18 November 2014 TEI Roundtable

18 November 2014 liason meeting between Tax Executives Institute and CRA

A. Introduction

Q. A1 CRA's strategic direction

In prior years, the Assistant Commissioner for Legislative Policy and Regulatory Affairs has provided a helpful update on the Agency’s overall strategic direction. We invite the new Assistant Commissioner to provide comments about his first months in the position, his thoughts on the vision for the future of the branch, and feedback on the role TEI can play in achieving that vision.

CRA Response

Rick Stewart advised that he was appointed to the role of Assistant Commissioner of the Legislative Policy and Regulatory Affairs Branch (“LPRAB”) in April of 2014. He recognized that he did not bring a lot of CRA experience to the position but, in the first few months, he realized that his broader experience in public policy and administration within the federal government, including his most recent position as the Assistant Secretary to the Cabinet within the Liaison Secretariat for Macroeconomic Policy at the Privy Council Office, has helped him transition to the CRA world. As a result, he has been familiar with many of the issues that have been tabled with him in his new role. Under his leadership, LPRAB will strive to support the Canada Revenue Agency (“CRA”) in its broader mission to achieve excellence in program compliance and service delivery to all of its clients.

As part of his plan for LPRAB, Rick will encourage enhanced communication and engagement with stakeholders as a key strategic direction of the branch – a goal to be achieved through collaboration with significant industry and professional associations such as the Tax Executives Institute, Inc. (“TEI”). By working together in partnership with these key stakeholders, LPRAB can continue to create space for open and constructive discussions around difficult issues, the results of which directly impact the ongoing development of Canada’s tax policy, and support the CRA’s role in providing a fair and effective tax administration.

More specifically, Rick described how LPRAB continues to foster its relationships with key stakeholders of the CRA in many ways, including annual events such as the TEI - CRA Liaison Meeting, by seeking insights through the CRA’s ongoing consultations into Red Tape Reduction with small and medium businesses, and by promoting collaborative arrangements such as the recently-signed Framework Agreement between the CRA and the Chartered Professional Accountants of Canada (“CPA Canada”). These initiatives will continue to be a source of constructive dialogue focused on the continual improvement of the services, processes and operations of the CRA. With this direction, LPRAB aims to ensure that Canadians have access to the services they need and to provide timely and accurate information in order to promote voluntary compliance with Canada's tax laws.

Maintaining the ongoing relationship with the TEI will continue to be a priority for him and for the CRA.

Q. A2 HMRC discussions

In addition, we understand that several CRA officials, including the Assistant Commissioner for Compliance Programs, met in early September with counterparts from HM Revenue & Customs in the United Kingdom to discuss and share experiences on efficient and effective tax administration and enforcement. TEI invites a summary of CRA’s discussions with HMRC in respect of large business tax compliance, including whether (1) CRA is considering implementing a cooperative compliance program for large companies in Canada; (2) benchmarking exercises were conducted (or discussed) in respect of large file audit and issue resolution practices and procedures; and (3) any formal or informal joint initiatives between the respective tax authorities are under consideration or being implemented (or expanded) in respect of large file cases.

CRA Response

Richard Montroy and Lisa Anawati accompanied the Honourable Kerry-Lynne Findlay, Minister of National Revenue, to London in early September, where they met with officials from HMRC to discuss and share best practices. In addition, the Canadian Tax Foundation organized a half-day workshop at which tax professionals from Ireland, the Netherlands, and the United Kingdom discussed cooperative compliance initiatives in their countries.

We at CRA found the discussions particularly helpful as it allowed us to gather different views and perspectives on various approaches to large business compliance. As TEI members are aware, for the past 3 years, CRA has been transforming its large file program to move from a coverage based approach to high risk based.

Our approach is not very different from the approaches used in other countries and in fact were built as a result of close cooperation and discussions with members of the OECD’s Forum on Tax Administration, Large Business Network.

Though approaches differ slightly depending on local legislation and business practices, what we know is that the premise of a Cooperative Compliance Regime still depends on the following pillars:

- Commercial awareness

- Impartiality

- Proportionality

- Openness

- Responsiveness

Also, what we confirmed is that culture change for both taxpayers and tax administrators is very important. Both must be willing to be transparent in dealing with each other. Tax administrations should communicate and try to resolve issues as early as possible.

CRA has considered whether its Large Business compliance approach is in line with a cooperative compliance regime and whether we should introduce a formal pre-filing review program.

A pre-filing program would require the mobilization of taxpayer and CRA appropriate resources and capacity to undertake a real-time audit. There is concern that such a program, while it may be very helpful for a handful of very cooperative taxpayers, could distract CRA from its overall transformation efforts to improve the audit process for all large file taxpayers. Going forward our strategy will be to leverage our existing approach through various program enhancements rather than introduce a new program. That is, we will not be pursuing a new enhanced cooperative compliance assurance program at this time.

Q. A3 CRA reorg, large case audits, resource allocation

Finally, we invite the Director General of the International and Large Business Directorate to provide an update on the following:

- Recent organizational changes at CRA, especially in respect of the Aggressive Tax Planning and International and Large Business Compliance Directorates, and thoughts on how the changes will streamline audits and facilitate earlier, more expedient and effective issue resolution;

- Priorities for ensuring large business compliance for the next three to five years and the role TEI may play in that vision; and

- The bases upon which resources are allocated across the country, taking into account both specialist industry knowledge and technical capabilities.

CRA Response - 3a, 3b (large case/aggressive)

Undoubtedly, TEI members may have heard recent public announcements on organizational changes within the CRA. In keeping with continually enhancing the Approach to Large Business Compliance (ALBC), the CRA will try to streamline the audit process to maximize efficiency and to reduce taxpayer burden.

These measures should enhance our risk assessment and workload selection processes nationally, further enhance our compliance efforts on higher risk taxpayers, leverage technical capacity across the country through workload portability, achieve audit currency for compliant taxpayers, and enhance our quality and integrity framework.

More specifically, in the past year, we have developed an Integrated Risk Assessment System (IRAS) that allows us to risk rank the large business population based on risk, and we have spent considerable time and effort closing our lower risk legacy files and transitioning to our audit currency policy. Please note that cases involving high risk issues will remain under audit until the noncompliance has been adequately addressed notwithstanding our audit currency policy.

Also, we are implementing Integrated Large Business Audit (LBA) teams by fiscal year 2016/17. These teams will be led by an International Large Business Case Manager and will include domestic auditors along with specialty auditors who have knowledge in aggressive tax planning and international tax. The benefits of the integrated audit teams include less burden to the taxpayer and better service under the concept of “One team, One Voice, One Audit”. There will be more informed and streamlined risk assessment, more comprehensive audit planning, speedier decision making on high risk compliance issues, and enhanced audit quality due to the consolidation of technical expertise within the team. The implementation of Integrated Teams will further strengthen our ALBC over time.

Finally, the CRA continues to work collaboratively at the international level to address international and aggressive tax planning issues. The CRA participates in the new Joint International Tax Shelter Information and Collaboration (JITSIC). In the recent month, JITSIC moved from a group of 9 member countries working together to combat tax avoidance to an expanded JITSIC Network under the OECD’s Forum on Tax Administration. This will facilitate participation by an even broader network of countries.

We are also working closely with the G8 and G20 on future measures to tackle tax avoidance, harmful practices and aggressive tax planning. As recently announced after the October conference of heads of the 2014 OECD Forum on Tax Administration, there is a commitment to implement a new standard on automatic exchange and improve the mutual agreement procedure. The new JITSIC platform will be a global effort against offshore tax avoidance by large companies and wealthy individuals, and base erosion and profit shifting by multinationals.

CRA Response - 3c (resource allocation)

In response to your question on the bases of allocating resources and technical capacity; as much as possible resources and specific specialties are located close to the large file taxpayer population. While we will continue to assign files from local offices closest to the taxpayer, to support our high risk approach to compliance we have developed a national portability protocol that will allow us to move the file where capacity exists.

Also, as you may be aware, the ILBD has four industry coordinating offices (ICOs). The industry segments are: Financial Institutions (located in the Toronto North TSO); Pharmaceuticals (located in the Laval TSO); Oil and Gas (located in the Calgary TSO) and Automobile and Manufacturing (located in the Windsor TSO). The purpose of these coordinating offices is to build commercial awareness of tax specific issues, to ensure consistent audit controls and assessing positions across specific industries, as well as provide a single-window for industry. These ICOs started as pilots in 2010 and have proven to be of value to the overall delivery of compliance programs. Therefore, they have become part of the ILBD business enhancements.

In harmony with the ICOs, the mandate/objective of ISS is to identify industry-related emerging issues, develop and communicate national assessing positions, and to provide technical assistance (including information and training sessions) to staff and various other stakeholders in support of building and enhancing industry-related knowledge, commercial awareness and other aspects of the Agency’s technical capacity. In addition, an Industry Specialist Services employee acts as a single window between the CRA and various stakeholders in the resolution of industry-related tax issues, thereby strengthening strategic relationships and promoting compliance.

ISS are expected to work closely with the ICOs, where applicable, to ensure national consistency of industry-specific technical positions. In the past year we have heard from industry about the need to bring back an ISS in pharmaceuticals. We are currently in the process of staffing this position.

Additionally, the ILBD continues to have Regional International Tax Advisors and Aggressive Tax Planning Regional Technical Advisors to support local staff.

B. Follow-up Questions and Carryover Items from Prior Years

Q. B1 Electronic filing

During prior liaison meetings, TEI and CRA have discussed the administrative and compliance efficiencies gained through electronic filing and interchange. TEI invites a status updateon the following:

a. Of T1134s (FAs) and T106s (NALs)

CRA Response

As outlined in Economic Action Plan 2013 (EAP 2013), Canadians who hold foreign property with a cost of over $100,000 are required to provide additional information to the CRA. The CRA will make improvements to help taxpayers meet their filing obligations with respect to Form T1135, including the ability to file the Form electronically in the future. In support of EAP 2013, CRA’s focus is to make the system changes necessary to allow electronically filing of Form T1135.

Once implemented, other Foreign Reporting Forms such as the T106 (Information Return of NonArm’s Length Transactions with Non-Residents) and T1134 (Information Return Relating to Controlled and Not-Controlled Foreign Affiliates) will be considered for migration to a similar electronic filing system to reduce the compliance burden for those who are required to file these forms with the CRA.

b. Of trust returns.

In its response to TEI’s 2012 liaison meeting recommendation that electronic services should be made available to trusts, the CRA said that “the expansion of electronic services to other business lines was being reviewed to determine the most efficient way to extend [such] services to the administration of trust returns.”

When does CRA anticipate that electronic filing might be available to mutual fund trusts?

CRA Response

Our strategic goals include exploring the feasibility to offer more enhanced online options that are secure, reliable, and easy to access. As operational realities improve, the Agency may be in a position to target the improvement for the assessments of trust income tax returns.

c. In audit

(See question and answer 3(d) from the 2013 liaison meeting agenda.)

CRA Response

Building on the success and lessons learned of the Electronic Transfer of Accounting Data (ETAD) service, which only worked for businesses under audit and their representative, the CRA sought to provide a single secure method/service for any individual, business and/or representative to submit documentation electronically to the CRA (via My Account, My Business Account (MyBA) and/or Represent A Client (RAC) web portals.

To fulfill the above objective, an enhanced service called “Submit Documents” was constructed.As an early adopter, in April 2014, the CPB deployed the ability for Individuals who were the subject of certain workloads (Office Audit-like workloads) to submit documents through the Submit Documents service.

For taxpayers, compared to ETAD this service allowed more than one document (up to 10) to be submitted in any single upload. For auditors, behind the scenes, the routing of any submitted documents was streamlined to make it simpler for auditors to use these documents in an audit. The overall effect is a streamlining of the audit process and related sub-processes such as “providing documents to auditors”.

Then in October 2014, the CPB deployed the ability for businesses who were GST/HST registrants and subject of audit work to submit documents through the Submit Documents service.

In the My Business Account (MyBA) and Represent A Client (RAC) portals, since the two services (ETAD and Submit Documents) now co-exist and are underpinned by different case management systems, the taxpayers and their representative need to be mindful of selecting the appropriate service (as indicated by their auditor) in order to submit their documents. Going forward, in April 2015, the two services will be integrated into a single service from the taxpayer/representative perspective.

Q. B2 - Tax account fund transfers

During the 2012 liaison meetings, CRA was asked whether it would consider linking the tax accounts of associated companies so that tax payments could be transferred at the taxpayer’s initiative. In its response, CRA stated:

A policy exists today which does not permit the transfer of funds between companies at the taxpayers’ initiative. The policy is there to avoid situations where one legal entity is making decisions for another. In addition, the CRA wants to avoid accounting corrections such as penalties and interest on misdirected payments.

The CRA has reviewed this request in the past and has drawn the conclusion that the negative impacts that this could potentially have on taxpayers are greater than the benefits of directing a payment.

- Does the CRA maintain the view expressed in 2012?

- If so, would the CRA consider removing large corporations in good standing from its automatic fund transfer program, or consider assigning an account manager or collections manager to work with the taxpayer so that CRA would not initiate and automatically transfer amounts among tax types, tax accounts, and tax years? Alternatively, could the Large File case manager assigned to a particular taxpayer be permitted to work with the collections staff to ensure “stall codes” are placed on accounts to prevent automatic collections or offsets are made prior to a formal reassessment being sent for processing?

CRA is responsible for promptly collecting taxes owing in order to minimize the risk of uncollectible tax debts. As a result, the CRA frequently applies funds on deposit in one tax account(such as GST/HST, payroll, or corporate income tax) automatically against the taxpayer’s obligations under another tax account. In many cases, the automatic application of a payment from one tax account to another is made before the taxpayer is even aware of a deficiency or had an opportunity to make a payment on account. The automatic offset thus creates significant confusion and burdens for taxpayers as they attempt to reconcile their payments against their tax obligations. This is especially problematic for large taxpayers where the responsibility for payroll, GST/HST, and corporate income tax compliance rests with different departments or divisions.

We believe the risk of a large taxpayer’s tax debt becoming uncollectible should be minimal given the frequency of their tax filing and payment obligations, including instalment requirements. As a result, CRA should consider eliminating automatic offsets among different tax accounts for larger taxpayers. If automatic transfers cannot be eliminated because of system issues, an alternative would be to assign a CRA account manager to work with the taxpayer to resolve payment issues in a timely manner. This would save CRA time and money since fewer payments would need to be processed and fewer corrections made for erroneous offsets. We invite CRA’s response and comments.

CRA Response - 2a (no taxpayer-directed transfers)

The CRA’s concerns regarding the potential negative impacts that could result from taxpayer initiated transfers between companies has not changed. The policy is to ensure compliance with the Financial Administration Act (FAA) and avoid situations where one legal entity is making decisions for another. In addition, the CRA wants to avoid accounting corrections such as penalties and interest on misdirected payments.

CRA Response - 2b (temporary holds on automatic transfers)

The CRA has a legislative requirement under Section 224.1 of the Income Tax Act and Section 318 of the Excise Tax Act to withhold and apply funds on one account to satisfy the liability on another account within the same legal entity. As part of the CRA’s ongoing red tape reduction commitments, we are reviewing potential administrative options to address concerns raised by taxpayers regarding the automated allocation of funds from one account to another, particularly in the case of accounts with a large number of divisions. An option currently being evaluated is the possibility of placing a temporary hold on accounts during audit periods that will suspend the reallocations for a specified period. This review is in the early stages therefore we are unable to provide further details at this time.

Q. B3 - Streamlining Reg. 102 waivers

In the 2012 and the 2013 liaison meetings, the CRA was asked about revising its administration of Regulation 102 given the onerous administrative burden imposed upon nonresident employers and the employees who work in Canada for such short periods that no tax will ultimately be payable in Canada. CRA’s 2012 response included the following:

The CRA recognizes the administrative burden faced by non-resident employers and non-resident employees in meeting reporting and withholding obligations when the employees are exempt from Canadian income tax under a tax treaty. The CRA is currently working towards a more comprehensive policy that will address these issues beyond situations for conference participants.

CRA’s 2013 response to a similar question included the following:

The CRA will continue to evaluate potential changes to the waiver process for nonresident employees over the next year. At the present time, we cannot provide a more definitive response regarding particular suggestions. The CRA is continuing to pursue potential policies to simplify the Regulation 102 administration and waiver process.

We invite the CRA to provide an update on its progress in simplifying the administration and waiver process relating to Regulation 102 and share any ideas that it is considering (e.g., pilot projects). Would the CRA consider establishing a working group with TEI and the Department of Finance to resolve these longstanding issues?

CRA Response

The CRA continues to work towards the development of a comprehensive administrative policy to streamline the waiver application process for non-resident employees and employers.

In the meantime, we remain proactive in monitoring the waiver application process and in modifying our existing procedures wherever possible. Establishing and maintaining communication with external and industry stakeholders is an important aspect in accomplishing our objectives and we would welcome a consultative and collaborative approach.

Rather than establishing a formal working group at this time, CRA will continue to meet and communicate with stakeholders as needed.

C. Administrative Matters

Q. C1 - MAP binding arbitration

On June 9, 2014, the CRA released its 2014 Mutual Agreement Procedure Program Report (hereinafter the “MAP Report”). The report acknowledges the availability of the mandatory arbitration process in the Canada-U.S. tax treaty (the “Process”), but provides few details. Would the CRA (1) share its observations about its experiences with the Process and (2) share any statistics about the Process similar to the data compiled in the MAP Report for all mutual agreement cases (i.e., specifically, cases in the system accepted for arbitration, completed, outstanding; arbitration cases by type and category; case completions by transfer-pricing methodology; case completions in favour of the Canadian or U.S. submission)?

CRA Response

Any cases that might be subject to the mandatory arbitration process are included in the statistics in the annual Competent Authority Services Division’s MAP report. As MAP statistics are not disclosed by country, neither are any specific arbitration statistics given as they would only relate, at this time, to cases with the United States. In addition and more importantly, arbitration proceedings are subject to stringent non-disclosure conditions and as such no information including the existence of any arbitration cases can be communicated.

The mandatory binding arbitration provision has been effective in controlling timelines and in imposing a discipline on both MAP and Advance Pricing Arrangement (APA) processes. Historically, very few cases ever resulted in double tax, however the arbitration provision has meant that results are now realized sooner.

Q. C2 - Pre-ruling consultations

We invite the CRA to provide a summary of its preliminary results or observations with respect to the pilot project for “pre-ruling” consultations. In addition, will the CRA confirm whether the person(s) involved in the pre-ruling consultation will be the same person(s) handling the official ruling?

CRA Response

The Income Tax Rulings Directorate (ITRD) officially launched the Pre-ruling Consultations service as a pilot project in November 2013. So, the question is a timely one, as it affords us an opportunity to take stock of our first year’s experience with the service and to consider whether the pilot project should be extended or made a more permanent service of ITRD.

ITRD announced the start of the pilot project at the 2013 annual conference of the Canadian Tax Foundation. A description of the service, its terms of reference and application forms can be found on the CRA’s website at http://www.cra-arc.gc.ca/tx/txprfssnls/srvcs/prcnsltns/pltprjctprcnsltnts-eng.html.

In the past year, we received 21 requests for pre-ruling consultations. There was a broad range of requests, which were handled by all four of ITRD’s Divisions. We have completed 17 of the consultations and 4 are still in progress.

Of the 17 completed requests, just under half (8 of the 17) were given a favourable reaction; i.e., we indicated that we were prepared to consider a full ruling request concerning the issue. In the remaining 9, we gave a negative reaction; i.e., we indicated either that the issue was one in respect of which we could not rule, or that it was likely that our ruling would not be favourable. For the 8 requests where a favourable reaction was given, 6 of those led to a formal ruling request.

Our experience with the pilot project has been generally favourable. The fact that just over half of the requests resulted in a negative reaction from ITRD is not problematic, in our view. Where a negative reaction is given at the pre-ruling consultation stage, the applicant is spared the time and expense of submitting a formal request in respect of which a favourable ruling is not likely to be received. That is one of the objectives of the service.

We will soon be deciding whether to continue the service and will likely announce our intentions at the upcoming annual conference of the Canadian Tax Foundation. [1]

With respect to the second question raised, ordinarily it will be the same persons handling the formal ruling request as were involved with the pre-ruling consultation, as that is most efficient from both our perspective and yours. However, there may be situations, of course, where the formal request may have to be handled by a new officer or manager for operational reasons (workload, availability of staff, etc.).

Q. C3 - International TSO delays

Taxpayers are experiencing lengthy delays in resolving assessment issues with the International Tax Services Office (ITSO), in processing amendments to Regulation 105 and NR4 filings, and remediating errors in the processing of withholding tax filings.

- Are any initiatives being considered by the CRA to improve the corporate tax assessment process in the ITSO?

- Does the CRA monitor the processing time for accounts?

- How are officers evaluated, especially in respect of the time required to process account issues?

CRA Response - 3a (speeding ITSO processing)

Non-resident T2 returns received at the International Tax Services Office (ITSO) are generally more complex, have special processing procedures, and often require additional levels of review. For these reasons, processing time frames can sometimes take longer.

The national service standard for processing paper T2 returns is 90% within 90 days; and the service standard for processing electronic T2 returns is 90% in 45 days. According to our most recent statistics for the 2014-2015 fiscal period, ITSO is exceeding the service standard for processing electronic T2 returns and is very near to meeting the standard for processing paper T2 returns. ITSO continues to strive to meet and exceed the national service standards for processing.

In an effort to reduce the processing times, the CRA continues to promote and expand its use of electronic services. As more non-resident corporations become aware that they can file their T2 returns electronically, the International Tax Services Office’s (ITSO) ability to reduce the average processing time of the T2 return on behalf of the taxpayer increases. Additionally, more requests for reassessments are being received electronically allowing for faster processing of adjustment requests.

Previously, a non-resident corporation filing a T2 return under Regulation 105 and claiming a refund due to a Tax Treaty with Canada often experienced lengthy delays in obtaining its refund. A revision to the screening process of these files, the implementation of an electronic referral system and the creation of a Workload Development position at ITSO have all contributed to a faster determination as to whether or not a file needs additional review. Overall, this contributes to improved processing time frames.

CRA Response - 3b (monitoring timelines)

The CRA recognizes the importance of timely processing of both NR4 and T4A-NR amendments, and makes every effort to assist payers in correcting errors. These requests are addressed on a first-in-first-out basis. CRA monitors this workflow to make sure that NR4 and T4A amendments are processed within reasonable timelines. The actual time it takes to resolve issues is often dependent on the volume of the workload and its corresponding complexity.

CRA Response - 3c (performance evaluation)

Performance management is a cornerstone of CRA’s commitments and is framed by internal policies and guidelines. In this case, CRA officers are required to address files as expeditiously as possible, taking into account the urgency of the matter, the information available and the need to complete the work accurately.

Q. C4 - Authorized representatives

To resolve account matters with CRA, taxpayers are required to have authorizations on file for designated representatives. TEI members have reported experiencing difficulty with seeming systemic lags (or disconnects) between the authorizations that they have filed for taxpayers within their corporate group and the records displayed within CRA’s system. For example, in some companies all members of a corporate group’s tax team have been authorized as representatives and added to the “Group ID,” which grants them online access (and access by telephone, fax, or mail) to administer all of the group’s business accounts. On occasion, authorized individuals from the company have called to speak with the CRA but the CRA representative has been unable to confirm that the individual calling was authorized on the account. In another example, a collections officer recently called a member about an account where every current employee within the tax group held an authorization but the collections officer could only see an authorization for (1) the current VP of Taxation and (2) certain ex-employees the company had de-authorized years ago. Can the CRA advise whether there are any plans to align all its systems for authorizations? Would the CRA consider assigning a liaison officer to administer large file authorizations?

CRA Response

Thank you for bringing this situation and examples to our attention. The protection and security of taxpayers’ information is a CRA priority; we are always open to reviewing our services to ensure they are as efficient and effective as possible.

In our existing process, in order to have a third party representative interact with the CRA on the business’s behalf, the CRA requires that a business owner complete and sign a RC59 Business Consent form. The owner must provide specific details regarding what business accounts, years, etc., the representative may access and/or update. Business owners may authorize an individual, a group, another business to act on their behalf. When authorizing a group to act as a representative, a valid group identification number (group ID) must be associated with the group and must be created through the CRA’s Represent a Client service. Individuals are then associated with the group ID. All individuals who have been associated with a group ID are authorized to interact with the CRA on the business’s behalf.

When a representative contacts the CRA on behalf of a business, CRA employees must first validate that the representative has been authorized by the owner to act on their behalf prior to divulging any information about the business. When a group member contacts the CRA, they are required to provide the group ID and group name for identification and validation purposes. Information regarding who has been authorized to act as a business’s representative is currently consolidated in one common system; the CRA will proactively take steps to ensure that access to and instructions regarding how to use this information is provided to all areas who deal with business representatives. Issues or concerns regarding large file authorizations can be sent to Linda Scott, the Manager responsible for third party authorizations for business; Linda can be reached at Linda.Scott@craarc.gc.ca or by telephone at 613-941-2749.

Third party authorizations may be submitted to the CRA via electronic services on My Business Account and Represent a Client, or by submitting a paper Business Consent form to the CRA. The CRA has established an internal goal of 5 business days to process all third party authorizations, but the quickest way to submit, update or delete information relating to an authorization is by using the CRA’s electronic services. Some authorizations that are submitted to the CRA may take longer than 5 days to process; in some instances, information that is submitted to the CRA does not match our records and must be validated prior to processing.

We will review current procedures and work with our public facing programs to address your concerns.

D. Audit Matters

Q. D1 - Risk-based audits

In 2012 CRA introduced its risk-based audit approach by undertaking a detailed risk assessment of each large taxpayer in Canada. In connection with those risk assessments, the CRA held more than 175 face-to-face meetings with officials from large businesses. Anecdotal accounts of taxpayers’ experiences with the risk-assessment process and the first post-risk assessment audit have varied widely. Now that large taxpayers have been informed of their risk rating, can the CRA provide comments on the implication these ratings have had on assessments and audits? Specifically, we invite CRA’s comments on the following:

- How has the CRA used the risk ratings? Have, and how have, the ratings changed the way CRA conducts audits?

- Has the CRA realized efficiencies with respect to the allocation of audit resources? If so, what are the efficiencies?

- Are there circumstances under which a company’s risk rating may change from high to medium? If so, when might this occur?

- Is the CRA planning any follow-up meetings with taxpayers in respect of their risk ratings within, say, two to three years?

CRA Response - 1a (use of risk ratings)

The Approach to Large Business Compliance strengthens Canada’s use of risk assessment, which takes into account taxpayer and tax intermediary compliance risks and encourages proper corporate tax management behaviours, to divide the large business population into three broad risk segments as described below. These segments have corresponding tailored compliance strategies that include open and transparent discussions between the CRA and the taxpayers on the Agency’s perception of their compliance risks and behavior.

The discussions include face-to-face meetings to discuss the evaluation of the taxpayers’ risk profile and measures that could be taken to move the profile to a more desirable level. To provide for meaningful discussion of the entities’ tax risk management strategies, corporate governance and internal controls, these meetings include the highest level taxpayer representatives (CEO, President, Board Directors, CFO, Senior VP - Tax, etc.) and senior local CRA representatives (TSO Director, Assistant Director of Audit, Senior Large File Co-ordinator) as the dialogue, particularly on corporate and tax governance issues, significantly benefits from consideration by those above the usual day-to-day tax compliance and audit interactions.

CRA officials began meeting with senior management of large corporations in 2011, and to September 2014 have met with approximately 350 taxpayers. Although our initial goal was to have face-to-face meetings with the entire large file population (approximately 1,100) we have been concentrating our efforts on meeting mainly with taxpayers that have a high risk rating.

We will now start focusing on repeat face-to-face meetings with senior tax representatives where we feel there has not been a shift in behavioural or controllable risks. That is, at the start of a subsequent audit year, we may ask to have another meeting to discuss the previous audit and a way forward.

CRA Response - 1b (efficiencies?)

Please refer to the discussion of allocation of CRA’s audit resources across the country in the CRA Response to Section A: Question 3c above.

CRA Response - 1c (lowering risk rating)

An expected outcome is that good co-operation, transparency and trust will enhance CRA’s relationship with many large enterprises and will influence their compliance attitude and behavior towards a lower risk segment. Taxpayers who behave transparently and who represent lower risk can reasonably expect a co-operative relationship with the CRA, increased certainty at an earlier stage, and therefore lower compliance costs. Under this segmented approach, CRA will continue to use a variety of compliance tools as necessary for taxpayers at the opposite end of the spectrum.

CRA Response - 1d (risk-rating follow-ups)

Please refer to the discussion of repeat face-to-face meetings in the CRA Response to Section D: Question 1a above.

Q. D2 - Unilateral HO referrals/screening

We commend the CRA for its efforts to make the audits of large file cases timelier and to close older tax years. This progress has allowed the CRA to conduct more efficient audits since the issues are more current and the documentation and personnel involved in transactions are more readily available to respond to CRA’s queries. On the other hand, in some cases taxpayers report that issues have been referred to Head Office or for a technical review without the taxpayer’s knowledge or an understanding of the CRA’s concerns. In such cases, taxpayers have not been afforded an opportunity to include their comments or ensure that the facts are accurate and complete. As a result of these referrals, the Large File case manager has been unable to conclude these issues, resulting in a delay in the completion of the audit and, frequently, a request for waivers of the statute-barred period. Large File case managers have told taxpayers that they have no ability to estimate when responses will be received from Head Office because of the backlog. Indeed, in many cases, the referrals remain unassigned for weeks or months.

Does the policy on referrals to the Head Office include a mechanism to permit taxpayers to ensure the accuracy and completeness of the referral and include taxpayer comments on the referred matter? How have the recent organizational changes in the International and Large Business Directorate discussed during the Introduction affected the Head Office referral process?

CRA Response

The mandate of the technical sections in Compliance Programs Branch is to support the auditor in achieving a fair, consistent, and accurate reassessing position.

Auditors are strongly encouraged to include taxpayers in the process of referring an issue to Headquarters for technical assistance. The availability of a clear and complete set of facts, the TSO’s position and the taxpayer’s view lends itself to the most efficient and comprehensive review of the issue. That said, the mandate of the technical sections is to support the TSOs, and therefore it is ultimately up to the auditor to determine how much taxpayer involvement there is in the process of making a referral.

As well, in the summer of 2014, the Income Tax Rulings Directorate entered into Memorandums of Understanding (MOUs) with the International and Large Business Directorate and the Small and Medium Enterprises Directorate of the Compliance Programs Branch. These MOUs serve as a framework for the provision of internal support to auditors.

The main objective is to provide auditors with timely and appropriate support related to technical interpretation and application queries that come up during their audits. The framework was designed to establish procedures for the internal flow of requests. Auditors are being asked to flow all requests through Compliance Programs Branch headquarters where they will be reviewed and allocated to the appropriate area within the CRA, including the Income Tax Rulings Directorate. The new process will ensure that Compliance Programs Branch headquarters are aware of the audit issues that are coming up in the field as a form of business intelligence to feed its audit process across the country. In addition, the process will ensure that field submissions contain the relevant facts and supporting documentation, including the taxpayer’s or representative’s views regarding the relevant facts and the application of the law, before it is forwarded to the relevant Headquarters experts. Ideally, the documentation to be included with a submission will include not only the auditor’s analysis, but also the taxpayer’s or representative’s. Consequently, Headquarters resources will have all of the relevant information when it considers the issue being raised by the auditor.

When referrals are made to the Income Tax Rulings Directorate, responses will be sent back to Compliance Programs Branch Headquarters for their records and sharing of the document with the auditor. The publication of the document will be delayed for 90 days to allow the auditor to discuss the findings with the taxpayer before publication.

The Headquarters support being provided under the MOUs should improve the CRA’s tax administration by ensuring that notices of reassessment are accurate and reflective of the law.

Q. D3 - ADR process?

As noted above, the CRA has made strides bringing audits of large corporations up to date and fine tuning the focus of its audits through an improved risk assessment process. This has significantly improved audit relationships with large corporations, reduced the administrative costs for both the CRA and taxpayers, and afforded large corporations greater tax certainty. Regrettably, one area that still consumes significant resources for the CRA and taxpayers is the resolution of issues where there are significant differences of opinion.

The CRA has a formal Appeals process and taxpayers ultimately have recourse to litigation in the courts, but these processes can be time consuming and expensive. TEI members have observed a reluctance to resolve issues at the audit level, which has led to the current backlog at Appeals and the courts. In recognition of the significant costs and time involved in litigating issues,other countries have instituted other dispute resolution processes administered by or complementary to administrative appeals processes. For example, the United Kingdom introduced its Litigation and Settlement Strategy (LSS) in 2007 and refreshed it in 2011. [2] Additional guidance for resolving disputes is also found in HMRC’s “Code of Governance for Resolving Tax Disputes,” [3] as well as the “Practical Guidance for HMRC Staff on the use of Alternative Dispute Resolution in Large or Complex Cases.” [4] These documents provide insights and benchmarks for improving the Canadian tax administration process by introducing a “Made in Canada” alternative dispute resolution process modeled on the UK programs. Indeed, TEI member companies that have participated in the HMRC dispute resolution processes have found it efficient and effective. The Australian Taxation Office [5] and the U.S. Internal Revenue Service [6] have introduced similar programs and the links below provide details on their respective programs. Would the CRA consider creating an alternative dispute resolution process as has been implemented in other countries? TEI would welcome the opportunity to assist the CRA in developing such a process.

CRA Response

CRA has been working on several initiatives that we feel will assist us to reduce the number of files that will go to Appeals. For example we have provided more technical training to ensure the auditors have the proper knowledge and tools to conduct high quality audits. In addition we recently introduced the above mentioned referral process from the auditors to HQ for technical assistance. Another initiative rolled out in this past year is a formal referral to the DG and Directors of ILBD of all proposed files with significant or material changes and/or complex or sensitive issues. While HQ does not do a technical review we are aware of issues and may be able to intervene in some situations.

As previously mentioned, there is also the extra effort we have been making to enhance technical capacity through our industry coordinating offices, industry sector specialists, the international and aggressive tax planning technical advisors. We also have our more formal oversight committees, such as the Third-Party Civil Penalty Review Committee, Transfer Pricing Review Committee, and

the GAAR Committee.

This is to ensure the audit reassessments are technically correct and therefore can be resolved without an appeal. Before any large file is closed there is usually a significant amount of input from various sources. While CRA is not entertaining an Alternate Dispute Resolution Process, we do continue to encourage early file resolution. Where issues arise, taxpayers should raise the items first with the Large File Case Manager, then the Assistant Director of Audit for the local office.

Q. D4 - Provincial allocation disputes

At one time, the CRA employed a formal process — the Tax Re-Allocation Committee (TRAC) — for resolving provincial allocation disputes. With the federal government’s assumption of the administration and enforcement of Ontario taxes, there seem to be fewer interprovincial allocation disputes, but when issues arise they often require an extensive period of time to resolve. In the interim, taxpayers are forced to pay the full amount of a disputed tax liability to more than one province. We invite the CRA to provide an update on the provincial allocation dispute resolution process and whether there is any opportunity for taxpayers to make representations with respect thereto, thereby improving and expediting the time for resolution of these disputes.

By way of example, a TEI member recently volunteered that an error had been made in its provincial allocation and provided revised calculations to the affected provinces. The non-agreeing province (Quebec) quickly reassessed the additional income but the agreeing province (Ontario) has been reluctant to reassess the reduction in its income that will be necessary to afford the taxpayer relief. As a result, the taxpayer has effectively been subject to double tax on the reallocated income for a substantial period. What recourse would the CRA recommend in these circumstances?

CRA Response

CRA still has the same formal process for resolving provincial income allocation (PIA) disputes for corporations. The TRAC is now called Allocation Review Committee (ARC).

Before any file is sent to ARC, an ARC member will propose the PIA initiated audit changes to the other affected parties and to the taxpayer, and try to resolve the PIA issues. At this time, the taxpayer has an opportunity to make representations. The ARC members have agreed on reasonable delays in resolving the issues before a file is referred to ARC.

The CRA recognizes that in the past, some files referred to ARC required additional time to resolve since their issues were very complex and all parties had to conduct extensive research and consult with their own experts. However, ARC members will try whatever it can to avoid double taxation and settle the files within reasonable timeframe.

At CRA, the taxpayer requested adjustments will normally be proposed to the other affected parties to avoid double taxation. CRA would like to clarify that an income tax amount is only due by the taxpayer if the taxpayer’s return is assessed or reassessed.

If a Non-agreeing province has assessed or reassessed a taxpayer’s return as a result of the taxpayer’s request, the CRA can still discuss the files with the other affected parties to avoid double taxation. If the parties maintain their adjustments, then the CRA recommends that the taxpayer files an objection with all the jurisdictions. The parties will also try to resolve any double taxation at the objection stage.

CRA now represents Ontario for pre and post-harmonized taxation years. Should there be any concerns, please contact CRA through its normal enquiries line.

Q. D5 - Requests to foreign tax authorities

What is the CRA’s policy with respect to CRA auditors issuing information requests to foreign tax authorities in respect of Canadian tax audits? What steps should be taken by CRA auditors prior to issuing requests for information from foreign tax authorities? When is it appropriate for auditors to request information through the Joint International Tax Shelter Information Centre (JITSIC) rather than issue a formal treaty-based request for information?

CRA Response

The authority to exchange or issue information requests between other foreign tax authorities is found in Canada’s tax treaties under the Exchange of Information Article or in a Tax Information Exchange Agreement (TIEA). The authority for exchanging information is vested with the Competent Authorities of the Contracting states and in Canada is the responsibility of the Competent Authority Services Division (CASD), International and Large Business Directorate (ILBD). All exchanges of information with tax treaty and TIEA partners are controlled and administered by the Exchange of Information Section (EOI).

CRA auditors submit requests through CASD-EOI who in turn deals with the treaty/TIEA partner’s competent authority to administer and fulfil the information exchange. It is the responsibility of the CRA auditor when making an information request to ensure that it contains sufficient information to demonstrate the foreseeable relevance of the requested information. Ordinarily CRA is to exhaust all domestic powers to retrieve the information in Canada prior to forwarding any exchange of information requests to a foreign tax authority. Canada and its international partners are not obligated to exceed the bounds of their own domestic laws and administrative practices, nor supply information that is not obtainable in the normal course of its own administration.

Requests for information from foreign tax authorities are also administered by CASD-EOI. Upon receiving a foreign tax authority request for information, CASD-EOI will review and confirm that the request meets the parameters of the treaty by ensuring:

- That Canada has a treaty or TIEA in force with the other foreign tax authority and that the information requested is covered in the agreement.

- That the foreign tax authority request is signed by an approved Competent Authority official of the requesting foreign tax authority.

- That the request contains sufficient information to demonstrate the foreseeable relevance to their case.

- That sufficient information is provided to action the request including the reason for the request and sufficient information to correctly identify the taxpayer.

Once the foreign request is accepted, CASD-EOI will directly respond to the request if the information requested can easily be retrieved from CRA’s various databases. Otherwise, CASD-EOI will prepare and forward a memo and summary to the applicable tax service office. CRA auditors will action and retrieve the requested information by utilizing domestic powers as necessary. Upon finalization of the request for information, auditors will forward their response to CASD-EOI, where it will be reviewed to confirm that the response is complete and meets the parameters of the treaty/TIEA prior to forwarding the response to the requesting foreign tax authority. All exchange of information requests, whether they occur under the auspices of JITSIC or otherwise are formal treaty-based exchanges and subject to the same considerations.

E. Technical Matters

Q. E1 - Timing of s. 152(1.1) application

2014-0550351C6 E – 2014 TEI Liaison Meeting, Q.E1

In a year where a taxpayer has section 3 income, the CRA is obliged to make an initial assessment “with all due dispatch.” The government’s ability to reassess (absent deliberate or negligent misrepresentation by the taxpayer) expires within specified periods following the initial assessment. The same rules apply for a year when a taxpayer has a non-capital loss or a net capital loss, but the rules do not have the same effect because losses carry forward and their quantum remains open to adjustment until the year in which the losses are used or become statute barred.

Subsection 152(1.1) of the Act affords a process for fixing the quantum of a loss, but traditionally this process has not been engaged until after an audit. The process can begin only after the CRA has “ascertained” that the loss differs from the amount reported by the taxpayer. That can be a long time and the losses may be relevant for 20 or more years after the year the loss is incurred, thereby creating substantial uncertainty for taxpayers about their tax position and subjecting taxpayers to a burdensome requirement to maintain records of the year of the loss until the loss amount is “ascertained.”

In 2013, TEI recommended that the Department of Finance consider an amendment to the Act that would require the CRA to make initial determinations of losses for a taxation year at the same time and in the same manner as the initial determination of income for that year. The response, captured in minutes of the meeting prepared by TEI members and subsequently reviewed by Finance, was, as follows:

Finance would support an interpretation of subsection 152(1.1) that allowed a taxpayer to request that the amount of a loss be determined when the taxpayer files its return. If this interpretation is correct, Finance sees no need for an amendment. If the provision does not allow this, it may be worth considering an amendment.

Is the CRA prepared to issue a determination of loss to a taxpayer who requests one upon the filing of its return?

CRA Response

Subsection 152(1.1) of the Act provides that two conditions must be satisfied for the Minister to issue a notice of loss determination.

These conditions are:

- the Minister ascertains the amount of a taxpayer’s non-capital loss for a taxation year to be an amount that differs from the one reported in the taxpayer’s income tax return; and

- the taxpayer requests that the Minister determine the amount of the loss.

When a taxpayer files its return of income and the Minister accepts the return as filed, the amount of the taxpayer’s loss has not been “ascertained” by the Minister in an amount that differs from the one reported in the return. Therefore the first condition required for a loss determination is not met, and the Minister cannot issue a loss determination upon the request of the taxpayer at the time of filing its

return of income.

We note that this interpretation has been confirmed by the courts.

The Act would need to be amended in order to require the Minister to issue a notice of loss determination where a taxpayer requested one at the time of filing its return of income.

Q. E2 - CCA claim amendments

Under paragraph 20(1)(a) of the Act, a taxpayer has a statutory right to a deduction in respect of the capital cost of depreciable property. The taxpayer may also claim less than the maximum allowable and recover greater amounts of undepreciated capital costs in future years. Information Circular 84-1 (July 9, 1984) describes the facts and circumstances under which a taxpayer’s written request to revise the capital cost allowance (CCA) for previous taxation years will be granted. Generally, revisions to previously claimed CCA amounts can be made as long as there is no change to the tax assessed or payable for the year of the revised claim or for any other year for which a return has already been filed. In addition, requests for revisions of CCA in a year that was assessable to tax are allowed as long as the time for filing a notice of objection in respect of that year has not expired. There are some exceptions to this timeline, which include property that was subject to “certification” for inclusion in another class providing for a faster write-off (the taxpayer may then make revised claims for additional CCA for all prior taxation years affected that are not statute barred to reassessment). Requests for revisions of CCA in a year where no tax was payable are allowed except where the Minister has issued a loss determination (unless the taxpayer makes the request within 90 days from the day of the mailing of the notice of determination for that year).

Some taxpayers have reported being denied requests for revisions of previous CCA claims on the basis of attempting to engage in “retroactive tax planning.”

- Are the guidelines outlined in IC 84-1 still valid or has the CRA changed its practices?

- Would the CRA’s practice differ from the practices outlined in the IC if a request for revision of CCA were made subsequent to an acquisition of control of the taxpayer and the adjustment related to the time before the acquisition of control?

CRA Response - 2a (closer look at IC 84-1 requests)

The CRA recently responded to a similar question at the 2013 Canadian Tax Foundation Roundtable. IC 84-1 is currently under review. Our position on the application of IC 84-1 however, has not changed. As stated in 2013:

IC 84-1 provides the CRA’s administrative policy with respect to taxpayer requests to revise permissive deductions in previous taxation years, including years that may be statute-barred. Because IC 84-1 is an administrative policy, the CRA has the authority to exercise some discretion in determining whether a taxpayer’s request will be allowed (Minister’s discretion).

IC 84-1 operates within the context and legislative framework of the Income Tax Act. As such, when considering an IC 84-1 request, it is necessary to look at other relevant provisions of the ITA (such as section 111) and whether acceding to that request would lead to an inappropriate result. Each decision is based on the specific facts of each case.

While to a certain extent IC 84-1 outlines situations where the CRA will consider adjusting returns in circumstances that would constitute retroactive tax planning, we have, in recent years, noted more situations that, in our view, lead to inappropriate results. As such, we are taking a closer look at IC 84-1 requests on a case-by-case basis to ensure that it is being used by taxpayers in the manner in which it was intended and that it is being consistently applied by the CRA.

CRA Response - 2b (concerns re pre-acquisition-of-control adjustments)

As stated in our response to part (a) above, the CRA is taking a closer look at IC 84-1 requests on a case-by-case basis. Although we cannot provide a definitive answer to your question without a specific fact situation, we can say that a request for adjustments to a period prior to an acquisition of control could raise some concerns for us.

Q. E3 - "Normal open-market" purchase in s. 39(3)

2014-0550401C6 E – 2014 TEI Liaison Meeting, Q. E3

Many Canadian taxpayers have issued bonds, debentures and similar obligations. Many of the instruments bear interest at rates higher than currently prevailing market rates. Hence, these companies are evaluating alternatives to refinance or repay their higher interest rate debts to lock in the advantage of the current low interest rate environment and reduce the overall costs of debt.

In many cases, the repayment of a higher rate obligation prior to maturity entails the payment of a penalty, bonus, or premium over the face amount that represents compensation for the interestrate spread between the rate on the obligation and the current market interest rates. In this context, when bonds are purchased in the open market by the issuing company the price will exceed the greater of the principal amount of the obligation and the amount for which it was issued by the taxpayer. By virtue of paragraph 39(3)(b) of the Act, the excess amount (assuming the transaction is not an income transaction under the general rules for distinguishing income from a capital gain) would generally be deemed to be a capital loss of the taxpayer for the taxation year from the disposition of a capital property. See, e.g., Technical Interpretation 2000-0036825 (September 13, 2000).

If the manner of repayment is not considered a purchase in the open market by the issuing company in the manner in which open market purchases are normally made by the general public, subsection 39(3) should not apply. Rather, subsection 18(9.1) of the Act may apply in respect of a penalty or bonus amount as described in paragraph 18(9.1)(d). Where all the conditions in subsection 18(9.1) are satisfied, the penalty or bonus amount may be deducted as interest in accordance with that subsection.

There are a number of alternative methods companies can use to facilitate the repayment of debt obligations. Many bonds do not trade publicly on a stock exchange and instead trade off-market or “over-the-counter.” In evaluating the potential application of subsection 39(3) to bond repurchase transactions it is not always clear what constitutes a “purchase in the open market in a normal manner by any member of the public.” Accordingly, we request that the Agency provide its views on whether the bond buyback or repurchase transactions noted below are within (or outside) the purview of subsection 39(3) and indicate whether each constitutes an open market re-purchase:

- A debt tender offer where a company makes a public offer to its bondholders to repurchase a predetermined number of bonds at a specified price.

- In some cases, certain investors will own a significant amount of a particular issuer’s bonds. Consider the case where a bond issuer enters into a transaction directly with one or more selected bondholders and agrees to repurchase all or a portion of the issuer’s bonds held by the selected investor-holder(s).

- Some bonds are callable, with the issuer having a right under certain conditions to redeem the bond prior to its maturity date. Consider an example where an issuer has issued callable bonds and subsequently exercises the call to force the redemption of the bonds.

CRA Response

It is the CRA’s position that the phrase "purchased the obligation in the open market, in the manner in which any such obligation would normally be purchased in the open market by any member of the public" for the purpose of subsection 39(3) of the Income Tax Act means that the obligation must be purchased on an exchange or over the counter through an independent party in accordance with the procedures and requirements of the relevant securities legislation and the by-laws or regulations of the relevant exchange or trading platform. If the vendor and the purchaser have made an arrangement with respect to the purchase and sale of the obligation in question, the purchase would not be considered to be carried out in the manner in which any member of the public would normally purchase obligations in the open market. Indeed, if the identities of both the purchaser and the vendor are known to each other with certainty, generally the bonds would not be considered to be purchased by the issuer in the open market in the manner in which bonds would normally be purchased by any member of the public. In our view, the provisions of subsection 39(3) of the Act may not apply if the issuer of a debt obligation is not bidding in competition with the general public or if the issuer exercises advantages or special rights not available to the general public.

In respect of the particular questions posed by TEI:

Generally a tender offer (i.e., an offer which requires an acceptance by the holder in the form of a tender of the relevant obligation by the holder directly to the issuer) is not considered to be an open market repurchase for purposes of subsection 39(3).

Generally a bond repurchase that is negotiated and concluded directly between an issuer and a holder is not considered to be an open market repurchase for purposes of subsection 39(3).

Generally the exercise by the issuer of an early repayment right pursuant to the terms of a

bond is not considered to be an open market repurchase for purposes of subsection 39(3). Skulski

Q. E4 - Assignment of dissolved sub refund

Frequently internal corporate reorganizations involve the winding-up of corporate subsidiaries in order to simplify corporate structures or eliminate redundant or dormant entities. After dissolution, these corporations may have either tax owing or be entitled to a tax refund.

Where a corporation has been formally dissolved and has an “overpayment,” the CRA has in some instances refused to issue a refund of the overpayment on the basis that the corporation no longer exists. On the other hand, where a dissolved corporation has a balance of tax owing, we understand the Agency assesses and pursues collection of the tax from the parent corporation that received the dissolved corporation’s property. (The claims against the parent presumably are pursuant to subsections 159(1) and (3)). Hence, there is seemingly inconsistent treatment of groups of corporate taxpayers depending on whether there is a refund or balance due for the dissolved corporation. We believe this inconsistency should be addressed.

We note that the formal dissolution of a subsidiary wholly owned corporation is typically preceded by a distribution of all of the property, rights, and interests of any kind to, and an assumption of all of its liabilities and obligations of any kind by, its parent. In the context of a corporate wind-up, would the Agency accept a subsidiary’s assignment of its right to a refund of tax to its parent (i.e., by issuing any refund to its parent)? Alternatively, would the Agency consider refunding an overpayment in respect of a dissolved subsidiary pursuant to paragraph 164(1) (a) of the Act?

CRA Response

The issuance of refunds and the collection of debts are governed by separate legislation. With respect to refunds, Section 67 of the Financial Administration Act expressly prohibits the assignment of a refund between different legal entities. When a subsidiary corporation is wound up into a parent corporation, it ceases to exist as a legal entity and cannot be considered part of the parent corporation. Paragraph 164(1)(a) of the Income Tax Act establishes when a refund is payable but does not provide any provision for assignment of a refund from one legal entity to another.

Under Subsection 227(1) of the Canada Business Corporations Act, any right to a refund of overpayments which a subsidiary corporation may have is lost once the corporation ceases to exist and any credits to which the corporation may be entitled automatically revert to the Crown. Although we are unable to issue a refund from a wound up subsidiary corporation to a parent, when certain conditions are met, a refund of an overpayment may be issued to the sole shareholder of a subsidiary corporation or to a legal representative of a subsidiary corporation when there are multiple shareholders. For example, when:

- the dissolved corporation is revived and all returns have been filed; or

- the dissolved corporation is not revived, all returns have been filed up to the date of dissolution, the articles of dissolution indicate that the corporation will distribute its assets to the shareholder(s) after satisfying its creditors, and

- immediately prior to the dissolution, it was owned by a sole shareholder and it has been determined that the shareholder is the rightful owner of the funds and the sole shareholder completes and returns a signed “Release and Indemnification”form to the CRA; or

- it was owned by multiple shareholders and a legal representative, as defined in Section 248(1) of the Income Tax Act, has been appointed by the shareholders, to act on their behalf and the appointed legal representative completes and returns a signed “Release and Indemnification”* form to the CRA.

In order to ensure that a subsidiary corporation is able to receive a full refund of any overpayments, the corporation should ensure that:

- all financial activities on a corporate account are finalized before dissolving the corporation;

- an open bank account is maintained until all financial activities have been completed; and

- all annual returns are filed and fees paid on time, to the applicable incorporating body (Industry Canada and/or the Provincial Government).

Q. E5 - Imaged records

In Technical Interpretation 2014-0526121E5 (July 17, 2014), CRA expressed the view that subsection 230(1) of the Act does not require taxpayers to keep their books and records in paper format. Specifically, the statutory requirement to maintain books and records can be satisfied with electronic records (or images) to the extent that the content and quality of the electronic image is sufficient to enable the taxes payable to be determined. The interpretation also states that it is the taxpayer’s responsibility “to select suitable electronic imaging requirements,” citing Information Circular IC 05-1R1 – Electronic Record Keeping (June 25, 2010).

IC05-1R1 includes the following requirements [7] :

- Paragraph 9 states that records must be located in Canada and clarifies that records kept outside Canada (e.g., on a server) and accessed electronically from within Canada are not considered records maintained “in Canada.” As a result, authorization from the Minister is required to maintain the electronic images and files on servers outside of Canada.

- Paragraph 26 states that “Imaging and microfilm (including microfiche) reproductions of books of original entry and source documents have to be produced, controlled, and maintained according to the latest national standard of Canada, as outlined in the publication called Microfilm and Electronic Images as Documentary Evidence (CAN/CGSB-72.11-93).”

- Paragraph 27 summarizes additional requirements for an acceptable imaging process as outlined in the national standards.

Since the issuance of the national standards and IC05-1R1 there have been significant advances in technology (e.g., cloud computing) that have increased taxpayers’ ability to convert paper documents to electronic images and minimize administrative and storage costs.

- What has CRA’s experience and involvement been in evaluating taxpayers’ imaging processes? Is such an evaluation required before the CRA will authorize the destruction of the paper source documents that have been converted into electronic images?

- With the advances in technology, is the CRA participating in any initiatives to update the national electronic imaging standards and the related requirements outlined in the information circular?

- In view of the easily accessible nature of electronic records through the internet — and in consideration of the decision in the Federal Court of Appeals decision in eBay Canada Ltd. V. M.N.R. [2008 F.C.A. 348; 2008 D.T.C. 6728] — would the CRA consider eliminating the requirement that electronic records be maintained on a server located in Canada? Eliminating this requirement would obviate taxpayers’ administrative burdens of securing the Minister’s approval for records kept outside of Canada and minimize the corresponding burden imposed on CRA to review taxpayers’ requests and processes.

CRA Response - 5a (paper destruction)

The CRA does not perform an analysis of a taxpayer’s imaging process. During an audit, auditors examine source documents. When those source documents have been imaged, the auditors examine the imaged documents for purposes of vouching transactions selected for audit testing.

It is the responsibility of the taxpayer to comply with the imaging standard 72.11 published by the Canadian General Standards Board (CGSB).

The standards are referenced in the following CRA record keeping publications:

- IC78-10R5 - Books and Records Retention/Destruction

- IC05-1R1 - Electronic Record Keeping

- RC4409 - Keeping Records

- GST/HST Memoranda Series 15-1 General Requirements

- GST/HST Memoranda Series 15-2 Computerized Records

Specifically, taxpayers may refer to paragraph 27 of IC05-1R1 for more information on what an acceptable imaging program requires.

Overall, it is the responsibility of the taxpayer to comply with the imaging standard 72.11 published by the Canadian General Standards Board (CGSB).

CRA record keeping publications state that paper source documents that have been imaged in accordance with the latest national imaging standard may be disposed of and their images kept as permanent records. This is specified in Paragraph 22 of IC78-10R5, and paragraph 28 of IC05-1R1.

In this regard, CRA’s publication RC4409 also includes the following statement at page 10:

You can destroy paper books of account and supporting documents if they have been imaged in accordance with the CGSB publication (CAN/CGSB 72.11). These images become the permanent records. If you have any doubt, obtain legal advice first.” … “If businesses cannot meet the CGSB standards, they must keep their original records.

CRA Response - 5b (no updates)

No. At this time, we are not participating in any initiatives with the Canadian General Standards Board (CGSB), nor have we been asked to participate in any initiatives regarding updating the national electronic imaging standards.

CRA Response - 5c (Canadian server)

Subsection 230(1) of the Income Tax Act requires that every person who is carrying on business, or is required to pay or collect taxes or other amounts, to keep books and records of account in a prescribed manner in Canada unless permission is given by the Minister to maintain them elsewhere. Taxpayers should refer to the following CRA publications that provide administrative guidance on the issue of electronic books and records, including the issue of “location of records”:

- RC4409 - Keeping records

- IC05-1R1 - Electronic Record Keeping

- IC78-10R5 - Books and Records Retention/Destruction

Q. E6 - S. 115.2(2)(b)(i)(B) - Forco share issuance to affiliated Canco

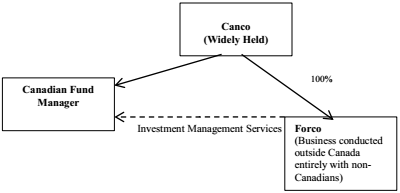

Where a non-resident engages a Canadian investment manager, the activities of the investment manager may cause the non-resident to be carrying on business in Canada for Canadian tax purposes. Under subsection 115.2(2), where certain conditions are met, the non-resident will not be considered to be carrying on business in Canada solely because of the activities of its Canadian investment manager. For purposes of discussion, assume that the management of a foreign company (Forco) wishes to engage a Canadian-resident corporation (CSP) to provide Forco with “designated investment services.” (All quoted terms are as defined in subsection 115.2(1)). CSP’s provision of these services to Forco could cause Forco to be carrying on business in Canada unless the exemption in subsection 115.2(2) is available.

The diagram below illustrates the relationships and the issue is whether the issuance of shares by Forco, from its treasury, to a Canadian resident precludes Forco from claiming the benefit of the safe harbor rule in subsection 115.2(2).

In responding to the questions and comments below, assume that:

- Forco was created more than a year ago;

- 100 percent of Forco’s shares were issued by Forco to, and continue to be owned by, a company resident in Canada (Canco);

- Canco is affiliated with CSP;

- Canco is a “designated entity” in respect of CSP;

- Forco has not, directly or through its agents, directed promotion of investments in Forco principally at Canadian investors; and

- Forco has not, directly or through its agents, filed any document with a public authority in Canada to permit the distribution of interests in Forco to persons resident in Canada.

Would the CRA agree that by issuing shares to Canco from treasury Forco would not be considered to have “sold an investment in itself,” as the phrase is used in clause 115.2(2)(b)(i)(B)? Does the mere issuance by Forco of treasury shares to a Canadian parent preclude the availability of the safe harbor even though Forco does not offer securities for sale to Canadians in Canada? We invite the CRA’s comments.

CRA Response

Forco’s issuance of shares from treasury to Canco (whether upon incorporation or otherwise), would result in Forco being considered to have “sold an investment in itself” as the phrase is used in clause 115.2(2)(b)(i)(B). As such, the issuance of treasury shares by Forco to Canco (whether upon incorporation or otherwise) would, to the extent the shares remain outstanding and Canco remains a “Canadian investor” within the meaning assigned by subsection 115.2(1), prevent Forco from benefiting from the availability of the safe harbour rule in subsection 115.2(2).