22 May 2014 IFA Roundtable

Q.1 (Application of the Foreign Affiliate Dumping Rules to CRIC Guarantees)

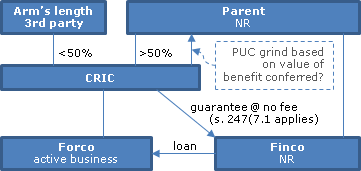

Assume that CRIC is majority (but not wholly) owned and controlled by Parent, a non-resident corporation, with the remainder of its shares being held by one or more persons at arm's length with Parent and CRIC. Forco is a CFA of CRIC that carries on an active business in a country other than Canada. A non-resident entity related to Parent lends money to Forco for use in its active business. The Forco debt is guaranteed by CRIC but no guarantee fee is charged or paid.

Assume that subsection 247(7.1) will apply so that there is no adjustment under subsection 247(2) for the nil guarantee fee.

Paragraph 212.3(10)(b) defines "investment" to include a contribution of capital to Forco by CRIC, which is deemed to include any transaction or event under which a benefit is conferred on Forco by CRIC. Does the provision of the guarantee by Canco for no fee constitute a conferral of a benefit so that there is an "investment" under subsection 212.3(10)?

Q. 1(a) - Benefit Conferral

Can the CRA comment on whether, and in what circumstances, it would consider the provision of the guarantee by CRIC for no fee not to be a conferral of a benefit for purposes of paragraph 212.3(10)(b)?

Notes From Presentation

In brief, a guarantee made for no fee is considered to be an investment in the subject corporation (Forco) by the CRIC in these circumstances. Although this ultimately is a question of fact based on all the circumstances, CRA’s analysis in this context is informed by the analysis that would apply in an analogous s. 15(1) situation. CRA considers for purposes of s. 15(1) that there is a conferral of a benefit by a corporation on its shareholder when the corporation guarantees debt of the shareholder for no fee. Similarly, there is considered to be a conferral of a benefit when the CRIC guarantees debt of a subject corporation for no fee.

Official Response

22 May 2014 IFA Round Table, Q. 1, 2014-0526691C6

Q. 1(b) - No benefit even if no fee?

[Not presented at Conference.]

Official Response

22 May 2014 IFA Round Table, Q. 1, 2014-0526691C6

Q. 1(c) - Quantum of "Investment"

If such guarantee does constitute an "investment", can the CRA comment on what the quantum of that "investment" would be? For example, would it be the NPV of an arm's length guarantee fee over the life of the loan?

Notes From Presentation

CRA cannot comment on all the considerations respecting the measuremnt of a benefit, which would be based on the facts and circumstances of each case. However, it can be noted that s. 212.3(2)(a) deems a dividend to be paid at the investment time of the fair market value at that time of the benefit conferred. Such determination would be a factual one based on all the relevant circumstances.

Official Response

22 May 2014 IFA Round Table, Q. 1, 2014-0526691C6

Q. 1(d) - Multiple PUC Grinds

If such guarantee does constitute an "investment", further assume that the resulting deemed dividend is reduced to nil by virtue of the PUC grind permitted under subsection 212.3(7). It appears that no PUC reinstatement would be permitted on the repayment in full of Forco's loan. There could therefore be multiple, cumulative PUC grinds arising as a consequence of future Forco loans guaranteed by Canco without a fee, even if only one such debt is outstanding at any given time. Can CRA comment on this apparent anomalous result?

Notes From Presentation

CRA agrees that repayment of Forco’s loan would not satisfy the tests in s. 212.3(9). However, it is possible that a subsequent distribution described in s. 212.3(9)(c)(ii) could reinstate a PUC grind resulting from such conferral of benefit to the extent that such distribution is in respect of the investment in Forco.

Official Response

22 May 2014 IFA Round Table, Q. 1, 2014-0526691C6

Q.2 (Application of the LOB to Gain on Sale of US Company)

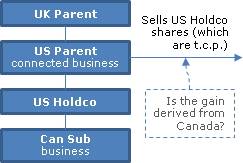

Assume that UK Parent owns US Parent, which owns US Holdco, which owns Can Sub. US Parent sells US Holdco. Assume further that US Holdco shares are "taxable Canadian property" within the meaning of subsection 248(1). If the Canada-US Treaty applies, Canada does not have the right to tax any gain on the disposition of US Holdco by US Parent. Paragraph 3 of Article XXIX-A of the Treaty (i.e., the LOB) reads in part "the benefits of this [Treaty] shall apply to that resident person [US Parent] with respect to income derived from [Canada] in connection with or incidental to that trade or business (including any such income derived directly by that resident person through one or more other persons that are residents of [Canada]…" Assume that US Parent is carrying on a business that is upstream, downstream or parallel to the business carried on by Can Sub.

Would the CRA consider the gain to be derived from Canada where Canada taxes the gain under domestic law, such that the Canada-US Treaty applies to exempt the gain?

Notes From Presentation

This situation is similar to Q.4 of ITTN No. 41 (i.e., the value of the US Holdco shares - and thus the taxable capital gain - is derived from an active business in Canada that is parallel to the active business carried on by US Parent in the United States, so that such gain is derived in connection with US Parent’s active business.) To the answer in that response, CRA would add that since the value of the shares of US Holdco is derived from taxable Canadian property, CRA would consider its value to be derived from the Canadian property for purposes of Art. XXIX-A, para. 3 as well.

Official Response

22 May 2014 IFA Round Table, Q. 2, 2014-0526711C6

Q3 (Upstream loan rules)

Q3(a) - Computation of surplus

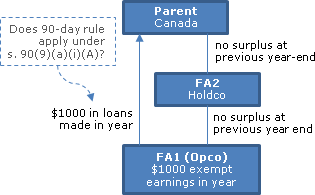

Clause 90(9)(a)(i)(A) of the Act permits a deduction in respect of an upstream loan included in a taxpayer's income pursuant to subsection 90(6) or subsection 90(12). The amount deductible is the amount that the taxpayer can demonstrate can reasonably be considered to have been deductible by the taxpayer pursuant to paragraph 113(1)(a) in respect of the exempt surplus of a FA of the taxpayer at the lending time, assuming that the amount lent was instead paid by the creditor affiliate or partnership as a dividend. Subsection 90(11) provides that for purposes of subparagraph 90(9)(a)(i), surplus accounts are deemed to be the amounts determined under paragraph 5902(1)(a)(i) of the Regulations.

Assume that an indirectly-owned FA (“FA1”) generates substantial exempt surplus during a taxation year and uses the resulting cash flow to make upstream loans to its Canadian parent corporation (“Parent”) in order to avoid a high withholding tax cost that would apply if it had paid a dividend through the ownership chain to Parent. Assume further that neither FA1 nor any of the FAs through which Parent indirectly holds its interest in FA1 has a surplus account balance at its last taxation year end.

In calculating exempt surplus for the purposes of clause 90(9)(a)(i)(A) can Parent rely on the 90-day rule in paragraph 5901(2)(a) of the regulations?

Notes From Presentation

No, it cannot.

S. 90(9)(a)(i)(A) refers to the exempt surplus of the affiliate in respect of the taxpayer at the lending time, and at the lending time there was not exempt surplus. In very general terms, the 90-day rule in Reg. 5901(2) effectively treats a dividend as being paid at a (subsequent) time at which, in fact, it was not paid. Thus, the 90-day rule does not act to change the actual surplus balances at an earlier juncture. Accordingly, the 90-day rule does not alter the fact that there is no accessible surplus at the lending time.

Official Response

22 May 2014 IFA Round Table, Q. 3(a), 2014-0526721C6

Q3(b) - Upstream loan rules

Subsection 90(6) applies at the time a creditor affiliate that is a FA of a taxpayer resident in Canada makes a loan to a specified debtor or when a specified debtor becomes indebted to the creditor affiliate.

If a loan made by a creditor affiliate to a specified debtor is interest-bearing, when is the amount of interest on the loan treated as indebtedness for purposes of subsection 90(6)? For example, if a loan provides that interest is payable together with principal on maturity of the loan, say after three years, would the interest be treated as indebtedness for purposes of subsection 90(6) when it accrued, when payment is due or at some other time?

Notes From Presentation

As well as applying to the principal of a loan or indebtedness, s. 90(6) can apply to accrued interest that is not yet payable (here, after three years). Accordingly, s. 90(6) could apply to the interest that accrued in the first year. However, the exclusion in s. 90(8)(a) could apply if such interest was paid within two years, and that exclusion would apply to the interest which accrued in the second and third year if the loan was repaid at the end of the third year. Furthermore, if the interest accruing in the first year was paid on maturity of the loan at the end of the third year, a deduction would be available under s. 90(14).

Official Response

22 May 2014 May IFA Roundtable, 2014-0526731C6

Q3(c) - Back-to-back loans

In some FA groups, one entity in the group provides cash management services to the other members of the group, pooling cash balances received from group members and making advances to other members of the group, generally on a short term basis. The volume of transactions may be so great as to make tracing each amount impractical or impossible.

How should the back-to-back loan rule in subsection 90(7) be applied in these circumstances? Should loans that are repaid within two years be ignored for purposes of applying subsection 90(7)? What is the result if a loan to the cash manager is for longer than two years, but the loan by the cash manager to another affiliate is shorter than two years?

No Response

Answer not presented. See subsequent written response below.

Official Response

22 May 2014 IFA Round Table, Q. 3(c), 2014-0526741C6

Q4 (95(2)(i) "At all times")

Paragraph 95(2)(i) provides that any income, gain or loss of an FA debtor is deemed to be income, gain or loss from the disposition of excluded property if it arose on the settlement or extinguishment of certain debts. The provision requires, generally, that all or substantially all of the proceeds of the debt must be used at all times to earn income from an active business carried on by the debtor or to acquire property that is excluded property at all times that the debt is outstanding.

Q4(a) - Short-Term Deposit

In many cases, there is a short period of time after money is borrowed and before it can be employed in the business or to acquire excluded property. This period may be as little as a day in some cases. Would earning interest on the borrowed money for such a period of time cause this provision to be inapplicable (for example, interest on a bank account or term deposit)?

Notes From Presentation

This general situation was addressed in 95-5293. CRA accepts that there may be a brief period of time before funds are deployed to acquire excluded property (or property used to earn income in an active business of the debtor). Conversely, there may be a brief period before proceeds are applied to the debt repayment. Accordingly, the holding of such funds does not automatically deny relief under s. 95(2)(i)(i). However, the delay in the application of the funds must be unavoidable. If it is determined that other factors (such as cash flow problems, or unfavourable prevailing interest or exchange rates or a desire to make an investment return) contributed to the delay in repayment, it is likely that the provisions of s. 95(2)(i) would not apply on the repayment of the debt.

Official Response

22 May 2014 IFA Round Table, Q. 4, 2014-0526771C6

Q4(b) - Purifying Shares

In other circumstances, the borrowed money may be used to acquire property such as shares that does not qualify as excluded property for a very short period of time. Immediately after the acquisition, the taxpayer takes steps to ensure that the shares qualify as excluded property by, for example, disposing of non-qualifying assets.

Would this cause this provision to be inapplicable?

Notes From Presentation

CRA assumed that the question arose in the context of a sale to an arm’s length third party, as related parties generally could structure their affairs so that the issue did not arise.

In such a context, non-qualifying assets could be identified during the due diligence process preceding the acquisition. Such assets might be disposed of before the acquistion – or immediately after the acquisition. If the non-qualifying assets were disposed of following the acquisition, their holding would not deny relief under s. 95(2)(i)(i) only if their disposition occurred immediately, i.e., on the same day as the acquisition.

Official Response

22 May 2014 IFA Round Table, Q. 4, 2014-0526771C6

Q5 (ACB of Shares of FAs - Relief for Internal Reorganizations)

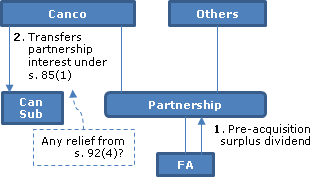

When a partnership in which a Canco is a member receives a pre-acquisition surplus dividend from a FA, there is no immediate reduction to the ACB of the shares of the FA. Rather, the amount is treated as (i) additional proceeds of disposition for Canco under subsection 92(4) when Canco disposes of the partnership interest or (ii) a deemed gain for Canco under subsection 92(5) and (6) when the partnership disposes of the FA shares.

Subsections 92(4), (5) and (6) are quite restrictive and may prevent Cancos that have received pre-acquisition surplus dividends through a partnership from being able to reorganize their group structure on a tax-deferred basis.

Will the CRA provide administrative relief in circumstances where the partnership interest or FA shares are disposed of as part of an internal reorganization that, absent subsections 92(4), (5) and (6), would occur on a tax-deferred basis? For instance, will the CRA provide administrative relief where the partnership interest is transferred to a new Can Sub under subsection 85(1) or where the FA shares are transferred to a new FA Holdco under subsection 85.1(3)?

Notes From Presentation

The Directorate consulted with the Compliance Branch and confirmed that there is no policy to provide administrative relief in these circumstances.

A recent interpretation, namely, 2012-043373 dealt with a transfer under s. 85 by a partnership with a Canadian corporate member to a wholly–owned subsidiary. Rulings confirmed that there was a deemed gain under s. 92(5) which did not affect the relevant amount determined in applying the provisions of s. 85.

Official Response

22 May 2014 IFA Round Table, Q. 5, 2014-0526751C6

Q6 (95(6)(b) Committee)

Who are the members of the 95(6)(b) Committee? How often does the Committee meet? Please provide statistics for referrals to the Committee 2010 forward, if possible, broken down by year. How many cases are before the courts?

No Response

Answer not presented. See subsequent written response below.

Official Response

22 May 2014 IFA Round Table, Q. 6, 2014-0526761C6

Competent Authority Panel

Points arising in the discussion by Susan Murray (CRA) and Patricia Fouts (IRS) of Competent Authority procedures for resolving disputes included:

- Although, even before the introduction of “baseball-style” arbitration provisions in Art. XXVI and Annex A, there were (per Susan) very few cases of ultimate double taxation, the presence of arbitration has speeded (by approximately 1/3) the resolution of Mutual Agreement Procedure cases due to the incentive for the two competent authorities to grapple with the more difficult issues on a more expeditious basis – and (per Susan) the resulting habit of greater efficiency also has speeded the handling of MAP files for third countries.

- The dialogue in a MAP case will be continued for so long as it can be carried forward (per Patricia) – and even if arbitration has commenced, the two authorities will continue to try to resolve the dispute consensually.

- After Patricia discussed the draft Rev Proc on taxpayer-initiated adjustements, Susan referenced the CRA announcement on this topic (“Update - Competent Authority Services Division” dated 20 December 2013).

- The difficulty of dealing with intangible migration was acknowledged, and the uniqueness of the issues over the Canada-U.S. boundary was noted.

- Both indicated that stock option compensation issues were approached as highly factually-driven determinations.