Subsection 40(1) - General rules

Cases

Abrametz v. Canada, 2009 DTC 5828, 2009 FCA 111

The taxpayer would have established that he realized a capital loss if he had established the following:

- a fellow shareholder ("Paulhus") of the corporation in question had paid a sum of money to the holders of defaulted mortgage debt of the corporation pursuant to a settlement agreement that also contemplated that the taxpayer would transfer to Paulhus all of his shares of another corporation ("Placid") in order to pay to Paulhus his share of the settlement payment;

- the taxpayer satisfied this payment obligation to Paulhus;

- as a consequence of the law of subrogation, Paulhus acquired the mortgage debt; and

- by transferring his shares of Placid to Paulhus, the taxpayer acquired ½ of the indebtedness formerly owing to the mortgage holders that Paulhus had acquired from the mortgage holders.

The Trial Judge had incorrectly found that the taxpayer had not made the payment referred to in (2) above, and the matter was referred back to the Minister for reconsideration of the third and fourth points above, together with consideration as to whether the claim by the taxpayer in his return for a business investment loss represented an election under s. 50(1).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 39 - Subsection 39(12) | 89 |

Administrative Policy

Calculating and reporting your capital gains and losses

Use the exchange rate that was in effect on the day of the transaction or, if there were transactions at various times throughout the year, you can use the average annual exchange rate.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 39 - Subsection 39(2) | 33 |

Paragraph 40(1)(a)

Administrative Policy

28 April 2008 External T.I. 2007-0243711E5 F - Gains et pertes sur change

Regarding a requested clarification of the second part of paragraph 13 of IT-95R regarding the realization of a foreign exchange gain or loss on the use of foreign currency funds, and a query as to whether FX fluctuations, rather than being recognized on a transaction of purchase and sale of investments other than funds on deposit, can have their recognition deferred to when the foreign currency funds are exchanged for Canadian money, CRA stated:

[T]he use of foreign currency funds that could result in a foreign exchange gain or loss is not limited to the acquisition of negotiable instruments but also includes the acquisition of any other property. Consequently, assuming that the transactions are on capital account, there will be a foreign exchange gain or loss calculation in respect of foreign currency funds used to acquire the property that is the corporate shares purchased in the US market. …

Where there is a sale of foreign currency investments other than funds on deposit ("investments"), the CRA's position is that the gain or loss on the sale of the investments will be computed by converting the adjusted cost base and the proceeds of disposition of the investments into Canadian currency using the exchange rate prevailing at the relevant time. Specifically, the CRA's position is that the adjusted cost base is to be converted into Canadian currency using the exchange rate prevailing at the time of the acquisition of the subject investments, and the proceeds of disposition of the investments are to be converted into Canadian currency using the exchange rate prevailing at the time of disposition of those investments. … We do not allow an individual investor to use the method you advocate that would delay recognition of the foreign currency fluctuation.

Subparagraph 40(1)(a)(i)

Cases

Martin v. Canada, 2015 FCA 204

The taxpayer's employment at his brokerage employer was terminated. He was unable to find replacement employment or to establish his own financial advisory business, so that he lost his clientele. He was unable to claim a capital loss of $14.8 million, computed as the fair market value of his clientele, and the value of property seized as a result of his ensuing financial troubles. He did not have a cost for his clientele (and the expenses incurred in building up his clientele had been deducted as business expenses) and his financial losses were not disposition expenses.

Gaynor v. The Queen, 91 DTC 5288, [1991] 1 CTC 470 (FCA)

In rejecting a submission that the capital gain realized by the taxpayer from the purchase and sale in U.S. dollars of U.S. securities should be computed by multiplying the gain measured in American currency by the exchange rate prevailing at the time of the disposition, Pratte J.A. stated that "both the cost of the securities and the value of the proceeds of disposition must be valued in Canadian currency which is the only monetary standard of value known to Canadian law" and that "once this is realized, it becomes clear that the cost of the securities to the appellant must be expressed in Canadian currency at the exchange rate prevailing at the time of their acquisition while the valuation of the proceeds of disposition of the same securities must be made in Canadian currency at the rate of exchange prevailing at the time of the disposition".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Amount | 62 |

The Queen v. Demers, 86 DTC 6411, [1986] 2 CTC 321 (FCA)

Although the price stipulated in the agreement for the sale of shares of a corporation ("Chibougamau") was $7,800,000, the agreement also provided that the vendors were required to use the sale proceeds to acquire from Chibougamau a debt owing to it by its subsidiary with a face amount of approximately $1,400,000 but a fair market value of only $600,000 (the difference being $800,000). Hugessen J.A., in his concurring reasons, found that the vendors were able to deduct $800,000 as an outlay or expense of the disposition (pp. 6413-6414):

"In my opinion it is not necessary for a payment to be made without any consideration for there to be a 'débours' or 'outlay' ... However, the provision recognizes that an outlay can be for more than one purpose: it is only 'to the extent' that it is made for the purposes of making the disposition that it can be taken into account in calculating the capital gain ... As it was not in dispute that in the case at bar the payment of $1,400,000 vested in the respondents property worth only $600,000, it follows that the sum of $800,000 was spent for purposes other than purchasing this property, namely for the disposition of their shares in Chibougamau."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Proceeds of Disposition | 130 |

See Also

Giguère v. Agence du revenu du Québec, 2018 QCCQ 874

The taxpayer received fraudulent advances from a corporation (Groupe Norbourg) managed by her husband. She used the money to purchase a property that was used as the second residence of her family and a second property which was occupied by her father-in-law at no rent (although he paid the property expenses.) When the corporation failed, the receiver (RSM) made a claim against her for return of the money plus interest. She agreed to repay the money out of the sales proceeds of the property with interest at 6% (with this obligation secured by a mortgage). She sold the properties at a gain, and when she was assessed for the gain by the ARQ, she claimed (among other arguments) that the interest was a disposition expense under the Quebec equivalent of s. 40(1)(a)(i).

In rejecting this position, Vaillancourt JCQ stated (at paras. 32-34, TaxInterpretations translation):

The plaintiff … recognized having received the amounts from Groupe Norbourg without any right thereto, which constitutes an insurmountable obstacle to her argument that she paid the interest on a loan.

… [T]he plaintiff paid the interest to RSM for the sole purpose of buying time to repay the receiver the sums which she had received without any right thereto.

Such interest does not in consequence constitute and expense “made or incurred for the purpose of making the disposition” of the properties as provided in TA section 234(a).

The above factual characterization also prompted a rejection of her argument in the alternative that the interest was a currently deductible expense - even before getting to his finding that the properties in question were personal-use properties rather than rental properties.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(c) - Subparagraph 20(1)(c)(i) | fraudulent advance did not qualify as a loan | 202 |

Rio Tinto Alcan Inc. v. The Queen, 2016 TCC 172, aff'd 2018 FCA 124

The taxpayer ("Alcan"), a Canadian public company, incurred fees on capital account respecting its butterfly spin-off of a subsidiary holding a laminated products division to the Alcan shareholders. Hogan J found that the portion of these expenses which were capital expenditures rather than expenses that were deductible under s. 9 or 20(1)(bb) could only be recognized as disposition expenses under s. 40(1)(a).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(a) - Legal and other Professional Fees | investment dealer fees incurred respecting the advisability of making hostile takeover were fully deductible under s. 9 | 417 |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(bb) | investment dealer fees re advisability of making hostile takeover were fully deductible | 529 |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(cc) | legal fees incurred in securing regulatory approval for a hostile bid related to the bidder's business of earning income from shares and interaffiliate sales | 182 |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(g) | takeover bid circular costs did not qualify | 102 |

| Tax Topics - Income Tax Act - Section 14 - Subsection 14(5) - Eligible Capital Expenditure | fees incurred in order to acquire shares were excluded/butterfly expenses excluded as taxpayer was not in the business of implementing corporate reorganizations | 365 |

| Tax Topics - Income Tax Act - Section 169 - Subsection 169(2.1) | raising general question of deductibility of fees and listing s. 20(1)(e) did not satisfy s. 165(1.11) | 246 |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(e) | failure to advance evidence showing allocation of fees to share consideration | 139 |

| Tax Topics - Statutory Interpretation - French and English Version | finding common meaning of 2 versions of s. 20(1)(bb) | 108 |

Brosamler Estate v. The Queen, 2012 DTC 1193 [at 3493], 2012 TCC 204 (Informal Procedure)

he estate of a deceased German resident sold three rental properties in BC. The estate added probate and legal fees that were paid in establishing the title of the estate to the properties to the adjusted cost base of the rental properties. The Minister denied the increase in adjusted cost base, and thereby reduced the estate's capital loss (which was deemed to be a capital loss of the deceased under s. 164(6).)

After finding that these fees were part of the estate's acquisition cost, Webb J. noted, in the alternative, that the fees could be characterized as outlays or expenses the estate incurred for the purpose of making a disposition of the rental properties, which would reduce the estate's proceeds of disposition under s. 40(1)(a), leading to the same capital loss that the deceased claimed.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Adjusted Cost Base | probate fees added to cost | 154 |

Dubois c. La Reine, 2007 DTC 1534, 2007 TCC 461 (Informal Procedure)

The taxpayer had to pay an amount in settlement of the damages claim of the vendor and incurred related legal expenses as a result of a cancellation by the taxpayer of an agreement to purchase a building. After finding that these amounts were incurred on capital account, Paris J. rejected (at para. 22) a submission of the Crown that the taxpayer "would not be entitled to a capital loss because...the Appellant did not dispose of any property in 2001," and stated:

...the expenses may have been incurred as part of a disposition of the Appellant's right to purchase the building , and the disposition of that right may constitute a disposition of property within the meaning of section 38...

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(a) - Start-Up and Liquidation Costs | 100 | |

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(b) - Capital Expenditure v. Expense - Contract or Option Cancellation | 94 | |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Disposition | legal expenses incurred re cancellation of purchase may be loss from disposition | 90 |

| Tax Topics - Income Tax Act - Section 4 - Subsection 4(1) - Paragraph 4(1)(a) | 152 |

Avis Immobilièn G.M.B.H. v. The Queen, 94 DTC 1039, [1994] 1 CTC 2204 (TCC)

The taxpayer, which was a corporation resident in West Germany, borrowed deutschemarks ("DM") from a German bank to help finance the acquisition in 1983 of three properties in Montreal. The bank consented to a sale in 1986 of the properties to an arm's length purchaser ("MCLR") provided that the taxpayer repaid the loans out of the proceeds of a sale of the properties to its shareholders ("Vogel" and "Fischer"). Vogel and Fischer financed the purchase by borrowing DM personally from the bank secured by hypothecs on the properties, then sold the properties to MCLR subject to the hypothecs.

In finding the that taxpayer had not made or incurred an outlay or expense for purposes of s. 40(1)(a)(i) by virtue of the appreciation of the DM between 1983 and 1986, Rip TCJ. found that no foreign exchange loss had arisen on the repayment of the DM loan with DMs, and that the foreign exchange loss arose as a result of DM being exchanged for dollars in 1983 and dollars being reconverted into DM in 1986. This exchange transaction was not effected "for the purpose of" disposing of the properties, i.e., "for the immediate or initial purpose" of so doing. S.40(1)(a)(i) "does not contemplate expenses or outlays which may have merely facilitated the making of the disposition or which were entered into on the occasion of the disposition." (p. 1046).

Capcount Trading v. Evans, [1993] BTC 3 (C.A.)

A capital loss of a British company from the disposal of shares of a Canadian company was to be determined by computing the difference between the cost, converted into pounds sterling at the spot rate prevailing at the time of acquisition, and the proceeds, converted into pounds sterling at the spot rate prevailing at the time of disposal.

Campbellton Enterprises Ltd. v. MNR, 90 DTC 1869, [1990] 2 CTC 2413 (TCC)

A bonus equal to three months' interest which the taxpayer paid in order to discharge a mortgage upon the sale of a rental property was deductible in computing its capital gain.

Samson Estate v. MNR, 90 DTC 1150, [1990] 1 CTC 2223 (TCC)

Professional fees incurred in seeking the cancellation of a zoning by-law were found to have been incurred in order to more easily dispose of the property, and therefore were deductible under s. 40(1)(a)(i). However, professional fees relating to a disputed municipal assessment were found instead to relate to the maintenance of the property.

Bentley v. Pike, [1981] T.R. 17 (HCJ.)

Mrs. Bentley was considered under the Finance Act 1965 to have acquired, on her father's death in 1967, a 1/6 share of real property situate in West Germany which passed to her for a consideration equal to its fair market value, and sold her interest for DM in 1973. It was held that her capital gain should be computed by translating her DM cost into sterling in 1967, and her DM proceeds into sterling in 1973, rather than by multiplying her DM gain by the 1973 exchange rate. Sterling was the only permissible unit of account.

Administrative Policy

7 October 2022 APFF Financial Strategies and Instruments Roundtable Q. 3, 2022-0943261C6 F - Average Exchange Rate

Can an average exchange rate be used in computing the gains or losses from the disposition of capital property? CRA responded:

As a general rule, the CRA will not accept the conversion of a gain or loss on the disposition of a capital property using an average exchange rate. A gain or loss is simply the arithmetic difference usually resulting from two or more separate transactions, a purchase and a sale, which generally occur on different dates. Consequently, the daily exchange rate for the particular dates should be used to determine, in Canadian dollars, the adjusted cost base ("ACB") of such property and any proceeds of disposition from its disposition.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 261 - Subsection 261(1) - Relevant Spot Rate | circumscribed acceptance of using average exchange rates | 257 |

| Tax Topics - Income Tax Act - Section 39 - Subsection 39(1.1) | use of average exchange rate under s. 39(1.1) is permitted | 36 |

22 January 2020 External T.I. 2014-0559281E5 F - T5008

The T5508 Guide states:

Report only the total proceeds in box 21. Do not deduct any expenses from the proceeds… .

Respecting the application of s. 49(1) to the writing and sale on an exchange of a naked call option and the T5008 reporting of the transaction “cost” of the option on the T5008 issued by the securities dealer, CRA did not reference the above statement, but effectively confirmed that it did not trench on how the gain was reported by the option writer. It stated:

The CRA's position is that expenses incurred in connection with the granting of an option may be deducted from the proceeds of disposition when calculating a taxpayer's gain.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 49 - Subsection 49(1) | writing of call option (with deemed nil ACB) is reported as having nil “cost” on T5008 | 99 |

| Tax Topics - Income Tax Regulations - Regulation 230 - Subsection 230(2) | “cost” of call options closed out by writer is nil, not the cost of offsetting call option purchase/cost re short sale is the FMV of the borrowed shares | 351 |

| Tax Topics - Income Tax Act - Section 9 - Computation of Profit | cost of short sale is FMV of borrowed shares | 59 |

15 October 2015 Internal T.I. 2014-0527041I7 F - Disposition de biens

In the course of a discussion not based on a repetition of the applicable facts, CRA stated:

...Avis Immobilien GMBH ... [found that] "for the purpose of" in subparagraph 40(1)(a)(i) means the immediate or initial purpose and not the eventual or final goal...[and] only the outlays and expenses incurred or made directly for the purpose of making the disposition of the property are considered in subparagraph 40(1)(a)(i), and not those which may have merely facilitated the disposition. The CRA is of the view that these principles established for the purposes of subparagraph 40(1)(a)(i) also apply to subparagraph 40(1)(b)(i).

15 September 2015 External T.I. 2015-0583221E5 F - Redemption by a cooperative of its own shares

Is a gain realized by a cooperative corporation, on the redemption of its own preferred shares, taxable? CRA responded:

[N]o provision of the Act contemplates a gain resulting to a cooperative corporation on the redemption by it of its own preferred shares for less than what had been received for them.

S4-F2-C1 - Deductibility of Fines and Penalties

1.22 If a fine or penalty (such as a mortgage prepayment penalty) is incurred in connection with the disposition of a capital property, the fine or penalty is taken into account under subsection 40(1) for purposes of calculating any gain or loss on that disposition.

10 June 2013 STEP Round Table Q. 10, 2013 0480411C6 (Brosamler decision)

CRA considers Brosamler Estate to be confined to "a very specific fact situation," noting that the legal and probate fees in issue would have been deductible in determining capital losses on the disposition of the properties regardless of whether they could be added to the property's ACB.

CRA's decision not to appeal reflects its general policy not to appeal decisions made under the informal procedure, rather than its views on the merits of the decision.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Adjusted Cost Base | 75 |

11 January 2013 External T.I. 2012-0436771E5 - Sale of a business

The sole shareholder of Aco is required under the terms of the share sale agreement to repay, in full, at closing, a bank loan owing by Aco and an early repayment penalty. Consistently with Demers, 86 DTC 6411, both amounts are deductible in computing the shareholder's gain under s. 40(1)(a)(i) as amounts incurred for the purpose of disposing of the shares.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(9.1) | penalty paid by shareholder | 85 |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(e) | continued deduction where debt settlement by shareholder rather than taxpayer | 24 |

15 November 2012 External T.I. 2012-0461291E5 F - Frais judiciaires pour clarifier une servitude

A taxpayer who owned both a lakeside lot on which the taxpayer had a cottage and an adjoining lot (the "second lot") on which there was an easement (covering s specific portion thereof) permitting access to the first lot, then secured a cadastral remaking of title under which a portion of the area of the second lot was integrated with that of the first lot. However, other landowners brought an action to challenge this change on the basis that they also had had an easement over the entire second lot, as a result of which the Superior Court of Quebec confirmed that the easement was restricted to the same specific portion of the area of the second lot as noted above. When asked whether these legal expenses could be included in the adjusted cost base of the expanded first lot, CRA instead addressed the question as to whether the expenses could constitute a disposition expense under s. 40(1)(a)(i), referred to the narrow meaning accorded to the phrase "for the purpose of” in s. 40(1)(a)(i) in Avis Immobilièn, and stated:

[T]he legal costs incurred by the owner of the two lots would not be expenses incurred or made by the latter in order to realize the disposition of the cottage and the land, which includes the entire area of the first lot and XXXXXXXXXX% of that of the second lot, and therefore no part of that expense would be added to the ACB of those lots.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Adjusted Cost Base | no comment on whether legal costs to avoid expanded easement were ACB addition | 78 |

24 April 2012 Internal T.I. 2011-0400671I7 F - Honoraires professionnels

A law firm (Advisor B) that was acting for both the purchasers and vendors (Mr. B and Corporation D) of shares of Corporation A was paid an agreed portion of its fees by Corporation D. In the course of finding that a pro rata portion of these were a disposition expense to Corporation D (with the balance giving rise to a s. 15(1) benefit to Mr. B), the Directorate stated:

[W]ith respect to professional services rendered by Advisor B on tax planning for Mr. B and Corporation D, we believe that such an expense can be considered an expense incurred to dispose of the shares. This expense could likely be recognized by Corporation D and would reduce the proceeds of disposition that Corporation D derived from the disposition of the shares.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(a) - Start-Up and Liquidation Costs | fees incurred by individual before intention to form a corp did not qualify as pre-incorporation expenses | 486 |

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | meaning of “benefit” | 164 |

4 September 2007 Internal T.I. 2007-0237791I7 F - Gain et perte sur taux de change

The taxpayer had a US dollar bank account into which it deposited US dollars from its sales and from which it lent US dollars to affiliates (in this case, a non-interest-bearing loan to its parent) which were repaid in US currency, which it deposited to that bank account. The Directorate rejected the taxpayer’s position that the advance to the parent came within the position in IT-95R, para. 13 that there was no realization of FX gains or losses where there was a mere change in the for in which money was held on deposit, stating:

[Such] position with respect to money on deposit does not cover situations where an investment in the form of a debt or loan, as in this situation, is acquired from an entity other than a financial institution. Consequently, the foreign currency funds would have been disposed of when the funds were used to acquire the debt obligation or loan. That disposition could result in a capital gain or loss pursuant to subsection 39(2). Furthermore … the taxpayer may realize a capital gain or loss when the debt or loan investments in its affiliates are repaid to the taxpayer since the repayment of a debt obligation is a disposition of property.

… [I]n calculating the capital gain or loss resulting from the repayment of the debt or loan, the proceeds of disposition would be converted to Canadian currency using the exchange rate at the date of repayment and the adjusted cost base would be converted to Canadian currency using the exchange rate at the date of the loan.

| Locations of other summaries | Wordcount | |

|---|---|---|

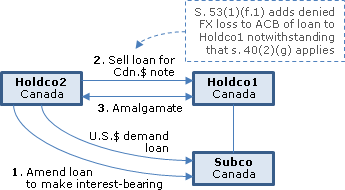

| Tax Topics - Income Tax Act - Section 40 - Subsection 40(2) - Paragraph 40(2)(g) - Subparagraph 40(2)(g)(ii) | s. 40(2)(g)(ii) extended to FX losses on non-interest-bearing loan to parent | 25 |

7 June 2007 External T.I. 2007-0228831E5 F - Pénalité au rachat d'une obligation

When a bondholder requested an early repayment of its bonds, it was required to pay a premium that was withheld first from any accrued but unpaid interest on the bonds, and second out of the principal payable on the repayment. CRA indicated that this withholding mechanic did not reduce the interest income that was to be reported by the issuer on the T5 slip it issued, or reduce the redemption premium, which was to be deducted in computing the capital gain or loss on the disposition by the bondholder of its bonds.

29 July 2004 Internal T.I. 2003-0023761I7 F - Contrat de SWAP d'équité

After concluding that the payment, on the termination of an equity swap, by the taxpayer of the swap termination payment gave rise to a capital loss, the Directorate indicated that in order for that capital loss to be deductible it was necessary for the taxpayer to demonstrate that the amount paid constituted an expense made or incurred with a view to realizing a disposition of the intangible rights which were the equity swap agreement. In particular, after referring to Marren v. Ingles (1980), 54 TC 76 (HL), the Directorate stated:

In the case of an equity Swap where the rights of each party are extinguished at the end of the Swap, it is possible to apply the ratio of these UK judgments and assume that the payment of the amounts by the Taxpayer is the result of the surrender of its rights in the Swap contract.

In order to conclude that there is an allowable capital loss, the Taxpayer will have to show that the amounts paid constitute an expense incurred or made in order to realize the disposition of the intangible right that is the Swap.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(b) - Capital Loss v. Loss | loss on equity swap entered into in monetization transaction was on capital account | 163 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Disposition | termination of equity swap contract entailed the disposition of property | 67 |

| Tax Topics - Income Tax Act - Section 9 - Capital Gain vs. Profit - Futures/Forwards/Hedges | equity swap was to hedge the risk under a capital borrowing, so that loss on closing out the swap was on capital account | 358 |

22 January 2004 External T.I. 2003-0006191E5 F - Frais et montant reçus lors de poursuite

A broker was sued for his alleged mismanagement of the portfolios (held on capital account) of a holding corporation, its principal shareholder and his RRSP under a combined suit of the corporation and the shareholder (the latter also claiming for his RRSP). CCRA stated:

[T]he compensation received for the loss realized on the disposition of the investments or their reduction in value could be compensation for property damaged so that such compensation could represent proceeds of disposition of capital property. … [W]hen computing the capital gain resulting from such a disposition, the costs incurred to receive such proceeds of disposition (such as legal fees and appraisal fees that have not been reimbursed) would be expenses incurred for the purpose of making the disposition and would be deductible when computing such gain.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | legal fees paid by corporation in suit by it and its shareholder and his RRSP should be allocated pro rata to them even though the joint incremental costs were minimal | 190 |

| Tax Topics - Income Tax Act - Section 54 - Proceeds of Disposition - Paragraph (f) | damages received for portfolio mismanagement could be proceeds under para. (f) | 87 |

11 December 2003 External T.I. 2003-0015975 F - calcul du gain/perte sur disposition

Under a Court-approved proposal to avoid the bankruptcy of a corporation, when Mr. A sold his shares of the corporation, he was required to pay a portion of the proceeds of disposition from such sale to the unsecured creditors as partial payment of their claims. In finding that any such payment likely would not be deductible under s. 40(1)(a)(i), CCRA stated:

[E]xpenses that are more of a consequence of the sale and not a condition of the sale cannot be considered in computing the gain or loss from the disposition of the capital property. Legal fees for the protection of property, the reimbursement of certain tax credits following the disposition of property, expenses relating to the possession of property such as maintenance costs, expenses relating to a cancelled sale, and legal fees relating to the recovery of proceeds of disposition or a dispute settlement relating to the proceeds of disposition are examples of expenses that normally arise from the sale of property and that, in our view, are generally not considered to be expenses made or incurred for the purpose of making the disposition of property. …

[T]he Proposal does not prevent Mr. A from selling his shares. Indeed, the Proposal is an agreement independent of the agreement to sell the Corporation’s shares and the sale of the shares must take place in order for the creditor payment clause of the Proposal to apply. Consequently, we are of the view that the expenses arising from the Proposal would not be expenses made or incurred for the purpose of effecting the sale of the Shares.

5 November 2003 Internal T.I. 2003-0037977 F - FRAIS POUR ANNULER UNE OFFRE D'ACHAT

An individual rescinded his agreement to purchase an immovable that he had initially intended to acquire for the purpose of renting it out, and incurred legal fees in order not to pay damages for such repudiation. After finding that such legal fees were capital expenditures, the Directorate stated:

There may be arguments that the legal expenses incurred to rescind the offer to purchase were expenses made or incurred by the individual to effect the disposition of property. Indeed, when the individual signed the offer to purchase, the individual may at that time have acquired property, that is, the right to purchase the immovable contained in the offer to purchase. Cancellation of the offer to purchase would constitute a disposition of that property and the expenses incurred to obtain the cancellation would be expenses incurred to effect a disposition of property. The disposition of the right to purchase the immovable would be at nil proceeds of disposition.

8 September 2003 Internal T.I. 2003-0010407 F - Gains et pertes sur change étranger

The Directorate indicated that an article, stating that the way to compute the capital gain on the disposition of shares of a US corporation was to compute a gain on the shares’ disposition using the historical exchange rate and to then compute a separate gain or loss under s. 39(2), was incorrect. Instead, under Gaynor, the shares’ ACB was determined using the historical exchange rate, and their proceeds were determined using the current exchange rate.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 39 - Subsection 39(2) | s. 39(2) applies to interest on US mortgage | 201 |

9 June 2003 Internal T.I. 2003-001330

Legal fees incurred, following the disposition by the taxpayers of a property, in a dispute as to the amount of the final payment due to the taxpayers for the sale of the property did not qualify under s. 40(1)(b)(i) as being directly incurred for the purpose of making the disposition of the property.

31 January 2003 External T.I. 2002-0161555 F - VENTE D'UN IMMEUBLE LOCATIF

The taxpayer signed an agreement with the tenant in which the taxpayer undertook to pay the tenant the rent paid over the past 12 months if he bought the rental building. CCRA indicated that such payment quite likely would be a reduction in the taxpayer’s proceeds of disposition of the building and could not be deducted in computing the taxpayer’s rental income since it was not paid for an income-earning purpose.

21 October 1993 Income Tax Severed Letter 9325325 - Mortgage Pay-out Penalties

Where penalty payments are made in order to pay off a mortgage, or reduce the interest rate on a mortgage, prior to the sale of the mortgaged capital property, the payment will be considered to have been made or incurred for the purpose of making the disposition and s. 40(1)(a)(i) will be applicable. However, if a substitute property is acquired, s. 18(9.1) may have application.

26 January 1993 Memorandum (Tax Window, No. 28, p. 15, ¶2399)

Legal fees incurred by a taxpayer in a year subsequent to the sale of a capital property in order to collect the proceeds of disposition will not be deductible in calculating the gain from the original disposition or on any other basis.

91 CR - Q.29

Where a landlord makes an inducement payment outside the ordinary course of its business to facilitate the sale of a building by increasing the occupancy rate, the unamortized amount of the inducement may, depending on the facts, form part of the cost of disposition of the building.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(a) - Timing | 12 |

18 November 1991 Memorandum (Tax Window, No. 11, p. 19, ¶1537)

S.40(1)(a)(i) may reduce the taxpayer's capital gain on the sale of shares where under the agreement the taxpayer is required to use a portion of the sale proceeds to repay a debt owed to the corporation.

89 C.M.TC - "Leasing Costs"

"payments made in contemplation of the sale of the property, i.e., to bring the property to full occupancy to enhance the sellling price ... are outlays and expenses made or incurred to dispose of the property ..."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(b) - Capital Expenditure v. Expense - Contract or Option Cancellation | 40 |

Subparagraph 40(1)(a)(iii)

Cases

Pineo v. The Queen, 86 DTC 6322, [1986] 2 CTC 71 (FCTD)

The reserve was not available in respect of a demand promissory note received by the vendors as partial consideration for the sale of shares of a family farm corporation, notwithstanding that the shares were held subject to an escrow agreement until the promissory note was paid off.

The Queen v. Derbecker, 84 DTC 6549, [1984] CTC 606 (FCA)

In S.40(1)(a)(iii)(A), "the words 'due to him' look only to the taxpayer's entitlement to enforce payment and not to whether or not he has actually done so." Thus, where part of the proceeds of disposition of shares was represented by a promissory note expressed to be payable "on demand after December 31, 1976", no reserve was available to the taxpayer after 1976 notwithstanding that no demand for payment was made by him.

Neder v. The Queen, 82 DTC 6022, [1981] CTC 501 (FCA)

Where a taxpayer has been reassessed so as to include in his income a taxable capital gain, a S.40(1)(a)(iii) reserve is not available to the taxpayer if the Minister's assessors have not been provided with the necessary information from which they could determine the applicability or otherwise of that provision. Here, the taxpayer did not even mention the S.40 reserve in his notice of objection, and in his statement of claim "facts [were] not pleaded providing any details of the mortgage [taken back] which could possibly form the basis of a proper claim for a reserve".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Fair Market Value - Land | 66 |

See Also

Alguire v. The Queen, 95 DTC 532 (TCC)

In 1981, the taxpayer sold the shares of a corporation owned by him to his mother for $600,000 under an oral agreement that she would pay him when she received cash dividends from the corporation. In 1983, his mother received $50,000 in dividends and paid such amount to him. Thereafter, the corporation became insolvent.

The sale transaction was not disclosed until the taxpayer's 1983 return, which took the $50,000 receipt into account in claiming a reserve of approximately $550,000 under s. 40(1)(a)(iii). In 1988, Revenue Canada included the amount of the reserve in his income, without allowing any further reserve. Bell TCJ. found that the taxpayer was entitled to claim approximately $550,000 as a reserve in his 1988 taxation year, given that such amount could not be said to be due to him during that year, and also stated (at p. 934) that "it would be illogical for the Appellant to be required to include in income any amount which he has not received unless it is required by statute so to be included".

Administrative Policy

S4-F7-C1 - Amalgamations of Canadian Corporations

1.95 A person entitled to a reserve under paragraph 20(1)(n), subparagraph 40(1)(a)(iii) or subparagraph 44(1)(e)(iii) in respect of an amount not yet due from a predecessor corporation will not become disentitled to the reserve by virtue of the amount becoming an obligation of the new corporation on the amalgamation.

24 February 2014 External T.I. 2013-0505391E5 F - Clause de earnout renversé

CRA confirmed its position in 2000-0051115 that:

Where the cost recovery method is not used and the sale price of a property is not certain at the time of the disposition because of an earnout agreement, a taxpayer may estimate the proceeds of disposition and use this amount to compute the capital gain or capital loss pursuant to subsection 40(1) of the Act. Where a taxpayer chooses this method… no amount is deductible as a reserve under subparagraph 40(1)(a)(iii) of the Act by virtue of the fact that…[a] "legally enforceable" entitlement to proceeds of disposition pursuant to the earnout agreement cannot be established until certain future events have occurred such that no amount is "payable" at the time the property is disposed of.

CRA went on to find that the same position applied to a reverse earn-out given that, due to the sale price potentially being reduced where certain conditions were not met, "the actaul proceeds of disposition are not determinable at the time of disposition of the shares ... [so that] the taxpayer will not be entitled to a capital gains reserve under subparagraph 40(1)(a)(iii)."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 12 - Subsection 12(1) - Paragraph 12(1)(g) | no capital gains reserve on reverse earn-out for a share sale | 230 |

7 October 2013 Internal T.I. 2013-0504081I7 F - Interaction between 55(2) and 40(1)(a)(iii)

Vendor sold blocks of shares in the capital of a corporation (the “Purchaser”) to the Purchaser, with the purchase price being payable over a following number of years based a percentage in each year of the annual consolidated after-tax profits of the Purchaser. The deemed dividend arising in the year of the repurchase under s. 84(3) was deemed by s. 55(2) to be proceeds of disposition. Was the reserve under s. 40(1)(a)(iii) available as a deduction from this capital gain?

After the Directorate confirmed that 1999-0009295 (respecting the availability of a reserve under s. 40(1)(a)(iii) to a capital gain under s. 55(2) where the capital gain arose on the receipt of a promissory note that was "considered to have been accepted as evidence of or security for the balance payable of the purchase price of the shares ... rather than] as 'absolute payment' of the debt"), and in responding affirmatively, the Directorate stated:

[T]he fact that the annual repayment of the balance of sale price was payable at the rate of XXXXXXXX% of the future consolidated annual profits did not cause the Vendor to have the right to demand payment of the balance of the sale price before the end of the taxation year of the Vendor ending on XXXXXXXXXX.

Similarly, the fact that the Purchaser could pay the balance of sale price before its due date does not give the Vendor the right to demand the immediate payment of the balance of sale price before the end of the taxation year ending on XXXXXXXXXX.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2) | s. 40(1)(a)(iii) reserve available where redemption proceeds payable on earnout basis | 173 |

| Tax Topics - General Concepts - Payment & Receipt | distinction between promissory note as conditional or absolute payment | 249 |

16 November 2001 External T.I. 1999-0009295 - Reserve deemed capital gain

Decision summary 55-066 dated 29 November 29 1985 addressed whether a shareholder could claim a reserve under s. 40(1)(a)(iii) when its shares were redeemed in exchange for a promissory note payable in the future and, pursuant to the application of s. 55(2) to the resulting s. 84(3) deemed dividend, the shareholder was deemed to have a capital gain on the redemption. The finding there – "that if the promissory note is a conditional payment then a reserve is permitted and if the promissory note is an absolute payment then a reserve is not permitted" – still represents the Directorate's views.

17 November 1999 External T.I. 9901265 - 97(1) AND A RESERVE

"[W]here and individual transfers property to a partnership under subsection 97(2) of the Act and receives, in addition to a partnership interest as consideration, a promissory note payable over, say, five years, the agreed amount would include the note and this amount would be deemed to be the proceeds for the individual and the cost to the partnership. In such a situation, where a gain has been triggered, i.e., the agreed amount exceeds the adjusted cost base of the property transferred, the transferor will be entitled to claim a reserve under paragraph 40(1)(a) of the Act if the note taken back is received as a 'conditional payment'."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 97 - Subsection 97(2) | 112 |

31 March 1995 External T.I. 9430115 - interest in a family farm partnership & capital gains RESERVE

A reserve may not be claimed where an individual transfers property to a partnership pursuant to s. 97(1) and receives as consideration a promissory note payable over five years. "According to the Derlago v. The Queen, 88 DTC 6290 (FCTD) case, where a provision in the Act deems property to have been disposed of for certain proceeds, the proceeds are considered to have been received by the taxpayer at the time of, or immediately after, the disposition."

93 C.R. - Q. 41

Re whether changes to the terms of a take back note or mortgage result in loss of the reserve.

10 October 1991 T.I. (Tax Window, No. 11, p. 14, ¶1515)

Where the original due date on a vendor take-back mortgage or promissory note is extended by agreement, the entitlement of the vendor to continue claiming a reserve under s. 40(1)(a)(iii) is unaffected by the extension if the note or mortgage continue to be merely evidence of the original debt.

21 August 1991 T.I. (Tax Window, No. 8, p. 6, ¶1403)

The entitlement of a vendor to claim a reserve where a promissory note was accepted only as evidence of the purchaser's obligation for the unpaid purchase price is unaffected by a renegotiation of the promissory note to extend the term or make other changes which IT-448 would consider to result in a disposition provided that the renegotiation occurs before the original due date of the note and before the end of the year in which the reserve is claimed, and the renegotiated note is accepted only as evidence of the continuing debt obligation.

14 February 1991 T.I. (Tax Window, Prelim. No. 3, p. 12, ¶1119)

A vendor take-back mortgage, whose scheduled payments of principal are substantially deferred due to the financial difficulty of the purchaser, would be considered to be a new mortgage. Where the new mortgage has been accepted as absolute payment of the original debt rather than being continuing evidence of the original debt, no reserve will be available to the vendor in the year in which the mortgage was amended. In addition, the purchaser's default might cause the debt to become due in the year of default, thereby resulting in no reserve being available in that year.

IT-236R2 "Reserves - Dispositions of Capital Property"

IT-436R "Reserves - Where Promissory Notes are Included in Disposal Proceeds"

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Payment & Receipt | 43 |

Articles

Smith, "Corporate Restructuring Issues: Public Corporations", 1990 Corporate Management Tax Conference Report, pp. 6:6-6:8: discussion of claiming of reserve by vendor under a take-over bid.

Paragraph 40(1)(b)

Administrative Policy

18 August 2014 External T.I. 2014-0540361E5 F - CDA and the deeming rules of 40(3.6) or 112(3)

A corporation's capital dividend accounts will not be reduced by a loss on the redemption of shares held by it where such loss is deemed to be nil by s. 40(3.6) or 112(3), given that where s. 40(3.6) or 112(3) applies to deem its loss to be nil, it is not considered to have sustained a loss for the purpose of s. 39(1)(b). After referring to the "except as otherwise expressly provided" reference in the s. 40(1) preamble, CRA stated (TaxInterpretations translation):

Our longstanding position is…that subsection 112(3) is an express contrary indication. In accordance with subsection 112(3), the amount of a loss as [otherwise] calculated…is reduced in accordance with that subsection. The resulting loss...is considered to be the loss determined in accordance with paragraph 40(1)(b).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 89 - Subsection 89(1) - Capital Dividend Account | no capital loss for CDA purposes where ss. 112(3) and 40(3.6) stop-loss rules apply | 128 |

Subsection 40(2) - Limitations

Paragraph 40(2)(a)

Subparagraph 40(2)(a)(ii)

Administrative Policy

18 May 2004 External T.I. 2004-0069691E5 F - Incorporation des professionnels

Each of the partners, all individuals, in a partnership (a SENC) transfers their interest therein to the same corporation and each becomes a shareholder. Is the s. 40(1)(a)(iii) reserve available if the sale price is not fully received in the year of disposition? CRA responded:

[S]ince the taxpayer is an individual … only clause 40(2)(a)(ii)(A) could apply if the corporation was controlled by one of the former partners who became a shareholder of the corporation immediately after the sale.

Clause 40(2)(a)(ii)(B) is not applicable since the taxpayer is an individual and not the SENC and clause 40(2)(a)(ii)(C) is not applicable since the taxpayer is an individual and not a corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 98 - Subsection 98(3) - Paragraph 98(3)(b) | WIP subject to s. 34 election is tranferred at nil | 149 |

| Tax Topics - Income Tax Act - Section 34 | insolvency practice carried on by accountants does not qualify as accountancy | 79 |

| Tax Topics - Income Tax Act - Section 249.1 - Subsection 249.1(2) | s. 249.1(2) not engaged by virtue only of no income being allocated to the partner | 236 |

Paragraph 40(2)(b)

Cases

Cassidy v. Canada, 2011 FCA 271

The taxpayer sold his six-acre rural property after it was rezoned for residential use as a result of an application made on behalf of owners of adjacent properties. He claimed a principal residence exemption on the entire gain. The Minister denied the gain on the basis of paragraph (e) of the definition of "principal residence" in s. 54 of the Act, which provides that a principal residence only includes up to a half-hectare of land contiguous with the residence unless the taxpayer can establish that a larger portion of the property was "necessary to the use and enjoyment" of the residence. The Tax Court rejected the taxpayer's appeal on the reasoning that the determination under paragraph (e) is to be made at the time the property is sold, and at that time the property had been rezoned and could be subdivided. Therefore, the entire six acres was no longer necessary to the use and enjoyment of the residence.

The Court of Appeal granted the taxpayer's appeal. Sharlow J.A. stated (at para. 35):

The error in the interpretation of paragraph 40(2)(b) proposed by the Crown, and perhaps implicit in Joyner, is that it fails to give effect to the language of paragraph 40(2)(b) that defines variable B. As mentioned above, the determination of variable B requires a determination, for each taxation year in which the taxpayer owned the property in issue, as to whether the property met the definition of "principal residence" of the taxpayer for that taxation year.

Given that the rezoning and the sale both occurred in 2003, and in light of the "plus one" component of B, the taxpayer was entitled to the principal residence exemption on the entire gain.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Principal Residence - Paragraph (e) | 251 |

The Queen v. Joyner, 88 DTC 6459, [1988] 2 CTC 280 (FCTD)

In 1972, 14 acres of land which the taxpayer had acquired in 1965 was prohibited, by virtue of an Order in Council passed pursuant to the Environment and Land Use Act (B.C.), from being subdivided. In 1975 the taxpayer obtained the right to subdivide 7.9 of the 14 acres into residential lots, and in 1980 the taxpayer sold this 7.9 acre parcel, which included his residence.

Reed J. rejected the taxpayer's contention that his capital gain that was exempt should be calculated on the basis that his principal residence was 14 acres from 1972 to 1975 and one acre thereafter until 1980. The relevant time for determining the area of the principal residence was at the time of its disposition.

The Queen v. Yates, 83 DTC 5158, [1983] CTC 105 (FCTD), aff'd 86 DTC 6296 [1986] 2 CTC 46 (FCA)

It was held that the gain from the disposition of a portion of a principal residence was completely exempt since "it was not argued that, by its very nature a principal residence cannot be subject of a partial disposition".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Principal Residence | 60 |

See Also

Francoeur v. Agence du revenu du Québec, 2016 QCCQ 11906

Aubé, J found that an entrepreneur who had followed a pattern of building and selling residences, realized a capital gain eligible for the principal residence exemption where he built a home to the exacting requirements of his spouse, and then sold it at again somewhat over three years after having purchased the vacant lot. She stated:

The financial situation motivated the sale of the property. Mr. R. F. stated that… his lines of credit had reached their limit. …

Although Mr. RF works in the construction industry, this does not deprive him of the right to acquire and sell his principal residence if circumstances make it unavoidable or desirable, even if the transactions occur over a relatively short period of time.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 9 - Capital Gain vs. Profit - Real Estate | somewhat quick flip by a builder was eligible for the principal residence exemption | 343 |

Cassidy v. The Queen, 2010 DTC 1336 [at 4287], 2010 TCC 471

The taxpayer sold his six-acre rural property after it was rezoned for residential use as a result of an application made on behalf of owners of adjacent properties. The taxpayer argued that the whole of the six acres was eligible for the principal residence capital gains exemption: when he bought the property, it could not be further subdivided; accordingly, the entire property was "necessary to the use and enjoyment" of the residence.

Favreau J. found that the taxpayer's exemption was limited, in accordance with paragraph (e) of the principal residence definition, to a half-hectare that included the house. The determination under paragraph (e) is to be made at the time of disposition of the property, and at that time the taxpayer's premise, that subdivision was impossible, was no longer correct.

Administrative Policy

11 October 2019 APFF Roundtable Q. 2, 2019-0812611C6 F - Résiliation d'un bail - Lease cancellation

A tenant had been annually renewing a lease of a condo since the time the condo was first leased in July 2013. The condo was sold in February 2019. The new owner, who wished to dwell in the premises, was not entitled to terminate the lease until effective July 2020. In consideration for the early termination of the lease, the new owner paid $15,000 to the tenant.

2007-0254721R3 confirmed that an amount received for the termination of a lease can come within the principal residence exemption. For purposes of calculating the application of the principal residence exemption to the $15,000, should the tenant be treated as holding the residence since July 2011? CRA stated:

… [W]here the tenant of a leased property receives from the owner of that property an amount to obtain the termination of its lease … such an amount represents proceeds of disposition of part or all of the leasehold interest. …

The definition of "principal residence" in section 54 provides that a leasehold interest may be a principal residence.

In the context described, the CRA understands that there was a continuation of the residential lease each year and on the transfer of ownership between the old and the new owner. Consequently, there would have been no leasehold disposition until the lease was terminated and the date of acquisition of the leasehold interest should be the time the lease was acquired by the tenant from the former owner.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(z) | s. 20(1)(z) applies notwithstanding s. 18(1)(a) but is subject to source rule in s. 20(1) preamble | 193 |

| Tax Topics - Income Tax Act - Section 54 - Principal Residence | lease termination payment received by tenant was eligible for principal residence exemption | 116 |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) | s. 20(1)-preamble source rule applied | 148 |

5 October 2018 APFF Financial Strategies and Instruments Roundtable Q. 11, 2018-0761571C6 F - Missing info on disposition of principal residence

CRA has summarized the detailed filing requirements for reporting a principal residence disposition and making the designation. CRA also stated:

[T]he administrative practice stated on the CRA's website, allowing the reduction of the penalty for late-filing a principal residence designation, except in the most excessive cases, has been extended [from 2016-year dispositions] to dispositions that occurred in the 2017 taxation year.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Principal Residence - Paragraph (c) | CRA is only waiving penalties for late-filed principal residence dispositions for 2017 and 2016 returns | 355 |

6 October 2017 APFF Roundtable Q. 3, 2017-0709011C6 F - Désignation d’un bien comme résidence principale

On page 2 of Schedule 3 of the return for the year of disposition of a principal residence, if the individual checks the box for Case 1, would this (by virtue of this effectively being a designation for all the years during which the taxpayer was owner) result in wasting the extra year under the “+1” computation? CRA stated:

Box 1 may be checked to designate [the house] as the individual’s principal residence for all years (or for all years less one year). … [T]he CRA will not require Form T2091 to be completed… .

| Other locations for this summary | |

|---|---|

| Tax Topics - Income Tax Act - Section 40 - Subsection 40(2) - Paragraph 40(2)(b) | no loss of bonus year if standard designation |

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Principal Residence - Paragraph (c) | an individual accessing the “+1” rule on a principal residence disposition need not complete Form 2091 | 253 |

17 October 2014 Internal T.I. 2014-0546091I7 F - Indemnités lors d'une négociation de gré à gré

An individual who purchased a residential property received indemnity payments from the vendor, pursuant to a negotiated indemnity clause, to compensate for expenses incurred in acquiring a replacement property and for the disruption of the relocation. The Directorate stated:

In this regard, the indemnity payments received could be of a capital nature if the taxpayer demonstrates that they compensated for the loss of property or for damage to property. Accordingly, the amount of the indemnity would be included in the proceeds of disposition of the property under the definition of "proceeds of disposition" in section 54. …

…[I]f the disposed-of property is the principal residence of the individual, that election is not necessary because the taxpayer can avail himself or herself of the exemption in paragraph 40(2)(b) and thereby reduce or eliminate any capital gain realized on the disposition.

S1-F3-C2 - Principal Residence

No designation before ordinary habitation

2.29 If a taxpayer acquires land in one tax year and constructs a housing unit on it in a subsequent year, the property may not be designated as the taxpayer’s principal residence for the years that are prior to the year in which the taxpayer, his or her spouse or common-law partner, former spouse or common-law partner, or child commences to ordinarily inhabit the housing unit. Such prior years (when the taxpayer owned only the vacant land or the land with a housing unit under construction) would not be included in variable B in the formula... .

Designation on part disposition

2.36 Where only a portion of a property qualifying as a taxpayer’s principal residence is disposed of (for example, the granting of an easement or the expropriation of land), the property may be designated as the taxpayer’s principal residence in order to use the principal residence exemption for the portion of the property disposed of. It is important to note that such a designation is made on the entire property (including the housing unit) that qualifies as the principal residence, and not just on the portion of the property disposed of. Accordingly, when the remainder of the property is subsequently disposed of, it too will be recognized as the taxpayer’s principal residence for the tax years for which the above-mentioned designation was made. No other property may be designated as a principal residence for any of those years by the taxpayer (or, for any of those years that are after the 1981 tax year, by the taxpayer or any of the other members of his or her family unit) as discussed in ¶2.13 - 2.14.

7 October 2016 APFF Roundtable Q. 2, 2016-0652841C6 F - Changement partiel d’usage - immeuble locatif et résidentiel

S1-F3-C2 “Principal Residence” para. 2.7 states that a housing unit includes a unit in a duplex. However, in 2011-0417471E5, CRA indicated that a duplex which has not been legally divided is a single property for s. 45(1) purposes.

A triplex with an FMV of $300K, $500K and $1,500K at the beginning of Years 1, 11 and 16 (the time of its sale), respectively, consisted: as to 50%, of Unit 1, which had direct personal use until Year 10 inclusive and thereafter was rented; as to 25%, of Unit 2, which was rented until Year 10 inclusive, and thereafter was used personally; and, as to 25%, of Unit 3 which was rented until Year 10 inclusive, and thereafter was occupied by children (paying a low rent).

How does s. 40(2)(b) apply to the disposition of the triplex at the beginning of Year 16 at a gain of $1,200K (or to any deemed disposition at the beginning of Year 11 at a gain of $200K)? After first indicating that because, after the Year 11 changes in use, the use of the single property (the triplex) was still 50% personal and 50% 3rd-party rental, the s. 45 rules did not apply, CRA stated:

Where multiple units in a building are designated as a principal residence for different years, the taxpayer must file, within one year of the building’s sale, a Form T2091(IND) - Designation of a Property as a Principal Residence by an Individual (Other Than a Personal Trust) for each of the units in the building covered by the designation. In the described situation, the taxpayer must file two T2091 forms in the year of the sale of the property if he is designating two units.

In calculating the capital gain, an allocation of the adjusted cost base ("ACB") and of the proceeds of disposition of a building made according to the area of each unit would, in some instances, be reasonable. However, the allocation must not necessarily be based on area. It must also take into account all factors that may affect the value of any of the units in the building.

Assuming that the value of Unit 1… represented 50% of the value of the building, the proceeds of disposition of the unit would be $750,000…[and] the ACB attributable to this unit was $150,000…the taxpayer would realize a capital gain of $600,000, of which part could be designated for purposes of the principal residence exemption.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 45 - Subsection 45(1) - Paragraph 45(1)(c) | switch between which triplex units used for personal/ family rental or 3rd-party rental did not trigger change of use | 249 |

| Tax Topics - Income Tax Act - Section 54 - Principal Residence | triplex contained separate housing units | 151 |

7 October 2016 APFF Roundtable Q. 3, 2016-0652851C6 F - Annulation d'une promesse d'achat sur une maison

As a result of breach of a puchaser's obligation to purchase a personal residence, the individual vendor received $50,000 in damages from the defaulted purchaser. Is the $50,000 eligible for the principal residence exemption? CRA responded:

[A]s the right under the [contractual] promise is a property distinct from the personal residence, this right could not qualify as a principal residence and paragraph 40(2)(b) would not apply.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 39 - Subsection 39(1) - Paragraph 39(1)(b) | no capital loss for damages paid for breach of purchase obligation | 73 |

10 June 2016 External T.I. 2015-0590371E5 F - Résidence principale - stationnement

Where a parking space was acquired as part of the purchase of a residential condo unit, the parking space can thereafter form part of the condo unit (viewed as a “housing unit” for principal residence exemption purposes) provided that the parking space facilitates the use of the housing unit (which presumably would always be the case if it is actually used by the condo owner) and it is part of the common or private area for the same building – and this is so even if the parking space as a matter of real property law is a separate from the condo unit.

Since the parking space is viewed as part of the single principal residence, CRA apparently considers that using the principal residence designation for the disposition of the parking space does not preclude the use of the principal residence exemption for the same years in question where there has been a subsequent sale of the condo unit.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Principal Residence - Paragraph (e) | a parking space can form part of a condo housing unit | 241 |

13 March 2013 External T.I. 2012-0473291E5 F - Société de personnes - maison détruite par le feu

The Taxpayer was a partner of a partnership carrying on a farming business and owning more than half a hectare of land on which there was a building (the "First House") which served as the exclusive principal residence of the Taxpayer and his father. A fire then completely destroyed the First House and the partnership used the insurance proceeds to build another building. If the partnership does not rely on the s. 44 property exchange rules, is the Taxpayer entitled to the exemption in s. 40(2)(b)? CRA responded:

[T]he Taxpayer could use paragraph 40(2)(b) to reduce or eliminate the capital gain on the disposition of the First House allocated to the Taxpayer by the partnership on the deemed disposition of the partnership, provided that it meets all the conditions in the definition of "principal residence".

If the partnership applies the s. 44 property exchange rules, could the Taxpayer use the principal residence exemption on a future disposition of the Replacement House and its land, if it continued to be used as the Taxpayer’s principal residence? CRA responded:

[T]o the extent that the partnership makes a valid election under subsection 44(1), we are of the view that the Taxpayer could use paragraph 40(2)(b) to reduce or eliminate part of the gain from a future disposition of the Replacement House and its land, which is allocated to it by the partnership, if at that future time, all the conditions of the definition of "principal residence" are also satisfied with respect to the Taxpayer.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 44 - Subsection 44(5) - Paragraph 44(5)(a.1) | replacement property generally is expected to have the same material characteristics | 159 |

| Tax Topics - Income Tax Act - Section 40 - Subsection 40(2) - Paragraph 40(2)(c) | s. 40(2)(c) unavailable re disposition of building only from fire | 111 |

5 October 2012 Roundtable, 2012-0453961C6 F - Copropriété indivise (50-50) d'un triplex

An individual held a triplex equally with his father in undivided co-ownership and also lived in one of the equally sized units as his principal residence. On a subsequent sale by them of the triplex, the individual realized a taxable capital gain of $90,000 on his portion (50% of the triplex) before taking the principal residence deduction into account. How is that deduction computed? In finding that the individual’s net taxable capital gain might be $30,000, CRA stated:

[T]he allocation does not necessarily have to be on the basis of floor area. Consideration should also be given to any factors which could have an effect on the relative value of any of the units in the building.

Assuming that the value of the three housing units is essentially the same and that the agreements between the individual and his father regarding the use of the building support such a conclusion, we could accept that the value of the individual’s undivided share of the triplex is attributable as to 2/3 for the housing unit of housing used by him as principal residence and as to 1/3 to the remainder of the triplex.

23 January 2008 External T.I. 2007-0237251E5 F - Résidence principale - Destruction d'un triplex

A taxpayer owns a triplex that was completely destroyed in a fire. He ordinarily inhabited part of the triplex as his principal residence before the destruction, and rented the balance, and also owned a garage on the land that was not destroyed in the fire and had been used exclusively for personal use. What are the consequences of his sale of the garage and the land?

After noting that the contiguous land referred to in para. (e) of the definition of "principal residence" included the garage given that under the Civil Code “the owner of an immovable (for example, land) is the owner by accession of all constructions and works located on the immovable,” CRA indicated that the taxpayer’s gain could be reduced under s. 40(2)(b), but “only for those taxation years in which the taxpayer ordinarily inhabited the principal residence, i.e., before the triplex was destroyed by fire,” and with an allocation between the principal residence portion and the rental portion being required, likely based on the relative building areas for the two uses.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Principal Residence - Paragraph (e) | garage remaining after destruction of triplex by fire was part of the contiguous land | 171 |

25 July 2007 External T.I. 2007-0224601E5 F - Application de l'alinéa 40(2)b)

A taxpayer acquired a residence and the subjacent land in 20X1, ordinarily inhabited it for three years, then in 20X4, demolished it without building another. Is the principal residence deduction available on the taxpayer’s sale of the vacant land in 20X6? CRA responded:

[T]he land could be designated as a principal residence for the taxation years in which the taxpayer ordinarily inhabited the residence. Consequently, if all the conditions for designating a property as a principal residence are satisfied … only the number of years the taxpayer ordinarily inhabited the residence, excluding the years the land was vacant, could be included in the description of B in the formula in paragraph 40(2)(b).

23 May 2007 External T.I. 2006-0215721E5 F - Application de l'alinéa 40(2)b)

A taxpayer acquired a cottage and the subjacent land in 1998, and ordinarily inhabited the cottage until 2002, when he demolished it and built a new one, which he continued to ordinarily inhabit until its sale some years later. Can he include the years of occupation of the first building in the exemption formula? CRA responded:

[T]he land could be designated as a principal residence for the taxation years in which the taxpayer ordinarily inhabited the first cottage as well as the second cottage. Consequently, if all the conditions for designating a property as a principal residence are met, we are of the view that the number of years the taxpayer ordinarily inhabited both the first cottage and the second cottage could be included in the description of B in the formula ... .

11 May 2007 External T.I. 2006-0214351E5 F - Transfert d'un droit de propriété

A and his wife B, had been undivided owners of a duplex since 1999, and lived in one of the units with their daughter C, while the other was rented out. In 2004, C, who contributed an initial amount when the property was purchased, moved into the rented unit. A and B now will by deed transfer to C her share of the ownership interest in the duplex based on the ratio of her down payment to the total purchase price.

After noting that IT-120R6, para. 3, “confirms that a unit in a duplex is a property that can be designated as a taxpayer's principal residence,’ CRA stated:

For each of the 2004 and subsequent years - that is, starting with the year in which C moves into the upper-floor housing unit of the duplex - it is our view that A and B will be able to designate either of the units in the duplex since they will have been ordinarily inhabited by the taxpayer, the taxpayer's spouse or common-law partner, or by a child of the taxpayer. For each taxation year prior to 2004, only the housing unit ordinarily inhabited by A and B may be designated as the principal residence. …

Similarly, we are of the view that C will be able to designate the housing unit into which she moved in 2004 as her principal residence for the years during which she ordinarily inhabited it … .

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Property | an occupied unit in a co-owned duplex can be designated as a principal residence | 97 |

6 December 2006 External T.I. 2006-0152101E5 F - Disposition d'un domaine résiduel

A farmer disposes of his principal residence to a family farm corporation while retaining a life estate in it until he and his spouse die.

CRA indicated that when the farmer disposed of his remainder interest, while retaining the life estate, s. 43.1(1) applied so that he was deemed to have disposed of his life estate in the property for proceeds of disposition equal to its fair market value at that time, and was deemed by s. 43.1(1) to have reacquired the life estate immediately after that time at a cost equaling such proceeds. As a result, any gain accrued on the entire property would have been recognized at that time – but such gain would have been offset by the principal residence exemption.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 43.1 - Subsection 43.1(2) - Paragraph 43.1(2)(b) | ACB addition to residual interest in farm principal residence disposed of to family farm corporation | 233 |

4 March 2003 External T.I. 2002-0150985 F - TRANSFERT-RESIDENCE PRINCIPALE

CCRA indicated that the principal residence deduction could be utilized on a transfer of the residence by the individual to a wholly-owned corporation, if the other conditions were met.

11 April 1995 External T.I. 9507405 - 40(2)(B)

A non-resident who disposes of his principal residence can reduce the amount of the resulting capital gain by virtue of the fact that the numerator in the formula in s. 40(2)(b)(i) will be one, even though he was never resident in Canada.

16 February 1995 Mississauga Breakfast Seminar, Q. 4

Discussion of interaction between capital gains election under s. 110.6(19) and claiming of principal residence exemption for some (but not all) the years of ownership.

88 C.R. - Q.55

The taxpayer is not required to review his use and enjoyment of the property on a year by year basis respecting the half-hectare test.

80 C.R. - Q.24

Where a taxpayer purchased a vacant lot and later constructed his principal residence on it, the denominator will include the years that he owned a vacant lot.

Paragraph 40(2)(c)

Administrative Policy

13 March 2013 External T.I. 2012-0473291E5 F - Société de personnes - maison détruite par le feu

The Taxpayer was a partner of a partnership carrying on a farming business and owning more than half a hectare of land on which there was a building which served as the exclusive principal residence of the Taxpayer and his father. A fire then completely destroyed the First House and the partnership used the insurance proceeds to build another building. If the partnership does not rely on the s. 44 property exchange rules, is the Taxpayer entitled to the exemption in s. 40(2)(c)? CRA responded:

However, at that time, paragraph 40(2)(c) would not be applicable to the Taxpayer since the partnership did not dispose of land.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 40 - Subsection 40(2) - Paragraph 40(2)(b) | partner can use the principal residence exemption re gain allocated by partnership from disposition of personally-used principal residence, including following s. 44 deferral | 263 |

| Tax Topics - Income Tax Act - Section 44 - Subsection 44(5) - Paragraph 44(5)(a.1) | replacement property generally is expected to have the same material characteristics | 159 |

Paragraph 40(2)(e)

See Also

Plant National Ltd. v. MNR, 89 DTC 401 (TCC)