Cases

Lark Investments Inc. v. The King, 2024 TCC 30

A week before realizing a $119 million capital gain, the taxpayer, which until then was wholly-owned by a Canadian-resident individual, issued voting preference shares to his non-resident children (who thereby acquired de jure control), but not to a resident son. CRA had decided not to take the position that the taxpayer had remained a CCPC by virtue of continued de facto control by the resident individual, but that GAAR should instead be applied. CRA assessed the taxable capital gain on sale, so as to deny the general rate reduction under s. 123.4 and impose refundable tax under s. 123.3, on this basis.

Based on the Crown’s submissions at the hearing of this motion, its position appeared to be that, although Lark was no longer a CCPC because of the de jure control of the non-resident children, there was a GAAR abuse because de facto control was maintained in Canada. However, this position was not reflected in the Reply, which instead contained vague references to the integration system and abuse of ss. 123.3 and 123.4, and did not refer to de facto control.

St-Hilaire J found (at para. 60) that the relevant part of the Reply “may prejudice the fair hearing of the appeal and is an abuse of process” and should be struck – but with leave to the Crown to amend its pleadings.

After noting (at para. 43) that the taxpayer “appears to complain that there was no GAAR analysis conducted by the GAAR Committee specifically for Lark’s case” and that the GAAR Committee minutes provided to the taxpayer instead referred to a continuance of the corporation as a non-Canadian corporation, St-Hilaire J stated (at para. 45) that she adopted the view in Aikman “that there is no requirement that the Minister consult the GAAR Committee.”

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Other Legislation/Constitution - Federal - Tax Court of Canada Rules (General Procedure) - Section 63 | Crown’s vague pleading that GAAR applied to convert a CCPC to non-CCPC was struck, but with leave to amend | 251 |

| Tax Topics - Other Legislation/Constitution - Federal - Tax Court of Canada Rules (General Procedure) - Section 8 | fresh start rule inapplicable where defects in Crown’s pleading did not become apparent until a subsequent procedural stage | 230 |

| Tax Topics - Income Tax Act - Section 169 - Subsection 169(1) | process behind assessment not relevant to its validity | 100 |

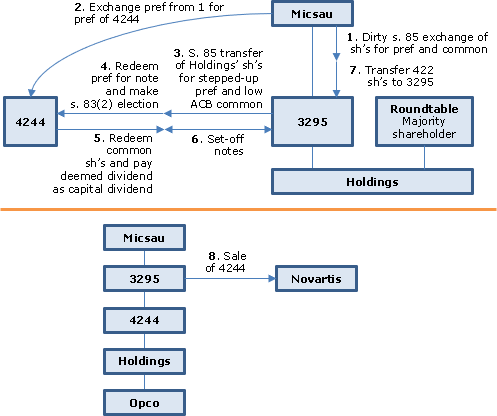

3295940 Canada Inc. v. Canada, 2024 FCA 42

The taxpayer (3295) was a holding company with a minority shareholding in a target company (Holdings) with a low ACB, whereas the holding company (Micsau) holding shares in 3295 had a high ACB for its shares. Unfortunately, the majority shareholder of Holdings (RoundTable), who initially handled the negotiations, only negotiated a sale of the shares of Holdings to Novartis by its two shareholders, and did not present alternatives that would have permitted Micsau to use its high ACB in the shares of 3295. Once those negotiations were completed, Micsau was able to speak to Novartis, and negotiated that it could sell its shares of Holdings through a Newco (4244 referred to below).

Under that plan:

- Micsau created a sister company (4244) to 3295 to which it transferred newly-created preference shares of 3295 having an ACB (of $31.5M) equal to their redemption amount in exchange for full-ACB shares of 4244.

- 3295 then transferred its Holdings shares to 4244 on a partial s. 85 rollover basis in exchange for Class D and common shares, and realized a capital gain corresponding to the capital gain (of $53M) that it would have realized had it sold its 3295 shares to Novartis; this capital gain was reflected in the full-ACB (of $57M) Class D shares which it received from 4244, whereas its common shares of 4244 had a high FMV (of $31.5M) and nominal ACB.

- 3295 redeemed the preference shares held by 4244 (see 1 above) for a $31.5M note, and elected for the resulting $31.5M deemed dividend to be a capital dividend paid to 4244.

- 4244 redeemed $31.5M of the low-ACB common shares that it had issued to 3295 in Step 2 for a $31.5M note, and elected for the resulting $31.5M deemed dividend to be a capital dividend paid to 3295.

- Then the two notes were set off, Micsau transferred its shares of 4244 to 3295, and 3295 sold the shares of 4244 to Novartis at no further capital gain.

Goyette JA found that in determining “whether transactions forming part of a series are abusive, one must consider the ‘entire series of transactions’ or its ‘overall result’” (para. 46) and that, here, the overall result of the series was the same as if Micsau had sold its 3295 shares to Novartis.

Furthermore, the Tax Court had erred in considering that the cross-redemption capital dividend (Steps 3 and 4) reduced the capital gain that 3295 would have realized from disposing of its commons shares in 4244 immediately before the dividend, i.e., the capital gain would have been the same if Novartis had purchased the 4244 shares without the cross-redemption. Thus, the “series’ overall result [was] consistent with the object, spirit and purpose of the capital gains regime as previously identified by this Court—that is, to tax real economic gains: Triad Gestco … “ (para. 54).

In addition,”courts consider alternative transactions’ tax consequences when determining whether tax avoidance is abusive” (para. 58). The Tax Court had erred in failing to consider four alternative transactions which would have produced the same tax result (of using the high outside tax basis in 3295 shares) as those implemented (which in fact had been presented by Micsau to RoundTable but with RoundTable not having put them to Novartis): Micsau selling its shares in 3295 to Novartis; 3295 amalgamating with Holdings, and Micsau selling its Amalco shares to Novartis; a tuck-under transaction (i.e., Micsau making a taxable sale of its 3295 shares to Holdings for high ACB shares of Holdings, selling those shares to Novartis, with 3295 then being wound up on a rollover basis under s. 88(1) into Holdings; and Micsau selling its shares in 3295 to RoundTable, which would wind–up 3295 and bump the ACB of the Holdings’ shares under s. 88(1)(d) before their sale to Novartis.

Goyette JA stated that these transactions were relevant because they were: available under the Act; realistic alternatives; commercially similar to the subject transactions and with similar tax results; and reflected a similar absence of abuse, i.e., they “would have enabled Micsau to realize its high ACB without attracting the application of the GAAR: (para. 61(e).)

The King v. MMV Capital Partners Inc., 2023 FCA 234

A venture capital corporation (MMV) acquired 49% of the voting common shares of the respondent while in interim bankruptcy proceedings and subscribed $1,000 for a large number of non-voting common shares giving it over 99.8% of all the common share equity. It then financed taking the respondent out of bankruptcy proceedings at a modest cost, and transferred a loan portfolio of U.S.$86 million to the respondent, effectively in consideration for secured debt and preferred shares, thereby reducing the equity interest of the five arm’s length holders of 51% of the MMV voting common shares to less than 0.01% and also permitting the use of the respondent’s non-capital losses.

In applying Deans Knight to reverse the Tax Court finding that there was no abuse of s. 111(5), Monaghan JA stated (at paras. 34-35):

The object, spirit and purpose of subsection 111(5) – its rationale – is “to prevent corporations from being acquired by unrelated parties in order to deduct their unused losses against income from another business for the benefit of new shareholders”.

As in Deans Knight, what happened here is exactly what subsection 111(5) seeks to prevent.

Regarding the respondent’s submission that the original five voting common shareholders still could have elected a new board that would pay them dividends, Monaghan JA stated (at paras. 45-46):

The power imbalance is self-evident. MMV had the right to demand immediate repayment of the credit facility and to demand redemption of the preferred shares within 30 days. Had it done so, the respondent would have been unable to pay dividends and, once those demands had been met, would have had little, if any, assets of value. Given this, and their collective infinitesimal interest in the respondent, the prospect of the five original shareholders electing directors and paying themselves dividends was illusory.

Put another way, while their common shares provided the five original shareholders with de jure control, they had no effective way to use that control to benefit from the respondent’s losses.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 111 - Subsection 111(5) | abuse of s. 111(5) for unrelated corporations to use losses from another business | 295 |

Deans Knight Income Corp. v. Canada, 2023 SCC 16

The non-capital losses of $90M, and other tax attributes (the “Tax Attributes”) of the taxpayer, were effectively sold to arm’s length investors pursuant to transactions under which:

- The existing shareholders of the taxpayer exchanged their shares for shares of a “Newco” under a Plan of Arrangement

- A venture capital company facilitator (Matco) entered into an “Investment Agreement” with the taxpayer and Newco pursuant to which Matco (principally in consideration for $3M in cash) acquired a debenture of the taxpayer that was convertible into shares representing 79% of its equity shares but only 35% of its voting shares.

- The taxpayer then transferred its assets (including the proceeds of issuing the debenture) and its liabilities to Newco.

- Matco then identified a mutual fund management company which wanted to effect a public offering of shares of the taxpayer and use the proceeds (of $100M) for a new bond trading business to be carried on in the taxpayer.

- The subscription price for the newly-issued common shares under this offering caused the securities of the taxpayer held by Newco and Matco to appreciate which, in the case of Matco, effectively was its fee.

Rowe J noted that in determining whether s. 245(4) applied on the basis of an abuse of s. 111(5), the Court’s goal was “to discern the underlying rationale of the provision” (para. 65) and that it must then be determined “whether the result of the particular series of transactions at issue is inconsistent with the rationale underlying s. 111(5)” (para. 120), and also indicated that s. 111(5) addresses where “the identity of those behind the corporation has changed” and “functions so that the tax benefits associated with those losses will not benefit a new shareholder base carrying on a new business” (para. 88).

In finding that the transactions did not accord with the rationale of s. 111(5), Rowe J stated (at paras. 124, 126, 128):

[T]he appellant was gutted of any vestiges from its prior corporate “life” and became an empty vessel with Tax Attributes. …

Moreover, the shareholder base of the taxpayer underwent a fundamental shift throughout the transactions … .

Matco achieved the functional equivalent of … an acquisition of [de jure] control through the Investment Agreement, while circumventing s. 111(5), because it used separate transactions to dismember the rights and benefits that would normally flow from being a controlling shareholder.

In this regard, he noted that “Matco contracted for the ability to select the corporation’s directors” (para. 129), “the Investment Agreement in effect placed severe restrictions on the powers of the board of directors” (para. 131) and the “restrictions in favour of Matco resemble[d] the fettering of discretion that would normally occur through a unanimous shareholder agreement and which would lead to an acquisition of de jure control” and the only reason it was not a USA was a “circuit-breaker transaction” pursuant to which a director of Matco purchased 100 shares through a holding company which was not a party to the agreement (para. 132).

Use of the Tax Attributes was properly denied pursuant to s. 245(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 111 - Subsection 111(5) | rationale of s. 111(5) addresses where there is a change in the identity of those behind a corporation | 416 |

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(5.1) | lender to distressed corporation may have de facto control | 118 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(10) | series includes transactions undertaken before or after the series in relation to the series | 75 |

Canada v. Alta Energy Luxembourg S.A.R.L., 2021 SCC 49

A Blackstone limited partnership and a U.S. shale company transferred their investment in a Canadian subsidiary (Alta Canada), that was to develop a shale formation in northern B.C., to a Luxembourg s.à r.l. (Alta Luxembourg). Alta Luxembourg was resident in Luxembourg for Treaty purposes as it had its legal seat there, but did not have a substantial economic presence there. About two years after the acquisition by Alta Canada of the exploration licences, it was sold to Chevron Canada at a significant gain. After losing on this issue in the Tax Court, the Crown did not now dispute that the gain of Alta Luxembourg was exempted from Canadian capital gains tax by virtue of the exclusion in Art. 13(4) of the Canada-Luxembourg Treaty (the “business property exemption”), which provided that the Alta Canada shares were not deemed immovable property (and thus not subject to Canadian capital gains tax) on the basis that the exploration licences were property of Alta Canada “in which the business of the company … was carried on” - but maintained its position below that such exemption of the gain constituted an abuse of the Treaty, contrary to s. 245(4).

Côté J indicated that the object, spirit, and purpose (“object”) of the business property exemption (which was an exception to the normal OECD model treaty approach) was to provide a “tax break [that] encourages foreigners to invest in immovable property situated in Canada in which businesses are carried on (e.g. mines, hotels, or oil shales)” (para. 77). The object of Arts. 1 and 4, which makes residence central to the Treaty’s application, was to allow such status to a person exposed to full tax liability. Consistent with international practice, Luxembourg law granted resident status to corporations having their legal seat in Luxembourg. This did “not depart from accepted usage such that the bargain struck in the Treaty could be upheld only if Luxembourg residents claiming benefits have ‘sufficient substantive economic connections’ to their country of residence” (para. 61). This conclusion was further reinforced by Art. 28(3) which (in contrast to the “look-through” approach in other contemporaneous treaties negotiated by Canada), denied Treaty benefits for “holding companies with minimal economic connections to Luxembourg” only in the case of some such holding companies (para. 65, see also para. 66).

Moreover, “the use of conduit corporations, ‘legal entit[ies] created in a State essentially to obtain treaty benefits that would not be available directly’, was not an unforeseen tax strategy at the time of the Treaty” (para. 80) and, instead, Luxembourg was well known as “an attractive jurisdiction to set up a conduit corporation and take advantage of treaty benefits” para. 81). Canada “could also have insisted on a subject-to-tax provision” under which it would forego its right to tax capital gains only if the other state actually taxed those gains – but did not (para. 85). Côté J stated (at para. 85):

The absence of a subject-to-tax provision, combined with Canada’s knowledge of Luxembourg’s tax system, confirms my view that Canada’s primary objective in including art. 13(4) was to cede its right to tax capital gains of a certain nature realized in Canada in order to attract foreign investment. It was not part of the bargain that Luxembourg actually tax the gains to the same extent that Canada would have taxed them.

She concluded (at para. 94):

There is nothing in the Treaty suggesting that a single‑purpose conduit corporation resident in Luxembourg cannot avail itself of the benefits of the Treaty or should be denied these benefits due to some other consideration such as its shareholders not being themselves residents of Luxembourg. In this case, the provisions operated as they were intended to operate; there was no abuse, and, therefore, the GAAR cannot be applied to deny the tax benefit claimed.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Treaties - Income Tax Conventions - Article 13 | utilization of the business property exemption by a Luxembourg conduit accorded with the bargain negotiated by Canada, which was to encourage investment by such investors | 605 |

| Tax Topics - Treaties - Income Tax Conventions - Article 4 | a company resident under Luxembourg domestic law (its legal seat was there), and that was “liable to be liable to tax,” was resident there for Treaty purposes even though a conduit | 366 |

| Tax Topics - Treaties - Income Tax Conventions | subsequent OECD Treaty commentary not followed | 198 |

| Tax Topics - Statutory Interpretation - Treaties | additional consideration in Treaty context of giving effect to the contractual bargain | 237 |

Canada v. Deans Knight Income Corporation, 2021 FCA 160, aff'd 2023 SCC 16

The non-capital losses of $90M, and other tax attributes of the taxpayer, were effectively sold to arm’s length investors pursuant to transactions under which:

- The existing shareholders of the taxpayer exchanged their shares for shares of a “Newco” (“New Forbes”) under a Plan of Arrangement

- A private company “facilitator” (Matco) entered into an “Investment Agreement” with the taxpayer and New Forbes pursuant to which Matco (principally in consideration for $3M in cash) acquired a debenture of the taxpayer that was convertible into shares representing 79% of its equity shares but only 35% of its voting shares.

- The taxpayer then transferred its assets (including the proceeds of issuing the debenture) and its liabilities to New Forbes.

- Matco then identified a mutual fund management company which wanted to effect a public offering of shares of the taxpayer and use the proceeds (of $100M) for a new bond trading business to be carried on in the taxpayer.

- The subscription price for the newly-issued common shares under this offering caused the securities of the taxpayer held by New Forbes and Matco to appreciate which, in the case of Matco, effectively was its fee.

- New Forbes sold its remaining shares of Lossco to Matco for a pre-agreed price of $0.8M.

Woods JA stated (at para. 72):

[T]he object, spirit and purpose of subsection 111(5)… is to restrict the use of specified losses, including non-capital losses, if a person or group of persons has acquired actual control over the corporation’s actions, whether by way of de jure control or otherwise.

After referring to “clear statements of government intent” (para. 78) including a 1963 statement that "the provision was introduced in order to prohibit arrangements which involve trafficking in shares of companies with loss carryovers” and a 1988 statement regarding the objectives of GAAR indicating “that the government believed in 1988 that the text of the restrictions on the use of non-capital losses did not fully reflect the purpose of this legislation” (para. 80), and the statement in Mathew that “the general policy of the Income Tax Act is to prohibit the transfer of losses between taxpayers, subject to specific exemptions” (para. 81), she further stated (at para. 83):

[I]t must be remembered that the GAAR is intended to supplement the provisions of the Act in order to deal with abusive tax avoidance. I see nothing inconsistent with the conclusion that the object, spirit and purpose of subsection 111(5) takes into account different forms of control even though the text of the provision is limited to de jure control.

In finding that Matco acquired “actual control” (albeit, not de jure control) of the taxpayer, she indicated that the Investment Agreement provided “severe restrictions on the actions” (para. 100) that New Forbes and the taxpayer could take including prohibiting the taxpayer from “engag[ing] in any activity other than related to a Corporate Opportunity” (i.e., sale or offering) and required that “New Forbes shall use commercially reasonable efforts to satisfy (or cause the satisfaction of) its obligation to cooperate with Matco in the implementation of a Corporate Opportunity” (para. 101).

As “the Investment Agreement resulted in New Forbes and the Respondent handing over actual control of the Respondent to Matco” (para. 105), there was an abuse of s. 111(5), and the tax benefit of the taxpayer’s tax attributes were properly denied by CRA.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 111 - Subsection 111(5) - Paragraph 111(5)(a) | the object and spirit of s. 111(5) is abused on an arm’s length acquisition of “actual” (albeit, not de jure) control of a Lossco | 522 |

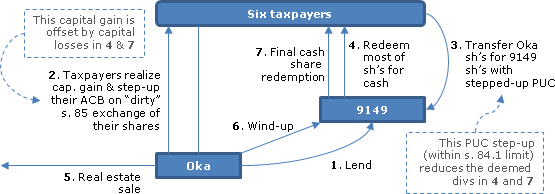

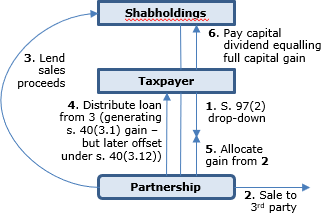

The Gladwin Realty Corporation v. Canada, 2020 FCA 142

The taxpayer, a private real estate corporation, rolled a property under s. 97(2) into a newly-formed limited partnership, with the LP then distributing to the taxpayer its capital gain of (using approximate amounts) $24 million realized on a property sale. Such distribution generated a negative ACB gain to the taxpayer of that amount under s. 40(3.1) and an addition to its capital dividend account (CDA) of $12 million (as this occurred before a 2013 amendment that eliminated such additions). The taxpayer recognized a further $24 million capital gain at the partnership year end, which increased its CDA by a further $12 million to $24 million. It then used this balance to pay a $24 million capital dividend to its shareholder, bringing its CDA down to nil. For its taxation year ending after the payment of that capital dividend, the taxpayer elected under s. 40(3.12) to generate a capital loss of $24 million to offset the s. 40(3.1) capital gain previously recognized by it, which resulted in its CDA becoming negative $12 million. The Tax Court confirmed CRA’s application of s. 245(2) to reduce the taxpayer’s CDA by ½ the amount of the s. 40(3.1) capital gain, thereby generating Part III tax unless an s. 184(3) election was made.

Noël CJ indicated (at para. 78) that “declaring the capital dividend before electing the deemed loss was not, in and of itself, objectionable,” after having noted in this regard (at para. 76):

… [T]he existence of a positive CDA balance, however generated, is the sole condition that governs a taxpayer’s right to declare a capital dividend. A deemed loss is elected during fiscal periods that are subsequent to the one in which the gain is deemed to arise… . That Parliament would have intended to freeze a taxpayer’s right to declare a capital dividend out of its CDA in the interim without so saying in express terms is unlikely.

However, he noted (at para. 79):

That said, it remains that we are dealing with a deemed gain and a deemed loss that are intended to self-erase. .Just as the deemed loss neutralizes the deemed gain, the CDA decrease that results from the deemed loss should over time neutralize the CDA increase that results from the deemed gain.

In contrast, here (para. 81) “the reality is that the dollars will never be there and that the CDA deficit will never be replenished as the appellant, crippled as it was by this running tax account and intent on preserving the tax benefit obtained, was to cease operation.”

In finding that there thus was a resulting abuse, so that the taxpayer’s appeal was dismissed, he stated (at paras. 83-84):

Like Triad Gestco, the appellant managed to isolate and use for the benefit of its shareholders the upward impact that the deemed gain had on its CDA in circumstances where it continues to hold, but will never have to contend with the negative CDA balance resulting from the corresponding deemed loss that had to be elected in the process. In both cases, the undesirable tax attributes that had to be created in order to obtain the tax benefit were isolated from the desirable ones and left to be forgotten without ever having any repercussion. …

This defeats the rationale that underlies the CDA regime because it allowed for the payment of a $12,000,000 capital dividend in circumstances where the $12,000,000 deficit that had to be created in the process will never be accounted for.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(1) - Tax Benefit | tax benefit did not arise until alleged excessive CDA utilized outside a corporate group | 261 |

Canada v. Alta Energy Luxembourg S.A.R.L., 2020 FCA 43, aff'd 2021 SCC 49

A Blackstone LP and a U.S. shale company transferred their investment in a Canadian subsidiary (Alta Canada), that was to develop a shale formation in northern B.C., to a Luxembourg s.à r.l (Alta Luxembourg – which, in turn, they held through an Alberta partnership). About two years after the acquisition by Alta Canada of the exploration licences, it was sold to Chevron Canada at a significant gain. In the Court of Appeal, the Crown conceded that the gain of Alta Luxembourg was exempted from Canadian capital gains tax by virtue of the exclusion in Art. 13(4) of the Canada-Luxembourg Treaty which provided that the Alta Canada shares were not deemed immovable property (and thus not subject to Canadian capital gains tax) on the basis that the exploration licences were property of Alta Canada “in which the business of the company … was carried on,” but maintained its unsuccessful position in the Tax Court that the exemption of the gain constituted an abuse of the Treaty.

After noting (at para. 34) that “it falls to the Crown to identify the object, spirit or purpose of the provisions that, according to the Crown, have been frustrated or defeated,” Webb JA rejected Crown arguments that such object etc. required that

- Alta Luxembourg be an “investor” in the project (he queried the implicit proposition that, for example, a legatee should not benefit from the Treaty exemption, and stated, at para. 52, that “There is nothing to suggest that the underlying rationale for the exemption is that it would only be available to a resident of Luxembourg who invests in the particular corporation in which such resident holds shares”)

- there be a potential to realize income in Luxembourg, whereas here the gain was offset by variable interest payable by Alta Luxembourg to the Alberta partnership (he stated, at para. 62, that “There is no basis to find that the rationale for the definition of ‘resident’ would suggest that any criteria other than the criteria included in the definition of resident in Article 4, should be used to determine if a person is a resident of Luxembourg”)

- the exemption be accessed only by persons who have some commercial or economic ties to Luxembourg (he stated, at para. 65 that “There is no distinction in the Luxembourg Convention between residents with strong economic or commercial ties and those with weak or no commercial or economic ties.”)

He concluded (at para. 80):

I agree with … MIL … that the object, spirit and purpose of the relevant provisions of the Luxembourg Convention is reflected in the words as chosen by Canada and Luxembourg. Since the provisions operated as they were intended to operate, there was no abuse.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Treaties - Income Tax Conventions - Article 13 | Treaty shopping was not an abuse | 391 |

Birchcliff Energy Ltd. v. Canada, 2019 FCA 151

A newly-launched public corporation (“Predecessor Birchcliff”), accessed the losses of a Lossco (Veracel), in order to shelter the profits from producing oil and gas properties which it was acquiring. Veracel raised the equity funds necessary for the properties’ purchase through issuing subscription receipts, which were converted into Class B common shares of Veracel and then immediately converted, on the amalgamation of Veracel with Birchcliff under a plan of Arrangement, into common shares of the amalgamated corporation “Birchcliff”), with the subscription proceeds applied to the properties' purchase. (If the amalgamation had not occurred, the subscription receipt proceeds instead would have been refunded to these investors.) As these investors received a majority voting equity interest in Birchcliff, the loss streaming rules otherwise engaged by ss. 256(7)(b)(iii)(B) and 111(5)(a) were avoided.

Webb JA dismissed Birchcliff’s appeal and found that these transactions were an abuse of s. 256(7)(b)(iii)(B) so that s. 245(2) should be applied to deny access by Birchcliff to the Veracel losses. In this regard, Webb JA first noted (at para. 48):

…The combination of the issuance of the Class B shares of Veracel to the holders of the subscription receipts followed immediately by the amalgamation of Veracel and the Predecessor Birchcliff, has the same effect and is equivalent to the holders of the subscription receipts only receiving shares of Birchcliff following the amalgamation of Veracel and the Predecessor Birchcliff. If the holders of the subscription receipts would only have received shares of Birchcliff, there would have been an acquisition of control of Veracel on the amalgamation of Veracel and the Predecessor Birchcliff.

He then noted (at para. 52):

The logical rationale of the exception in clause 256(7)(b)(iii)(B) is that it would apply to exclude the larger corporation from the deemed acquisition of control rule in the opening part of subparagraph 256(7)(b)(iii), if two corporations amalgamate.

However, although in form Veracel was the larger corporation, essentially all its assets were the subscription-receipt cash proceeds – and “There was no scenario under which Veracel would have been allowed to retain the money…” (para. 53).

Accordingly (para. 54):

[T]he policy underlying clause 256(7)(b)(iii)(B) of the Act would dictate that there was an acquisition of control of Veracel in this situation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(7) - Paragraph 256(7)(b) - Subparagraph 256(7)(b)(iii) - Clause 256(7)(b)(iii)(B) | policy is to exclude the truly larger corporation (ignoring transitory cash) from loss streaming rules | 299 |

Madison Pacific Properties Inc. v. Canada, 2019 FCA 19

Predecessors of the taxpayers had been acquired for their losses in transactions where less than 50% of their voting shares, but more than 90% of their non-voting participating shares, had been acquired. The Minister had reassessed to deny the acquired losses primarily on the basis that there had been an acquisition of control, but secondarily through applying the general anti-avoidance rule.

V. Miller J had required the Minister to disclose a draft proposal letter in the audit file, as well as a memo dated March 8, 2004 from Income Tax Rulings Directorate Finance’s Director General, Tax Legislation (excepting portions thereof that identified another taxpayer) in which the Directorate expressed concerns regarding the scope of the restrictions on the deductibility of non-capital losses under s. 111(5) and requested an amendment to “deem an acquisition of control to occur where a person or group of persons acquire, as part of a series of transactions, a certain level of equity in a corporation […] and one of the main purposes of the series of transactions is to avoid any limitation of the deductibility of non-capital losses”. She held that the respondent was required to disclose this memo as it had been placed in the CRA’s audit file for the taxpayer.

Gleason JA found no reversible error in requiring production of this memo - nor in the decision of V. Miller J that a request for all correspondence between the Directorate and Finance respecting the legislative scheme dealing with transfer of corporate losses was an impermissible “fishing expedition of vague and far-reaching scope.” However, Gleason JA stated (para. 28):

[T]he documents in issue are of limited relevance and likely inadmissible at trial as, under the GAAR analysis, the question of the policy in the ITA that the taxpayer is alleged to have avoided is ultimately a question of law. … Thus, while it may well be incumbent on the Minister to set out the disputed policy in the Minister’s pleadings as a matter of fairness … it does not follow that evidence on the policy will be admissible at trial as matters of law are for a court to determine.

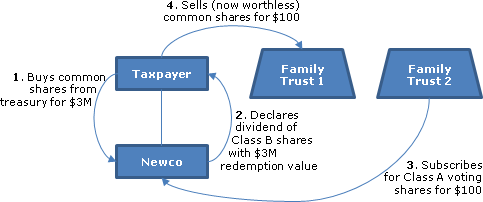

2763478 Canada Inc. v. Canada, 2018 FCA 209

An individual did not sell his shares of an operating company (Groupe AST) directly to a third-party purchaser, but instead transferred them on a s. 85(1) rollover basis into a holding company (276), following which some internal transactions occurred in which the adjusted cost base of the Groupe AST shares was stepped up to fair market value - including a non-rollover drop-down of those shares to a subsidiary (9144) in exchange for high-basis common shares - with 276 realizing corresponding capital gains. The Groupe AST shares were then sold to the purchaser at no additional gain.

Nine months later in the same year, 276 engaged in “value shift” transactions, i.e., a stock dividend of high-low preferred shares was paid on the high-ACB common shares that 276 held in 9144, thereby rendering those common shares almost worthless, and then the capital loss was realized by selling those common shares for $1 to a corporation owned by the son of 276’s shareholder.

After finding that the value-shift transactions entailed an avoidance transaction given that their professed estate-freezing purpose could have been accomplished more conventionally (utilizing a s. 85(1) or 86(1) rollover), Noël CJ went on to find that they were an abuse of the basic capital gains provisions (ss. 38(b), 39(1)(b) and 40(1)(b)), stating (at para. 56, TaxInterpretations translation):

[I]t is possible for the object and spirit of provisions in issue to have a larger rationale that that which emerges on a reading based on the words (See … Triad Gestco, paragraph 51). In this case, on examining the object and spirit of the regime for capital gains taxation, it becomes necessary to recognize that permitting a real gain to be absorbed by a paper loss goes against the raison d’être of this regime.

Accordingly, the Minister’s denial of recognition of the loss under s. 245(2) was confirmed.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(10) | 9 month separation did not avoid series | 290 |

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(3) | not each transaction in series effecting an estate freeze had that objective | 417 |

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(6) | individual allegedly suffering double taxation re s. 245(2) denial of capital loss of his corporation failed to apply under s. 245(6) within 180 days | 327 |

Canada v. 594710 British Columbia Ltd., 2018 FCA 166

The taxpayer was a holding company which wholly-owned a “Partnerco” holding an approximate ¼ limited partnership interest in a strata development partnership (the partnership) which, by May 25, 2006, had realized income of $13 million from the sale of most of the strata units. The three siblings of the shareholder of the taxpayer held their interests in the partnership under the same Holdco-Partnerco structure, and the general partner, holding a 0.1% interest, was held by the Holdco shareholder.

On May 25, 2006, the partnership lent $8.5 million ($2.1 million each) to the four Partnercos, and then each Partnerco immediately declared stock dividends of preferred shares with an aggregate paid-up capital and redemption amount of $2.1 million to each Holdco, with each Partnerco using the proceeds of such loan to redeem the preferred shares.

On May 29, 2006, each Holdco sold its shares of its Partnerco to an arm’s length public corporation (“Nuinsco”) with substantial resource pools (and Nuinsco acquired the shares of the general partner for $1.) The partnership then lent its cash of $4.4 million to Nuinsco.

On May 30, 2006, each Partnerco was wound up into Nuinsco. On May 31, 2006, the partnership allocated its income of $12.1 million to its partners (mostly, Nuinsco). The partnership then sold its remaining strata units at a pre-agreed price to the vendor group, and was wound up (with the result that the balance of the upstream loans referred to above were extinguished). The TCC summary describes ancillary transactions.

The sale of the Partnercos to Nuinsco two days before the partnership’s year end resulted in the deemed commencement of new taxation years for the Partnercos, which thereby permitted most of the income of the partnership to be allocated to Nuinsco as the principal partner at year end. In finding that such allocation defeated the object of s. 96(1) and thus was abusive for purposes of s. 245(4), Woods JA stated (at paras. 68-69, 71) that:

[T]he allocation of the partnership’s income for tax purposes to Nuinsco, which became a partner one day before the end of the partnership’s fiscal period, frustrates the object, spirit or purpose of paragraph 96(1)(f) … by divorcing the economic consequences of the arrangement from the allocation of taxable income … [as] Nuinsco had virtually no economic interest or risk in the real estate development … except for a 10 percent “deal fee”.

Similarly, in finding that there also was an abuse having regard to the object, spirit or purpose of s. 103(1), she stated (at para. 75):

It may often be reasonable to allocate taxable income to persons who are partners at year end, but it was not reasonable in the transactions that took place here that are devoid of any material substance except for the “deal fee”.

In also finding that there was an abusive circumvention of s. 160, i.e., avoidance of the application of s. 160 to the stock dividends and preferred share redemptions (viewed as being in combination a gratuitous transfer of property by the Partnercos to the Holdcos) as a result of the acquisition of control of the Partnercos (resulting in deemed taxation year ends of the Partnercos occurring before they had been allocated partnership income and, therefore, before they had incurred a tax liability) occurring shortly before the partnership fiscal period end, Woods JA stated (at paras. 123):

[T]he acquisition of control of Partnerco arose as part of a series of transactions that was devoid of any purpose or effect except to obtain a tax benefit, or in this case, two tax benefits – the avoidance of tax by Partnerco and the avoidance of liability under section 160 by Holdco. …

Landrus … makes it clear that abuse may be established by the vacuity of transactions.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 160 - Subsection 160(1) | stock dividend followed by redemption of the stock dividend shares effected in combination a transfer of property for no consideration | 334 |

| Tax Topics - Income Tax Act - 101-110 - Section 103 - Subsection 103(1) | s. 103(1) likely applies to the allocation of most of the partnership profits at year end to a lossco that never had significant economic interest or risk in the partnership business | 327 |

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(8) | s. 152(8) cured an error in an assessment as to when the taxation year in question commenced | 371 |

| Tax Topics - Income Tax Act - Section 96 - Subsection 96(1) - Paragraph 96(1)(f) | purpose of s. 96 is for income allocation to be allocated in accordance with economic participation | 102 |

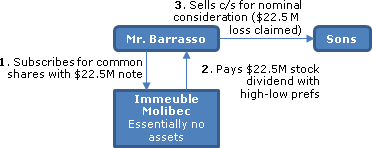

Pomerleau v. Canada, 2018 FCA 129

To simplify the facts somewhat by ignoring transactions in which the taxpayer accessed tax attributes of his sister, the taxpayer wanted to extract $2M from a family corporation, and was willing to do so on a basis that resulted in him receiving a deemed dividend of $1M provided that he was able to extract the other $1M tax free by using the previous step-up of the ACB of the shares of him (and his sister) to $1M using the capital gains deduction. The “hard” ACB and paid-up capital of the shares was nominal, so that the full $2M would have been deemed to be a dividend if he had simply transferred the shares to a new Holdco for cash proceeds of $2M.

Instead, he transferred the shares to a new holding company (P Pom) under s. 85(1) in consideration for high ($1M) basis Class G shares and low basis Class A shares, and redeemed the Class G shares. Most of the proceeds were deemed to be a dividend, and there was a largely matching capital loss that was denied under s. 40(6) and added to the ACB of his Class A shares under s.53(1)(f.2). He now could transfer the bumped Class A shares of P Pom to Holdco, taking back high PUC shares of Holdco, which he promptly redeemed for $2M free of additional tax.

CRA’s assessment of a deemed dividend under s. 245(2) effectively treated the ACB of the shares that were transferred to Holdco as not having been stepped-up under s. 52(1)(f.2). In agreeing with this assessment, Noël CJ stated (at paras. 75, 77, TaxInterpretations translation):

The object and spirit of this provision, or its rationale, is to prevent amounts which have not been subjected to tax to serve in extracting surplus of a corporation free of tax. Subsection 84.1(2) proceeds with this goal in targeting amounts which, while forming part of the ACB of the shares concerned, have not been subjected to tax and have been excluded in the computation of the paid-up capital of new shares. To this end, subparagraph 84.1(2)(a.1)(ii) requires going beyond the ACB of the shares concerned – or of the shares for which they are substituted – and enquiring as to the source of the funds which constituted them in order to ascertain if they were subjected to tax. …

This rationale was circumvented by the plan implemented by the appellant. Of the amount of $1,993,812 that he withdrew, $994,628 represented amounts as to which no income tax had been paid.

After noting that the application of s. 84.1 could have a punitive effect on an inter-generational transfer of a business, he stated:

That situation, if it presented itself in the context of an analysis made under the GAAR, could possibly lead to an interpretation which prevented a punitive application of section 84.1. That situation, however, is not before us.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 84.1 - Subsection 84.1(2) - Paragraph 84.1(2)(a.1) - Subparagraph 84.1(2)(a.1)(ii) | GAAR applied to converting soft ACB (generated from crystallizing the capital gains deduction) into pseudo-hard ACB under s. 53(1)(f.2) for use in extracting surplus | 497 |

Wild v. Canada (Attorney General), 2018 FCA 114

Mr. Wild stepped up the adjusted cost base of his investment in a small business corporation (PWR) by transferring his PWR common shares to two new Holdcos for him and his wife in exchange for preferred shares of the Holdcos, and electing under s. 85 at the right deemed proceeds amount to use up his capital gains exemption. However, the paid-up capital of those preferred shares was ground down to essentially nil under s. 84.1. The solution adopted was for PWR to then transfer high basis assets to the Holdcos in consideration for preferred shares of the same class, so that the PUC of the preferred shares held by Mr. Wild personally could be bumped due to the class-averaging rule in s. 89(1).

For a more detailed factual description and diagrams, see the TCC summary. Dawson JA essentially did not describe these transactions at all and instead merely noted that their effect was to step up the PUC (as well as the ACB) of Mr. Wild’s shares – and that no transaction had occurred so far for such PUC (or ACB) to be utilized.

The Court reversed the finding of the Tax Court that there was an abuse under s. 245(4), and that the Minister's assessment reversing the step-up to the preferred shares’ PUC should be confirmed. Dawson JA first accepted (at para. 28) the Crown’s submission that the object, spirit and purpose of s. 84.1 was to prevent “the tax free distribution of a corporation’s retained earnings or surplus through non-arm’s length transactions designed to artificially or unduly increase or preserve the PUC of shares.” She then stated (para. 32):

Because the tax-free distribution of retained earnings section 84.1 is intended to prevent has not occurred section 84.1 has not, to date, been mis-used or abused.

Dawson JA further stated (at para 45):

… The purpose of the transaction is relevant when considering whether the transaction giving rise to the taxable benefit was an avoidance transaction (Copthorne, paragraph 40). The purpose of a transaction should not be the focus of the abuse analysis where the question is whether a transaction abused the object, spirit or purpose of the provisions relied on.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 84.1 - Subsection 84.1(1) | transactions to bump PUC did not abuse s. 84.1 prior to use of such PUC to strip surplus | 207 |

Fiducie financière Satoma v. Canada, 2018 FCA 74

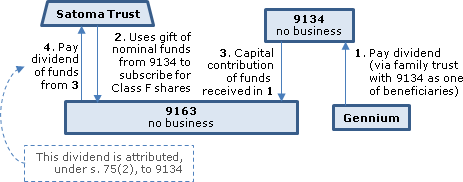

In order to strip surplus of an operating corporation (“Gennium”) controlled by the Pilon family, a dividend paid by Gennium was distributed through a series of transactions to a corporation with no assets (“9163”), which then paid the amount to a Pilon family trust (“Satoma Trust” – which also had a corporate beneficiary) as a dividend on special shares that Satoma Trust held in 9163. The transactions had been structured so as to result in s. 75(2) applying to attribute that dividend to a group holding company (“9134”). 9134 excluded the dividend from its taxable income under s. 112(1). The TCC summary has details.

In confirming CRA’s application of GAAR to include the dividend in the hands of Satoma Trust, Noël CJ stated (at paras. 52-53, TaxInterpretations translation):

[T]he combined operation of subsections 75(2) and 112(1) gave rise to an abuse upon the optional deduction under subsection 112(1) being taken. Subsection 75(2) is an anti-avoidance provision that was conceived to prevent income splitting. Even where the application of this provision by itself has the desired effect, its utilization in combination with subsection 112(1) goes counter to the object and spirit of the latter provision [citing Lipson]. In this regard, the object and spirit of subsection 112(1) consists in permitting the transfer, free of tax, of dividends within certain groups of corporations, subject to their eventual taxation when the dividends are paid to their ultimate recipients. This object was thwarted, as the dividends can now be transferred to the beneficiaries without tax.

The structure implemented … effectively insulated the taxable dividends received from the scope of the tax regime without any tax being paid. At the end of the day, subsection 104(2), under whose terms a trust is deemed to be an individual for income computation purposes, was not engaged, even though the appellant retained all of the dividends paid to it.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(1) - Tax Benefit | tax benefit to trust from tax-free dividend even though not distributed to a beneficiary | 277 |

| Tax Topics - Income Tax Act - Section 3 | pervasive rule that the same income is not to be taxed in 2 persons’ hands | 148 |

| Tax Topics - Statutory Interpretation - Double Taxation/Deduction (Presumption Against) | inclusion of income in more than one taxpayer’s hands is contrary to s. 3 | 173 |

| Tax Topics - Income Tax Act - Section 112 - Subsection 112(1) | abusive to use s. 112(1) so as to avoid ultimate taxation of individuals | 180 |

| Tax Topics - Income Tax Act - Section 75 - Subsection 75(2) | use of s. 75(2) to access s. 112(1) deduction for dividend in fact received by family trust, was abusive | 286 |

| Tax Topics - Income Tax Act - Section 82 - Subsection 82(2) | s. 82(2) supports the primacy of s. 75(2) over the actual dividend recipient | 60 |

Canada v. Oxford Properties Group Inc., 2018 FCA 30

A corporation (“BPC”), which was mostly owned by a Canadian pension fund (“OMERS”), obtained the agreement of a predecessor of the taxpayer (“OPGI Amalco”) that, prior to BPC’s acquisition of OPGI Amalco, it or an OPGI Amalco subsidiary (“MRC Amalco”) would transfer various of its rental real estate properties (including the three “real estate properties”) on a s. 97(2) rollover basis to newly formed LPs (the “first tier partnerships”). Following the acquisition in 2001 of OPGI Amalco by a subsidiary of BPC, the cost of the interests in the first tier partnerships was bumped under s. 88(1)(d) on an amalgamation which formed the taxpayer (“Oxford”). In 2004, the first tier partnerships transferred the three real estate properties to respective newly-formed LPs (the “second tier partnerships”) on a s. 97(2) rollover basis and the first tier partnerships were wound–up, thereby permitting the high ACB in their units to be pushed down onto the cost of the interests in the second tier partnerships under s. 98(3)(c). The taxpayer then sold its interests in the second tier partnerships, somewhat after the three-year period referenced in s. 69(11), to entities that were exempt from Part I tax. The Minister found that these transactions, through their use of the s. 97(2) rollover and the ss. 88(1)(d) and 98(3)(c) bumps, had allowed Oxford to circumvent s. 100(1) so that tax on the latent recapture of $116M and the latent capital gains of $21M on the buildings (as well as the latent capital gain of $11M on the land), was avoided, and assessed a taxable capital gain of $148M, being the sum of these three amounts.

In reversing the finding below that the transactions did not frustrate the object, spirit and purpose of s. 97(2), Noël CJ stated (at paras 59 and 73):

…[T]he object, spirit and purpose of subsections 97(2) and 97(4) is to track the tax attributes of depreciable property in order to ensure that deferred recapture and gains are subsequently taxed.

The question … is whether the fact that deferred gains and recapture will never be taxed frustrates the object, spirit and purpose of subsection 97(2). Given that the only reason why Parliament would preserve the tax attributes of property that is rolled into a partnership is to allow for the eventual taxation of the deferred gains and latent recapture, the answer must be in the affirmative.

Noël CJ similarly found (at paras 77, 78, 79 and 97):

The bump provided for in paragraphs 88(1)(c) and (d)…essentially allows any ACB that would otherwise be lost on a vertical amalgamation to be preserved and transferred to different property that is taxed the same way.

…[D]epreciable property or other types of property that give rise to a 100% rate of inclusion cannot be bumped.

… The rationale [in s. 98(3)] is the same… .

…[T]he bumps insofar as they allowed the respondent to avoid latent recapture on the depreciable property held by the partnerships frustrate the object, spirit and purpose of paragraphs 88(1)(c) and (d) and subsection 98(3).

In finding that the object and spirit of s. 100(1) also had been circumvented, Noël CJ stated (at paras 101 and 102):

…[S]ubsection 100(1) brings into income 100% of the gain resulting from the sale of a partnership interest to an exempt entity insofar as it is attributable to depreciable property. … Parliament wanted tax to be paid on the latent recapture which would otherwise go unpaid on a subsequent sale of the depreciable property by the tax-exempt purchaser.

Given this, the inevitable conclusion is that the object, spirit and purpose of subsection 100(1) was frustrated by the result achieved in this case as the latent recapture in the depreciable property held by the second tier partnerships at the time of the sale of the partnership interests to the tax-exempt entities will forever go unpaid.

However, Noël CJ also found that the GAAR assessment should have been based only on the amount of recapture (of $116M) that had been avoided rather than also the building capital gain of $21M, stating (at paras 115 - 119):

…[N]o abuse of these of these provisions arises when disappearing costs are used to increase the cost of property that is taxed the same way as the property from which the transferred costs originate.

In contrast with the deferred recapture, the deferred capital gain did not simply vanish. Rather, it was offset by adding real costs to the capital cost of the depreciable property. The failure to recognize a cost that has been actually incurred but which would disappear on a vertical amalgamation or a partnership dissolution goes against the integrity of the capital gains system because it allows for the subsequent realization of a capital gain in circumstances where there has been no economic gain. Preventing this outcome is the reason why the bump provisions were enacted.

In the end, the only basis on which the Minister could refuse to give the bumps this limited application is by insisting on a construction of the bump provisions which focuses on the meaning of the words, specifically on the unqualified and express disqualification of depreciable property. However, the Crown cannot have it both ways. In a GAAR context, the same interpretative approach must be applied to both the determination of the abuse and the consequential adjustments required in order to counter it.

Respecting the land capital gain of $111M, there was not the same interpretive challenge since even on the words actually used in s. 100(1), a capital gain on land that was capital property was not targeted with a 100% inclusion rate. Accordingly, the bump in the cost of the land by that amount also was not abusive (paras. 119-120).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 88 - Subsection 88(1) - Paragraph 88(1)(d) | s. 88(1)(d) bump is intended to permit the transfer of ACB that otherwise would be lost to another property that is taxed in the same way | 371 |

| Tax Topics - Income Tax Act - Section 98 - Subsection 98(3) - Paragraph 98(3)(c) | s. 98(3)(c) bump is intended to avoid gain realization where there has been no economic gain | 267 |

| Tax Topics - Income Tax Act - Section 69 - Subsection 69(11) | 3-year time limitation in s. 69(11) did not establish safe harbor for avoidance of recapture on sale after that period | 382 |

| Tax Topics - Income Tax Act - Section 100 - Subsection 100(1) | purpose is to ensure that latent recapture will be recognized on sale to tax exempt | 254 |

| Tax Topics - Income Tax Act - Section 97 - Subsection 97(2) | object includes ultimate taxation of the deferred gain | 234 |

| Tax Topics - Income Tax Act - Section 171 - Subsection 171(1) | GAAR question as to determining a provision’s object was subject to correctness standard | 169 |

| Tax Topics - Statutory Interpretation - Hansard, explanatory notes, etc. | statement that amendment was for “clarification” was self-serving | 209 |

| Tax Topics - Statutory Interpretation - Interpretation Act - Subsection 45(2) | determination of whether amendment merely clarified requires review of pre-amendment state of law | 146 |

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(2) | consequential s. 245(2) adjustment must be scaled to the abuse | 391 |

GUY GERVAIS V. HER MAJESTY THE QUEEN, 2018 FCA 3

The taxpayer’s wife (Mrs. Gendron) purchased 1.04M preferred shares from the taxpayer (Mr. Gervais) at a cost of $1.04M (with Mr. Gervais electing out of s. 73 rollover treatment) and was gifted a further 1.04M shares, having an accrued gain of $1M, on a s. 73 rollover basis, so that her cost of the gifted shares was $0.04M. The transactions were reported on the basis that on the immediately following sale of those shares to a third party for $2.08M, the effect of basis averaging under s. 47 resulted in the shares having an ACB of approximately $0.50 per share, which was half their value of around $1.00 per share. Consequently, there was a $0.5M capital gain attributed back to Mr. Gervais on the gifted shares, and the other $0.5M capital gain was "hers," so that she could claim the capital gains exemption.

In confirming that GAAR applied to include Mrs. Gendron’s reported capital gain of $0.5M in the computation by Mr. Gervais’ income, Noël CJ stated (at paras 50 and 51):

… Subparagraph 40(1)(a)(i) required that the ACB of the shares sold by Ms. Gendron be computed “immediately before the disposition” to BW Technologies and subsection 47(1) which had been brought into operation as a result of the gift deemed the ACB of the shares at that time to be 50 cents per share, that is the average cost of the shares… . The result is that the deferred gain attributed back to Mr. Gervais turned out to be half of what it would have been had subsection 47(1) not applied.

That result, although it flows from the text of the relevant provisions, is contrary to the object, spirit and purpose of subsections 73(1) and 74.2(1), the purpose of which is to ensure that a gain (or loss) deferred by reason of a rollover between spouses or common-law partners be attributed back to the transferor. … Because the rollover provided for in subsection 73(1) deferred this accrued gain [of $1M] in its entirety, the whole of the gain realized on the sale to BW Technologies had to be attributed back to Mr. Gervais when regard is had to the object, spirit and purpose of subsection 74.2(1). It follows that the splitting of that gain, by reason of the astute use that was made of subsection 47(1), frustrates the rationale underlying these provisions or their reason for being.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 74.2 - Subsection 74.2(1) | purpose of ensuring that a gain deferred under interspousal rollover is attributed back to the transferor | 241 |

Univar Holdco Canada ULC v. Canada, 2017 FCA 207

A non-resident's acquisition of the shares of a Netherlands public company (Univar NV) indirectly holding the shares of a valuable Canadian subsidiary (Univar Canada) with nominal paid-up capital was structured to effectively step-up the paid-up capital of the shares of Univar Canada to fair market value by using the pre-2016 version of s. 212.1(4). This was accomplished by setting up a sandwich structure immediately after the acquisition, under which a new Canadian unlimited liability company, capitalized with notes and high-PUC shares, held the shares of a U.S. corporation holding Univar Canada – so that such U.S. corporation could distribute the shares of Univar Canada (on a Treaty-exempt basis) to its controlling Canadian purchaser (the ULC) without technically being affected by the s. 212.1(1) deemed dividend rule. (See the more detailed summary of the TCC decision.)

Webb JA noted (at para. 19) that "If the taxpayer can illustrate that there are other transactions that could have achieved the same result without triggering any tax, then ... this would be a relevant consideration in determining whether or not the avoidance transaction is abusive." He then noted (at para. 21) that the purpose of s. 212.1 “was not to prevent the removal from Canada, by an arm’s length purchaser of a Canadian corporation, of any surplus that such Canadian corporation had accumulated prior to the acquisition of control” since a non-resident could use a Canadian Buyco with full outside basis and paid-up capital to acquire an arm’s-length Canadian target and then extract the target’s surplus. Accordingly, the above transactions were not an abuse of s. 212.1 (para. 22):

The shares of Univar NV were acquired in an arm’s length transaction and, at the time that such shares were acquired, the avoidance transaction was contemplated. Therefore, the avoidance transaction would be part of the series of transactions by which control of Univar Canada was indirectly acquired in an arm’s length transaction. Whether the surplus of the Canadian corporation is removed by completing the alternative transactions described … above or by completing the transactions that were done in this case, the same surplus is removed from Canada.

And at para. 31:

In this case, the Minister has not clearly demonstrated that the avoidance transaction completed in this case was abusive. The transactions were completed as part of an arm’s length purchase of Univar NV.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 212.1 - Subsection 212.1(4) | using old s. 212.1(4) to extract surplus from a non-resident target’s Canadian sub was not abusive | 371 |

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(2) | the result achieved (no s. 212.1 withholding) accorded with the underlying policy of permitting surplus stripping as part of an arm’s length acquisition | 109 |

Canada v. Superior Plus Corp., 2015 DTC 5118 [at 6319], 2015 FCA 241, aff'g 2015 TCC 132

The Superior Plus Income Fund (the "Fund") effectively converted (in accordance with the distribution method contemplated under s. 107(3.1)) into a public corporation using an existing corporation (the taxpayer, a.k.a. "Old Ballard") with non-capital losses and other tax attributes as the new corporate vehicle - rather than using a new corporation. The transactions were designed to ensure that there was no acquisition of control of the taxpayer (which would have resulted in a streaming of its losses). In particular, although the unitholders of the fund became shareholders of the taxpayer, this was considered not to entail an acquisition of control of the taxpayer by a group of persons. Subsequent to the conversion, s. 256(7)(c.1) was introduced, which would have deemed there to be an acquisition of control of the taxpayer, if it had had retroactive effect (which it did not). The Minister disallowed the use of the tax attributes, on the basis that there in fact had been an acquisition of control of the taxpayer or, alternatively, under s. 245(2) (i.e., GAAR).

At the discovery stage, the taxpayer moved to compel the Minister to answer various questions, or to produce documents, or previously redacted portions of documents previously requested under the Access to Information Act, which CRA had resisted principally on the grounds of irrelevance. The questions included whether the Department of Finance considered making the 2010 SIFT amendments retroactive, why it had changed its explanatory notes to say that s. 256(7)(c.1) "clarified" rather than "extended" the change-of-control rules and whether the Attorney General agreed that initially the policy choice of the SIFT conversion rules was to allow the use of existing corporations. Requested documents included GAAR Committee minutes including comments of individual members (whereas CRA had provided only the final Recommendation of the Committee), and correspondence between CRA and Finance (resulting in the drafting of s. 256(7)(c.1))and between the GAAR Committee and Aggressive Tax Planning, with the questions seeking particulars on the questions posed above and policy considerations brought to bear on this file, and respecting what initially may have been diffidence on the part of Finance as to how to proceed, if at all.

Following the reasons in Birchcliff, Hogan J in the Tax Court granted the taxpayer's motion in the main (including all the above-mentioned questions and documents).

In the Court of Appeal, Noël CJ stated (at para. 8):

As was held…in Lehigh Cement Ltd. v. R., 2011 FCA 120… information pertaining to the policy of the Act, even where it is not taxpayer specific, can be relevant on discovery. …

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Solicitor-Client Privilege | non-tax legal opinion produced on discovery which potentially supported a GAAR argument did not entail implied waiver of tax memos until used in evidence | 200 |

Inter-Leasing, Inc. v. Ontario (Revenue), 2014 ONCA 575

In order to minimize provincial income tax, a Canadian corporate group restructured so that various intercompany debts were owing (on a back-to-back basis through an intermediate company) to the taxpayer which, although it was resident in Canada and had a permanent establishment in Ontario for other tax reasons, was exempt from tax on the interest income by virtue of an exemption in the Corporations Tax Act (Ontario) for income from property earned by a corporation which had been incorporated outside Canada (here, the British Virgin Islands.) For more detail see under s. 115(1)(b) – and respecting the BVI situs issue, see summary under TA, s. 54(2)(b).

In finding found that Ontario's GAAR did not apply, as there was no abuse of the relevant provision, Pardu JA stated (at para. 55) that "in 1959, Ontario adopted the place of incorporation test [for residence], unlike the federal government and all other provinces," referred (at para. 60) to "the deliberate decision not to tax corporations incorporated outside Canada on income from property" and (at para. 61) noted that Copthorne stated that "in some cases the underlying rationale of a provision would be no broader than the text itself." She then stated (at paras. 62, 66):

Here, the purpose of s. 2(2) of the OCTA was to tax corporations incorporated outside Canada with a permanent establishment in Ontario on income from business but not on from income from property. Where such a corporation structures its affairs to earn income from property rather than income from business, it has not…defeated the underlying rationale of the provision… .

The approach taken by the appeal judge - to define the purpose of the provision as to raise revenue and to define the tax base as broadly as possible - renders "abusive" any transaction that has the effect of reducing tax. I do not accept that approach.

In rejecting an argument that situating the specialty debt instruments in the British Virgin Islands was an abusive transaction, Pardu JA noted (at paras. 95-7) that "the rule governing the situs of specialty debts instruments is a long-standing and well-established rule," "the situs for the instruments was not arbitrary, but was a place to which the corporation had some link, namely, its place of incorporation," and "the level of [the taxpayer's] activity in Ontario to generate the income from property was minimal."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 115 - Subsection 115(1) - Paragraph 115(1)(a) - Subparagraph 115(1)(a)(ii) | holding intercompany loans was not a business, corporate objects presumption not applied | 366 |

Canada v. Global Equity Fund Ltd., 2013 DTC 5007 [5526], 2012 FCA 272

The taxpayer subscribed for common shares of a new subsidiary for approximately $5.6 million, which then declared a stock dividend in the form of preferred shares having $56 of paid-up capital and a $5.6 million redemption price. Consequently, the value of the common shares was largely eliminated. (The taxpayer's subscription for an additional $200,000 was acknowledged to be "window dressing" to give the common shares some value.) The taxpayer (which was involved in the business of trading securities) disposed of the common shares to a family trust in consideration for their depleted value and reported a business loss.

Mainville J.A. found that the transactions were abusive of ss. 3, 4, 9, and 111. He stated (at para. 62):

The fundamental rationale underlying these provisions is that, in order to be used for taxation purposes, business losses must be grounded in some form of economic or business reality. As noted in Canderel at para. 53, "[i]n seeking to ascertain profit, the goal is to obtain an accurate picture of the taxpayer's profit for the year." That same common sense principle applies to a business loss, thus harmonizing the concept of business loss with the related concept of profit under the Act.

The Court concluded that the taxpayer's transactions were "nothing more than a paper shuffle," that "nothing was gained or lost," and that it would "defeat the underlying rationale of sections 3, 4, 9 and 11" for such paper losses to avoid "the payment of taxes otherwise owed on the profits resulting from the real-world business operations of Global" (para. 66-68).

The Minister argued in the alternative that no business loss had in fact occurred, given that the shares had not been acquired as inventory or as part of an adventure in the nature of trade. These arguments had not been raised at trial and entailed new evidence, and were therefore disallowed (paras. 35-37).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(9) | on appeal to FCA, Crown could not introduce new arguments that required further evidence | 295 |

1207192 Ontario Limited v. Canada, 2012 DTC 5157 [at 7396], 2012 FCA 259, aff'g 2011 DTC 1301 [at 1686], 2011 TCC 383

This was a companion case to Triad Gestco.

The taxpayer, which had realized a capital gain of $2,974,386, transferred cash and marketable securities with a value of $3 million to a newly-incorporated subsidiary ("Newco") as the subscription price for common shares of Newco. Newco then paid a stock dividend to the taxpayer consisting of preferred non-voting shares having a nominal paid-up capital and a total redemption value (in the hands of the initial holder) of $3 million, thereby effecting a "value shift" away from the common shares. Special voting shares of Newco having nominal value were issued to a trust for members of the family of the sole shareholder of the taxpayer ("Mr. Cross"). The taxpayer then sold the common shares of Newco to a second family trust for the sum of $100 and claimed a capital loss of nearly $3 million.

Paris J. denied the capital loss under s. 245(2). The taxpayer had clearly engaged in an avoidance transaction, and the transaction was an abuse of s. 38(b) of the Act. He stated (at TCC paras. 90, 92):

I find that the Respondent has shown that the purpose of paragraph 38(b) is to recognize economic losses suffered by a taxpayer on the disposition of property. The Respondent has also shown that despite the repeal of subsection 55(1) [a provision specifically aimed at stopping artificial capital losses such as surplus-stripping], the policy of the Act is still to disallow the artificial or undue creation or increase of a capital loss, which underlines the intention to allow capital losses only to the extent that they reflect an underlying economic loss. ...

These transactions did not reduce the Appellant's economic power in the manner contemplated by Parliament in allowing for the deduction of capital losses.

In accordance with its conclusions in Triad Gestco, the Court of Appeal affirmed Paris J.'s reasoning. Furthermore, in response to the taxpayer's argument that the main purpose of the transaction was to effect creditor protection for Mr. Cross, Sharlow J.A. stated (at FCA para. 20):

I am unable to accept this argument. In my view, Justice Paris followed the correct approach when he determined the purpose of the series of transactions on an objective basis – that is, by ascertaining objectively the purpose of each step by reference to its consequences – rather than on the basis of the subjective motivation of Mr. Cross, or his subjective understanding of what may or may not have been required to achieve creditor protection.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(3) | purpose objectively determined | 141 |

Triad Gestco Ltd. v. Canada, 2012 DTC 5156 [at 7385], 2012 FCA 258

The taxpayer, which was directed and controlled by Mr. Cohen, and which had realized a capital gain of approximately $8 million, transferred $8 million of assets to a newly-incorporated subsidiary ("Rcongold") in consideration for the issuance of common shares. Rcongold declared a stock dividend of $1 on its common shares, which was payable through the issuance of 80,000 non-voting preferred shares with an aggregate redemption price of $8,000,000 and (presumably) a stated capital of $1. An unrelated individual settled, with $100, a trust of which Mr. Cohen was a beneficiary, so that under the "affiliate" definition then in effect it was an un-affiliated trust. The taxpayer then sold its common shares of Rcongold to the trust for $65 and claimed a capital loss of $7,999,935, which permitted it to offset the realized capital gain through a loss carry-back.

After noting (at para. 39) that after the taxpayer's disposition of its common shares it "was neither richer nor poorer," Noël J.A. (while citing Ramsay) stated (at para. 41) that "the capital gain system is generally understood to apply to real gains and losses" as contrasted to "paper gains or losses" (para. 44), so that, under the general capital loss provisions of the Act, there was:

relief as an offset against capital gain where a taxpayer has suffered an economic loss on the disposition of property... [and] offsetting a capital gain with the paper loss that was claimed [here] results in an abuse and a misuse of [these] relevant provisions... . (Para. 50.)

The Court found that the trial judge erred in his alternative finding that s. 40(2)(g)(i) reflects a general policy against the deduction of losses "within an economic unit" (paras. 54-56). Finally, although there was a corresponding accrued but unrealized gain on the taxpayer's preferred shareholding, the taxpayer had not "put forth a credible scenario indicating that the preferred shares were to be sold" (para. 59).

The taxpayer's appeal was dismissed.

Canada Safeway v. Alberta, 2012 DTC 5133 [at 7271], 2012 ABCA 232

This case was a companion decision to Husky Energy.

An Alberta taxpayer ("CSL") borrowed $600 million from its Alberta parent ("CSHL") over the course of a month, and used the borrowed funds to repay commercial paper which it previously had borrowed for an income-producing purpose. At the same time as these borrowings occurred, CSL paid dividends totaling $600 million to CSHL. CSHL then assigned the $600 million of debt to another subsidiary ("SOFC") which had been incorporated in the British Virgin Islands but had a permanent establishment in Ontario. CSL paid interest to SOFC, SOFC paid dividends to CSHL, and CSHL would make further loans to CSL. CSL deducted the interest paid to SOFC in computing its income for Alberta purposes, SOFC was not taxable in Ontario on the interest it received from CSL, and CSHL claimed the intercorporate dividend deduction respecting the dividends it received from SOFC.

In the course of finding that the series of transactions was not subject to Alberta's general anti-avoidance rule (on similar reasoning to Husky), Hunt J.A. stated (at para. 38):

I am not persuaded by Alberta's argument that Safeway did not "need" to borrow $600 million... . It is clear that a taxpayer is free to replace retained earnings with borrowed money and doing so does not by itself show that the purpose of section 20(1)(c) has been frustrated: Lipson at para 41; see also Ludco and Singleton.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(3) | focus on whether individual transactions are avoidance transactions | 139 |

Husky Energy v. Alberta, 2012 DTC 5132 [at 7262], 2012 ABCA 231

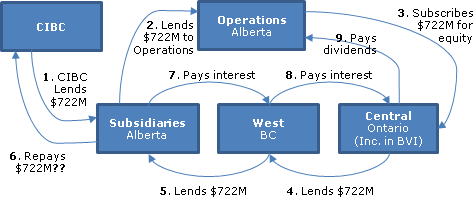

An Alberta corporate taxpayer within the Husky group of companies ("Operations") used the proceeds of loan repayments received from other Alberta taxpayers within the group (the "Subsidiaries" - who had borrowed those proceeds from a bank) to subscribe for equity in a subsidiary ("Central") which had been incorporated in the British Virgin Islands but which was resident in Ontario. Central used the subscription proceeds to make an interest-bearing loan to another (BC) subsidiary of Operations ("West") which, in turn, on-lent those funds at interest to the Subsidiaries. The Subsidiaries deducted the interest payments made by them to West, West included those payments in its income and deducted the interest paid by it to Central - however, Central was not required to include such interest payments in its income for Ontario corporate income tax purposes. Central applied the untaxed interest payments so received by it to make dividend payments to Operations, which claimed the intercorporate dividend deduction.

Further transactions were engaged, which were viewed as raising the same issues under the general anti-avoidance rule ("GAAR") in the Alberta Corporate Tax Act (ACTA), which is essentially identical to the federal GAAR.

The Court dismissed the Minister's submission that the Subsidiaries' deduction under 20(1)(c) of the interest payments to West, and Operations' claiming of the intercorporate dividend deduction under s. 112(1), abused those provisions. The principle of corporate non-consolidation, set out in para. 97 of Copthorne, requires that each corporation's tax liability be considered independently (para. 47). It was therefore irrelevant for the Subsidiaries' tax position that Central had no corresponding income inclusion on the interest payments (paras. 45-46), and it was irrelevant for Operations' tax position that dividends from Central came from a non-taxable stream of income (paras. 52-56).

Copthorne Holdings Ltd. v. Canada, 2012 DTC 5006 [at 6536], 2011 SCC 63, [2011] 3 S.C.R. 721