIC? In other words, can it be expressed and made in a way that covers all indebtedness owing by the particular debtor to the particular CRIC, or will a separate election be required for each indebtedness?

Notes from Presentation

CRA will require that an election specify the particular debts which are covered by the PLOI election. An election which stated that it covered all indebtedness owing by the particular debtor to the particular CRIC would not satisfy this requirement.

Summary of Written Response

If the filing due date is the same for electing PLOI treatment for more than one amount owing:

a single written communication may be prepared and filed with the Minister which contains an election for each particular amount owing. However, in order for a PLOI election to be valid, in our view, it must refer to a specific amount owing.

Also summarized under ss. 15(2.11), 212.3(11).

Official Response

23 May 2013 IFA Round Table, Q. 6c, 2013-0483751C6

Q. 6(d) [more closely connected]

• In the context of s. 212.3(16)(a) [exception – more closely connected business activities], if a subject corporation (“SC”) carries on an active business related to the CRIC’s Canadian business (e.g. local distributor of goods manufactured by the CRIC) and also carries on similar activities in respect of operations of non-resident members of the Parent’s group, is there a threshold that would be relevant in determining whether the SC’s business is more closely connected to the CRIC’s (e.g., SC’s revenues are derived 51% from distributing CRIC’s products, and 49% from distributing products of other group members)?

• Will the CRA require data concerning all other group members in order to compare the relative degree of connectedness?

Notes from Presentation

CRA cannot provide guidelines on the more closely connected test without the benefit of an examination of all the relevant factual considerations which would be reviewed on audit. It would be necessary to review all the relevant circumstances including transactions of other group members.

Summary of Written Response

CRA has no firm guidelines, but would consider the Explanatory Notes statement of intention that the exception apply "only where the relationship between the CRIC's and the subject corporation's businesses clearly justify the investment in the subject corporation being made by the CRIC...." CRA also would need to consider the business activities of:

· the CRIC;

· all corporations resident in Canada with which the CRIC does not at the investment time, deal at arm's length;

· the subject corporation;

· all subject subsidiary corporations, as that term is described in s. 212.3(16)(a); and

· all non-resident corporations with which the CRIC, at the investment time, does not deal at arm's length, other than any corporation that is, immediately before the investment time, a controlled foreign affiliate of the CRIC for the purposes of s. 17.

Also summarized under s. 212.3(16)(a).

Official Response

23 May 2013 IFA Round Table, Q. 6d, 2013-0483751C6

Q. 6(e) [cash damming]

• In the computation of the amount to be included in income under s. 17.1(1)(b) in respect of a PLOI, element A of the formula is the greater of two amounts. One of those amounts is the amount of interest payable in respect of a debt obligation – entered into as part of a series of transactions or events that includes the transaction by which the PLOI arose - to the extent that the proceeds of the debt can reasonably be considered to have directly or indirectly funded, in whole or in part, the PLOI.

• Could the indirectly funded rule in s. 17.1(1)(b) be avoided through the use of cash damming techniques? For example, what if a CRIC sets up two bank accounts and uses account A to receive borrowings and fund business expenses and account B to receive business revenues and fund a PLOI, or alternatively, CRIC 1 uses its business revenues to fund a PLOI while CRIC 2 (a sister corporation, where there are no cross-shareholdings between CRIC 1 and CRIC 2 or inter-company debts), uses borrowings to fund its business expenses?

Notes from Presentation

The wording of s. 17.1(1)(b) is substantially broader than that of s. 20(1)(c). Furthermore, it is a question of fact whether the proceeds of a loan funded a PLOI. CRA is not prepared to concede that a cash damming approach would preclude an application of s. 17.1(1)(b).

CRA intimated that the 2nd scenario respecting CRIC 1 and 2 was fanciful.

Summary of Written Response

It was intended that the application of s. 17.1(1)(b) would not be limited by the principle of “tracing,” so that CRA would not concede that the proceeds of a debt obligation could not reasonably be considered to fund a PLOI simply because those proceeds were deposited into one account while the funds used to directly make the PLOI were withdrawn from another. It is CRA's general view that:

[I]t would be reasonable to expect that the proceeds from a borrowing had directly or indirectly funded, in whole or in part, a PLOI when a CRIC borrows money and, while the borrowing is outstanding, it makes a PLOI. Whereas, it is difficult to imagine circumstances in which it would be reasonable to consider that the borrowings of a sister Canco, where there are no cross shareholdings or inter-corporate debts, had directly or indirectly funded the PLOI of a CRIC.

Also summarized under s. 17.1(1).

Official Response

23 May 2013 IFA Round Table, Q. 6e, 2013-0483751C6

Q. 6(f) [series of loans]

• S. 212.3(10) defines “investment” in a subject corporation made by a CRIC. S. 212.3(10)(c)(i) excludes an amount that becomes owing by the subject corporation to the CRIC that arises in the ordinary course of business of the CRIC and that is repaid, other than as part of a series of loans or other transactions and repayments, within 180 days.

• Would the CRA accept FIFO as the method to track the origination and settlement of multiple debts that may arise from inter-company dealings or cash pooling?

• Would the CRA consider a “series or loans” to arise where there are inter-company dealings or cash-pooling but each item arises for its own reasons and not in contemplation of recycling an existing item?

• Would the CRA accept that each loan in a “series” will be repaid once all loans in the series have been repaid?

Notes from Presentation

Trade receivables generally would be considered to arise in the ordinary course of business. Cash pooling arrangements potentially also could so qualify but this would require a careful examination, so that cash pooling arrangement receivables might very well not be considered on such examination to arise in the ordinary course of a business. CRA is reserving on this question.

A FIFO ordering approach would be accepted with respect to receivables which had identical terms. Where there were differences in terms (for example, different interest rates), it would be commercially unreasonable for the debtor to make a payment without specifying what was being paid off.

The CRA would not consider it appropriate to apply the notion that there was a series of loans and repayments when trade receivables arising seriatim were repaid on the basis that there was a series of goods or services supplied in consideration for the trade receivables and thus the repayments thereof would normally be considered bona fide repayments. Cash pooling arrangements would require closer consideration, and the same analysis may not apply.

CRA (having regard to the broader statutory context) will accept that a final repayment of the last loan will effect the repayment of all the loans in that series.

Summary of Written Response

An amount owing to the CRIC as the result of selling property or services to a subject corporation on credit in the ordinary course of the CRIC's business would meet the ordinary course of business exception in s. 212.3(10)(c)(i) if the resulting debt is repaid within the time limit required by that exception.

The determination of whether a particular “cash pooling” arrangement results in an amount that becomes owing to a CRIC that arises in the ordinary course of the business of the CRIC is a question of fact. However, the ordinary course of business exception could apply when a CRIC temporarily advances funds at risk in its business (i.e., the permanent removal of such funds would have a destabilizing effect on the business of the CRIC) to a subject corporation if the resulting debt is repaid in the manner required by that exemption.

The repayment rule in s. 212.3(10)(c)(i) is similar to that in s. 15(2.6).

(i) If a particular amount owing comprises several amounts owing of the same nature (e.g., various product acquisitions on credit), FIFO would be an acceptable method to track the origination and settlement the amounts. However, if a particular amount owing is made up of several amounts owing of different natures (e.g., secured v. unsecured, or different interest rates), CRA would expect the debtor to specify the application of payments.

(ii) The “series of loans or other transactions and repayments” issue is discussed in IT-119R4. However, repayments of a temporary nature (for example, certain cash pooling arrangements) may be evidence of a series of loans and repayments.

(iii) A final bona fide repayment would not be considered part of a series for the purpose of s. 212.3(10)(c)(i), so that a particular amount owing by a subject corporation to a CRIC which arose in the ordinary course of its business of the CRIC would meet the exception if its final bona fide repayment was made within 180 days after the day on which it became owing.

Also summarized under s. 212.3(10)(c).

Official Response

23 May 2013 IFA Round Table, Q. 6f, 2013-0483751C6

Q. 6(g) [internal dispositions]

• Do internal dispositions give rise to “proceeds” for the purposes of s. 212.3(9)(c)(ii)(A), and does it matter whether the CRIC retains a complete or partial indirect interest in the subject shares? For example, what if the CRIC sells shares of one foreign affiliate (“FA1”) to another foreign affiliate (“FA2”) for cash?

Notes from Presentation

Yes - proceeds arising from such an internal disposition are included.

Summary of Written Response

As a result of the exclusion for acquisitions to which s. 212.3(18) applies, many internal dispositions will not result in a PUC reinstatement. However, if the PUC of a class of shares of a CRIC was suppressed as a result of its investment in FA1 and the CRIC then sells FA1 to FA2 for cash such that the CRIC’s cross border investment is reduced and, within 180 days, it reduces the PUC in respect of the suppressed class, the PUC reinstatement will apply.

Also summarized under s. 212.3(9).

Official Response

23 May 2013 IFA Round Table, Q. 6g, 2013-0483751C6

Q. 6(h) [no QSC]

• Can a s. 212.3(3) dividend substitution election be made even if there is no Qualifying Substitute Corporation in the group?

Notes from Presentation

Yes. This election can be used where there is only one Canadian corporation in the group, to determine which non-resident corporation received the s. 212.3 dividend, or which class of shares it was paid on - or the dividends to which the PUC suppression under s 212.3(7) would apply. Making the election engages the non-tracing rules in s. 212.3(6)(a).

Summary of Written Response

A s. 212.1(3) election can be made in respect of shares of the CRIC when there are either no qualified substitute corporations in the group or if there is simply no desire to have any other corporation be viewed as the payer of the dividend. Furthermore, there is no requirement that an amount be agreed on in respect of a class of shares of the capital stock of a QSC, only a requirement that any such amounts be considered in the application of s. 212.3(3)(a)(ii). As a result, the entirety of a dividend that would otherwise be deemed to be paid by the CRIC to the non-resident corporate parent and received by the parent from the CRIC pursuant to s. 212.3(2)(a), may instead, pursuant to s. 212.3(3)(a)(ii), be deemed to be paid by the CRIC to another non-resident corporation in the group.

Finally, the CRIC and the parent may choose to elect under s. 212.3(3) simply to trigger s. 212.3(6)(a) and thereby s. 212.3(7). In such case, there need not be a QSC or a non-resident corporation other than the parent taking part in the election but to achieve its goal, the election must satisfy s. 212.3(6)(a)(ii).

Also summarized under s. 212.3(3).

Official Response

23 May 2013 IFA Round Table, Q. 6h, 2013-0483751C6

Q. 7 – Thin capitalization

• Assume that a Canadian subsidiary has two loans outstanding to specified non-residents: its US Parent and a UK related company. A portion of the interest payable on the two loans is denied under the thin capitalization rules and is deemed to be a dividend under the changes to the rules.

• Can the taxpayer allocate the deemed dividend first to the US Parent such that the 5% dividend rate applies rather than the 15% rate applicable on a deemed dividend to the UK sister company?

Notes from Presentation

No: s. 18(4) applies to all relevant loans. The rule in s. 214(16) provides for a separate designation with respect to each loan in respect of which subsection 18(4) applied and only permits a designation of which interest paid in the year on that loan is deemed to be a dividend paid to a particular person.

Summary of Written Response

S. 214(16)(b) allows the corporation resident in Canada to designate all or a portion of each specific interest payment to a particular non-resident as a dividend, to the extent of the total amount of the interest payments to that non-resident that were otherwise deemed to be a dividend under s. 214(16)(a), thereby effectively allowing the corporation to determine the timing of the deemed dividends for Part XIII purposes. However, the paragraph does not allow the corporation to transfer a deemed dividend from one payee to another, to alter amounts paid to a specified non-resident, or to affect the timing of amounts paid.

Example

Assume that throughout the year, Canco in the above example has $1,000 in paid-up capital and no other equity, and owes $1,000 to US-Co (its parent) bearing interest at 7% (paid as to $35 at the end of each of Q2 and Q4), and owes $1,000 to UK-Co (a sister) bearing interest at 5% ($25 at the end of Q2 and Q4).

$500 (or 25%) of this debt exceeds the thin capitalization limit of 1.5-to-1. Accordingly, 25% of each of the above interest payments would be deemed to be a dividend absent a designation under s. 214(16)(b). If Canco instead designates $17.50 of its fourth quarter US-Co interest payment to be a dividend (i.e., 25% of total US-Co interest of $70), and $12.50 of its fourth quarter UK-Co interest payment to be a dividend (25% of $50), the imposition of Part XIII tax will be deferred to the end of Q4.

Also summarized under s. 214(16).

Official Response

23 May 2013 IFA Round Table, Q. 7, 2013-0483731C6

Q. 8 – Form T1134

The following questions are related to the new Form T1134, Information Return Relating to Controlled and Not-Controlled Foreign Affiliates, released by CRA early in 2013.

Q. 8(a) [tiered structures]

• Section 3B of the new T1134 Summary Form requires a disclosure of the equity percentage between two foreign affiliates of a reporting entity. In the case of a tiered corporate structure where Canco (the reporting entity) owns 100% of FA 1, FA 1 owns 100% of FA 2, and FA 2 owns 100% of FA 3, please consider the following:

• Since “equity percentage” is defined in s. 95(4) as including direct and indirect share ownership percentages, both FA 1 and FA 2 will have a 100% equity percentage in FA 3. In this case, should FA 3 be reported in Section 3B twice (i.e., FA 1’s 100% equity percentage in FA 3, and FA 2’s 100% equity percentage in FA 3)?

Notes from Presentation

CRA will require such multiple reporting, which gives it a more complete picture of the group's structure.

Summary of Written Response

Yes, that is correct.

Also summarized under s. 233.4(4).

Official Response

23 May 2013 IFA Round Table, Q. 8a, 2013-0483811C6

Q. 8(b) [relief?]

• If the answer to Question (a) is yes, this could mean a great number of repetitive reporting by large multinational groups. For example, if FA 3 owns another 200 foreign affiliates, those 200 foreign affiliates will each be reported at least 3 times, resulting in a Section 3B disclosure of more than 600 entries. Would the CRA provide any administrative relief in this repetitive reporting situation?

Notes from Presentation

CRA is reviewing whether there are potential improvements to the reporting process. Perhaps getting a complete corporate chart could reduce some of the other reporting requirements?

Summary of Written Response

CRA is considering developing an administrative policy to provide relief in such situations.

Also summarized under s. 233.4(4).

Official Response

23 May 2013 IFA Round Table, Q. 8b, 2013-0483811C6

Q. 8(c) [$100,000 threshold]

• There has been a change in the administrative relief on filing requirements previously provided for dormant or inactive foreign affiliates. The new Form T1134 now limits the administrative relief for dormant or inactive foreign affiliates to situations where the total cost of investment in all foreign affiliates is less than $100,000. The $100,000 threshold is very low for large multinational corporations. This basically means that large multinational companies would now have to report dormant or inactive foreign affiliates. Is this the intent of the proposed change?

Notes from Presentation

Yes. CRA understands that some taxpayers were using the previous exception as a cloaking device, i.e., transferring securities to a dormant entity.

Summary of Written Response

CRA provided relief from the filing requirements under s. 233.4 for dormant or inactive foreign affiliates. Unfortunately, this created a reporting gap between Form T1135 filing requirements and Form T1134 filing requirements. Accordingly, it was necessary to close this gap to be consistent with the legislative thresholds for Form T1135.

Also summarized under s. 233.4(4).

Official Response

23 May 2013 IFA Round Table, Q. 8c, 2013-0483811C6

Q. 9 – Convertible and Exchangeable Debentures

• What is the CRA’s current position with respect to the application of Part XIII tax to convertible and exchangeable debentures owned by foreign lenders (s. 212(1)(b), the definition of “participating interest” in s. 212(3), s. 214(7) and their qualification as an “excluded obligation” under s. 214(8)(c) of the ITA)?

• Is there anything new to report?

Notes from Presentation

On convertible debentures, CRA has not concluded its review, is examining questions of interpretation and is seeking policy guidance from Finance. It ruled in June 2012 that periodic interest on a convertible debenture was not participating interest.

In CRA’s experience, exchangeable debentures are often used in monetization transactions, and the interest on exchangeable debentures often tracks the dividends on the referenced shares, so that treatment of such interest as participating interest may be appropriate.

Summary of Written Response

Convertible Debentures

In June 2012, the Directorate issued 2011-0418721R3, stating that the regular periodic interest payments on a convertible debt issued by a taxable Canadian corporation to a non-resident would not be “participating debt interest.” The Joint Committee would like CRA to establish guidelines that would apply to “standard convertible debentures.” The Directorate has written to Finance for guidance respecting the tax policy of ss. 212(1)(b), 214(7), 214(8)(c) and the definition of “participating debt interest.” Although CRA's analysis is substantially advanced, it is important to obtain the views of Finance. CRA is unable to provide any guidance as to when it will respond to the Joint Committee.

Exchangeable Debentures

Exchangeable debentures have been used in the past in the context of the “monetization” of shares of the capital stock of public corporations owned by the issuers of debentures. The interest paid on exchangeable debentures could be a proxy for the dividends paid on the shares into which the debentures are convertible. Accordingly, it may be relevant to determine whether the interest paid on exchangeable debentures constitutes “participating debt interest.” The Directorate is not prepared to provide additional comments (outside the context of any ruling request) concerning the potential application of Part XIII tax with respect to exchangeable debentures without knowing all the relevant facts in relation to particular situations (including the terms and conditions of the exchangeable debentures).

Also summarized under s. 212(3) - participating debt interest.

Official Response

23 May 2013 IFA Round Table, Q. 9, 2013-0483781C6

Q. 10 – Treaty Protocol and Hybrid Entities

• Are there any new issues with respect to Article IV(6) and (7) of the US treaty that have been raised with Rulings and would be of interest? It seems most rulings are becoming repetitive in this area. Similar question with respect to the services PE provision in the Article V of the US treaty.

Notes from Presentation

CRA has looked at strategies designed to allow Art. IV(6) to apply or to avoid IV(7). However, CRA recognizes some circumstances in which these may be a legitimate approach and has issued three rulings since 2009 on this question. CRA very well may be inclined to apply the GAAR where U.S. investors who otherwise would be subject to the rule in Art. IV(7) of the Canada-U.S. Income Tax Convention, invest in Canada through a vehicle resident in a third country.

Summary of Written Response

New issues with para. IV(6) & IV(7)

Since the 5th Protocol to the Canada-U.S. Treaty, CRA has considered many strategies designed to ensure that either Art. IV, para. 6 applies to a particular amount, or that para. (7) of that Article does not apply, along with the possible application of the general anti-avoidance rule. CRA has recognized that some structures may be utilized for legitimate reasons. Among the strategies previously considered, the CRA is aware of some structures designed to avoid the application of para. (7) through the introduction of an interposing entity located in a third jurisdiction. In this regard, the CRA has previously expressed its long-standing concerns over “treaty shopping;” and Finance bolstered these concerns in Budget 2013, in announcing consultations on these practices. In addition, the GAAR Committee recently approved the application of the GAAR to a treaty shopping case. Accordingly, taxpayers should not expect the Directorate to look favourably upon the interposition of an entity in a third jurisdiction to avoid the application of para. (7).

Also summarized under Treaties - Art. 4.

New issues with para. V(9)

The Directorate recently ruled on the applicability of Art. V of the Treaty to a US resident corporation (“USco”) carrying on a web-based business, which entailed the sale of advertising space on its websites to Canadian-resident businesses, and the sale of digital content by Canadian resident software developers. A Canadian resident subsidiary of USco (“Canco”) was to build and operate a data centre consisting of numerous servers in Canada, and use that data centre to provide website and data hosting services to USco. USco would pay Canco an arm’s length fee for these services. Canco would not have the authority to legally bind USco, and would not provide any services to Canadian resident users, advertisers or software developers. Employees of USco would not have unsupervised access to the servers, although they would be able to manage the software and data on the servers through remote access.

CRA position

CRA considered the fixed base PE provision in para. (1) of Art. V, the agency PE provision in para. (5), and the services PE provision in subpara. (9)(b), and ruled that USco would not carry on a business through a PE in Canada. CRA noted that USco also had another Canadian subsidiary providing services to USco in connection with marketing and sales support activities for USco’s development and expansion of its user, advertiser and software developer base in Canada, but was not asked to and did not address how this might affect the PE issue.

Also summarized under Treaties - Art. 5.