AUSPICE Crude/Gas

Overview

Each (listed) ETF will track its designated (Canadian crude or Canadian natural gas) "Underlying Index" by entering into forward agreements with the Counterparty (expected to be NBC), and pledge T-Bills or other cash raised from its Unit offerings to secure its obligations thereunder. The forward agreements will be for a term of five years, but will be extended annually with the consent of the parties. The Underlying Indexes track the performance of a strategy of continually rolling over near month futures contracts for intermediate-term futures contracts. Income account gains under the forwards will only be realized as they are partially (or fully) settled. Accordingly, Unitholders who sell their units on the TSX generally will not have significant income allocated to them (whereas those who redeem units may have income allocated to them).

CCX

CCX seeks to replicate, to the extent possible, the performance of the Canadian Crude Excess Return Index, net of expenses. The Canadian Crude Excess Return Index is designed to measure the performance of the Canadian crude oil market. The Canadian Crude Excess Return Index targets an exposure that represents an approximately 3 month rolling position in the nearby Referenced Futures Contracts.

GAS

GAS seeks to replicate, to the extent possible, the performance of the NGX Canadian Natural Gas Index, net of expenses. The NGX Canadian Natural Gas Index is designed to measure the performance of the Canadian natural gas market. The NGX Canadian Natural Gas Index tracks the forward purchase value of its Referenced Futures Contract, the AECO physical one month forward price of natural gas, in Canadian dollars. In order to track the Underlying Index while maintaining an orderly transition from the prompt contract to the deferred contract, these contracts are "rolled" during an eight day period known as the "roll period" that begins on the thirteenth business day prior to the start of the delivery month.

Forward sales

Each Forward Document will require the ETF to pay the Counterparty an agreed notional amount. In return, the Counterparty will pay the applicable ETF the value of the notional investment, plus an amount based upon any increase in its Underlying Index. Each ETF will also invest the net proceeds of Unit subscriptions in interest bearing accounts and T-Bills to earn short-term money-market interest rates. The terms of the Forward Documents will require each ETF to pledge its respective interest bearing account and T-Bills to the applicable Counterparty to secure the payment of that ETF's payment obligations under the Forward Documents. Each Forward Document will have a remaining term to maturity at any point in time of less than five years which, with the consent of the applicable ETF and the applicable Counterparty, will be extended annually for a fixed number of years.

Counterparty

Expected to be National Bank of Canada.

Manager/trustee

The manager and trustee of the ETFs is Auspice Capital Advisors Ltd. ("Auspice", the "Manager" or the "Trustee"). The Manager has retained Horizons ETFs Management (Canada) Inc. (the "Portfolio Adviser") to act as the portfolio adviser and to make and execute investment decisions on behalf of the ETFs.

Distributions

The ETFs will distribute sufficient net income (including net capital gains) so that no ETF will be liable for income tax in any given year. Distributions on Units of an ETF, if any, are expected to be made annually at the end of each year where necessary and will automatically be reinvested on behalf of each Unitholder in additional Units of the applicable ETF and then consolidated.

Redemptions

In addition to the ability to sell Units of an ETF on the TSX, Unitholders of an ETF may redeem Units of that ETF in any number for cash, subject to a 5% redemption discount, or may redeem a PNU (the prescribed number of Units of that ETF determined by the Manager from time to time) or a multiple PNU of an ETF for cash equal to the net asset value of that number of Units, subject to any redemption charge.

Allocations on redemptions

Pursuant to the Trust Declaration, an ETF may allocate and designate any income or capital gains realized by the ETF as a result of any disposition of property of the ETF undertaken to permit or facilitate the redemption of Units to a Unitholder whose Units are being redeemed. In addition, each ETF has the authority to distribute, allocate and designate any income or capital gains of the ETF to a Unitholder who has redeemed Units of the ETF during a year in an amount equal to the Unitholder's share, at the time of redemption, of the ETF's income and capital gains for the year or such other amount that is determined by the ETF to be reasonable. Any such allocations will reduce the redeeming Unitholder's proceeds of disposition.

Canadian tax consequences

Ordinary income under forwards. The ETFs will each recognize income under a Forward Document when it is realized by such ETF upon partial settlements or upon maturity of the Forward Document. An ETF will partially settle the Forward Documents in each taxation year in order to fund operating expenses and other liabilities of the ETF. To the extent such income is not offset by any available deductions, it would be distributed to the Unitholders of the applicable ETF in the taxation year in which it is realized and included in such Unitholder's income for the year.

S. 39(4) election

Assuming that the ETF is a "mutual fund trust,", certain Holders may be entitled to have their Units and all other "Canadian securities" treated as capital property by making the irrevocable election under s. 39(4).

SIFT rules

The ETFs are not expected to have any income from "non-portfolio property."

FATCA

Information provided to the CRA regarding U.S. Reportable Accounts will be exchanged by the CRA with the U.S. Internal Revenue Service in accordance with the provisions of the Canada-U.S. IGA….

Horizons Futures

Overview

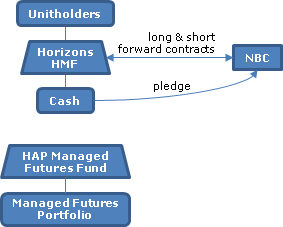

Horizons HMF, which trades on the TSX, seeks to replicate the return of a tailored index (the "Managed Futures Index"), which tracks the return resulting from going long or short various commodity, interest rate and currency futures contracts in accordance with a quantitative trading program. Horizons HMF accomplishes this result by entering into long or short forward contracts (the "HMF Forward Documents") with National Bank of Canada ("NBC") for forward prices which collectively track the Managed Futures Portfolio, which is a long-only portfolio held in a separate entity. A second older ETF described in the prospectus is not summarized here.

Direct investments

HMF Forward Documents. Horizons HMF has entered into multiple HMF Forward Documents with NBC. Each HMF Forward Document in which Horizons HMF is provided with exposure that corresponds positively with the exposure to the Managed Futures Portfolio requires Horizons HMF to pay NBC an agreed notional amount. In return, NBC pays Horizons HMF the value of the notional investment, plus an amount based upon any increase or decline in the notional exposure to the Managed Futures Portfolio. Each HMF Forward Document in which Horizons HMF is provided with exposure that corresponds negatively with the exposure to the Managed Futures Portfolio requires NBC to pay Horizons HMF an agreed notional amount. In return, Horizons HMF pays the Counterparty the value of the notional investment, plus an amount based upon any increase or decline in the notional exposure to the Managed Futures Portfolio.

Term of HMF Forward Documents

HMF Forward Documents have a remaining term to maturity at any point in time of less than five years which, with the consent of Horizons HMF and NBC, will be extended annually for a fixed number of years. Subject to default or other exceptions, Horizons HMF has the ability to request the termination of its exposure under an HMF Forward Document, in whole or in part, at any time.

Forward collateral

Horizons HMF invests the net proceeds of Unit subscriptions in interest bearing accounts and T-Bills to earn short-term money-market interest rates. The terms of the HMF Forward Documents require Horizons HMF to pledge substantially all of its interest bearing accounts and T-Bills to NBC to secure the payment of Horizons HMF's payment obligations under the HMF Forward Documents.

Managed Futures Index

The Auspices Managed Futures Excess Return Index (to use its full name) uses a rules-based quantitative methodology to track the prices of a diversified portfolio of futures contracts covering the energies, metals, and agricultural commodities sectors as well as interest rate and currency sectors. The determination of position size and whether to be long or short is based on the methodology and changes can occur on any day. The size of the position that the Managed Futures Index takes in any component is dependent only upon the individual component's volatility and the total value of the Managed Futures Index.

Managed Futures Portfolio

The Managed Futures Portfolio is comprised primarily of futures contracts, financial swaps, total return swaps, physical commodities and T-bills or short term interest rate derivatives, and may also include commodity futures, and currently is held by the HAP Managed Futures Fund, whose managers are as described below. Horizons HMF (directly or indirectly) and the HAP Managed Futures Fund (directly) seek to gain exposure to a currency hedged portfolio of the constituent securities and other instruments of the Managed Futures Index in substantially the same proportion as in the Managed Futures Index. The HAP Managed Futures Fund was established by declaration of trust on February 15, 2013.

Managers/Trustee

AlphaPro Management Inc. (the "Manager"), a Canadian corporation is advised by Horizons ETFs Management (Canada) Inc. (the "Investment Manager"), its Canadian parent, and subadvised by Auspice Capital Advisors Ltd. ("Auspice"), an Alberta corporation. The Manager also is trustee of Horizons HMF.

Distribution Policy

On an annual basis, the ETF will ensure that its income and net realized capital gains have been distributed to the Unitholders to such an extent that the ETF will not be liable for ordinary income tax thereon.

Redemption rights

On any trading day, Unitholders may redeem units for cash at a redemption price equal to 95% of the closing price on the TSX on the effective day of the redemption, or PNUs (prescribed numbers of units) for their NAV less any applicable redemption charge – subject to specified rights to suspend redemptions. Income or capital gains can be allocated to redeeming unitholders.

Canadian tax consequences

Holders. Holders may in certain circumstances elect for their units to be capital property under s. 39(4). A conversion of Advisor Units of the ETF into Class E Units should not constitute a disposition.

Non-resident ownership of Units

The ETF is prohibited from holding more than 10% of its property in "specified property" (as per draft s. 132(4)).

Income recognition

The ETF will each recognize income under a HMF Forward Documents when it is realized by the ETF upon partial settlements or upon maturity of the contract. This may result in significant gains being realized by the ETF at such times and such gains would be taxed as ordinary income. To the extent such income is not offset by any available deductions, it would be distributed to applicable Unitholders in the taxation year in which it is realized and included in such Unitholder's income for the year. There is a Risk Factor disclosure re potential application of the draft loss restriction event rules.

Horizons Stock Index

Overview

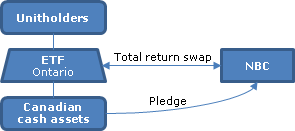

Each ETF, which will trade on the TSX, seeks to replicate the performance of its "Underlying Index" through entering into a total return swap (the "Swap") with National Bank of Canada or another bank. Any (income account) gains on the Swap generally will only be distributed to redeeming unitholders so that such income generally will not be allocated to unitholders who only trade their units.

Structure

TRS. Each of the ETFs have entered into or will enter into a total return swap (the "Swap") with NBC (or other Canadian chartered banks, "Counterparties") pursuant to which the ETFs each gain exposure to its Underlying Index. Under each Swap, the ETFs will pay the Counterparty a floating amount based on prevailing short-term market interest rates and an equity amount based upon any negative return of the applicable Underlying Index and, in return, the Counterparty will pay the ETFs an equity amount based upon any positive return of the applicable Underlying Index. The ETFs also each intend to invest the net proceeds of Unit subscriptions in cash and short-term debt obligations to earn prevailing short-term market interest rates.

TRS collateral

Each ETF will invest the net proceeds of Unit subscriptions in cash and short-term debt obligations, and pledge those assets as collateral under the applicable Swap. The income earned on such cash and short-term debt obligations is expected to be sufficient to fund the required floating payments by the applicable ETF (other than HXS) under the current Swaps.

Net TRS value limitation

Under a Swap, the daily marked-to-market value of the exposure of an ETF to any one Counterparty will, generally, not exceed 10% of the net asset value of that ETF and will, at all times, be in accordance with NI 81-102.

Trustee/Manager

Horizons ETFs Management (Canada) Inc.

Distribution Policy

On an annual basis, an ETF will ensure that the net income and net realized capital gains of the ETF have been distributed to Unitholders of the ETF to such an extent that the ETF will not be liable for ordinary income tax thereon, and distributions will only be made to accomplish such distribution of income. Any such distributions will be automatically reinvested in further units at the end of the calendar year, with the number of units then consolidated to the pre-distribution number.

As long as a Swap is used as the sole investment strategy of the ETFs, the Manager anticipates that, prior to termination of the Swap, an ETF should only realize income for purposes of the Tax Act in a taxation year if the Swap has to be partially settled as a result of a redemption of Units. If this occurs, then the Manager intends, on behalf of the ETF, to allocate for purposes of the Tax Act any income realized by the ETF from such partial settlement in a taxation year to the Unitholders who redeemed their Units in the taxation year. Based on the foregoing, provided a Unitholder does not redeem its Units while the applicable ETF uses a Swap as its sole investment strategy, the Unitholder is not expected to receive any distributions of income for purposes of the Tax Act in a taxation year throughout which the Swap is in effect.

Redemption rights

On any trading day, Unitholders may redeem units for cash at a redemption price equal to 95% of the closing price on the TSX on the effective day of the redemption, or PNUs (prescribed numbers of units) for their NAV less any applicable redemption charge – subject to specified rights to suspend redemptions. Income or capital gains can be allocated to redeeming unitholders.

Canadian tax consequences

Holders. Holders may in certain circumstances elect for their units to be capital property under s. 39(4).

Non-resident ownership of Units

At no time does the Manager expect or believe that the property of either ETF will consist of property specified in s. 132(7) (the "Specified Property") that would impact the ability of (i) non-residents of Canada or (ii) partnerships that are not Canadian partnerships, to beneficially own units of an ETF. If the Manager believes that more than 10% of an ETF's property is Specified Property and if the Manager determines that more than 40% of the Units of such ETF are beneficially held by non-residents and/or partnerships that are not Canadian partnerships, the Manager may send a notice to such non-residents and/or partnerships requiring them to sell their Units of such ETF or a portion thereof within a specified period of not less than 30 days.

Income recognition

The ETFs will each recognize income under a Swap when it is realized by such ETF upon partial settlements or upon maturity of the Swap. This may result in significant gains being realized by the ETF at such times and such gains would be taxed as ordinary income. To the extent such income is not offset by any available deductions, it would be distributed to applicable Unitholders in the taxation year in which it is realized and included in such Unitholder's income for the year.

Horizons 2X Commodity

Overview

After running through the applicable transitional periods respecting the new character conversion rules, the ETFs will replace existing forward contracts, for the sale of Canadian equities at a price based on the performance or inverse performance of the underlying commodity, with cash-settled forward contracts, and will use new unit proceeds to invest in cash equivalents (to be pledged under the cash-settled forwards) rather than in Canadian equities.

Existing Forward Contracts

The ETFs are double-leveraged exchange traded funds (i.e., on the TSX) which have acquired shares of Canadian public companies, made s. 39(4) elections and entered into forward agreements (the "Existing Forward Documents") for the sale of those shares to a Canadian bank (NBC or CIBC) for an amount which reflects the performance of a continually rolling position in forward contracts (long or short, as the case may be) for the subsequent delivery month, such that on any given day, the return will be approximately 200% or -200%, as the case may be, of that day's performance of the underlying futures contract. Such Existing Forward Documents are secured by the Canadian equities.

Proposed Forward Contracts

Each ETF will enter into multiple cash-settled "New Forward Documents" with an acceptable counterparty which will require a cash payment on maturity based on the performance of the referenced rolled position in future contracts (i.e., they no longer are for a forward sale of Canadian shares). Each ETF will invest the net proceeds of unit subscriptions in interest-bearing accounts or T-Bills (or, where appropriate, in reverse repo agreements), which generally will be pledged to secure the ETF's obligations under the New Forward Documents. Each New Forward Document is expected to have a remaining term to maturity of less than one year which, on consent, will be extended monthly. The forward expenses under the New Forward Documents may be lower than those under the Existing Forward Contracts.

Distribution policy

Distributions are expected to be made annually, at the end of each year, with such distributions automatically being reinvested in further units. The manager does not anticipate that any material amount of distributions will be made on units in 2013. "As long as the Existing Forward Documents remain in effect, and an ETF enters into New Forward Documents, the level of distributions paid by an ETF to its Unitholders will depend upon payments received by the ETF under the Existing Forward Documents and the New Forward Documents, as applicable."

Redemption rights

On any trading day, Unitholders may redeem units for cash at a redemption price equal to 95% of the closing price on the TSX on the effective day of the redemption, or PNUs (prescribed numbers of units) for their NAV less any applicable redemption charge – subject to specified rights to suspend redemptions. Income or capital gains can be allocated to redeeming unitholders.

Trustee/Manager

Horizons ETFs Management (Canada) Inc.

Canadian tax consequences

Holders. Holders may in certain circumstances elect for their units to be capital property under s. 39(4).

Existing Forward Documents

Provided the ETF makes a s. 39(4) election, gains realized on the sale of its common share portfolio (including under the Existing Forward Documents) will be taxed as capital gain or losses. If the Existing Forward Documents are cash-settled, this may be treated as giving rise to an income account outlay or receipt.

Grandfathering

The March 21, 2013 federal budget proposals respecting derivative forward agreements are not expected to apply to gains or losses realized by an ETF in connection with its Existing Forward Documents provided that their terms are not extended and that, prior to their expiration date, they are not increased (i.e., generally, the size of the basket of Canadian securities to be delivered to the counterparty is not increased). The Department of Finance is expected to release further guidance, which may permit additional Existing Forward Documents with a total term of up to 180 days from the expiry of Existing Forward Documents to become exempt. Manager has advised that all Existing Forward Documents were entered into prior to March 21, 2013 and their terms have not been extended, or Existing Forward Documents expired after March 21, 2013 and upon expiration the ETF entered into new Existing Forward Documents with a term of no more than 180 days.

New Forward Documents

Payments received by the ETFs under a New Forward Document upon partial settlement or upon maturity, will be received on income account which will be distributed to the unitholders in the year realized. There may be significant accrued gains in an ETF prior to the settlement of Existing Forward Documents (or New Forward Documents).